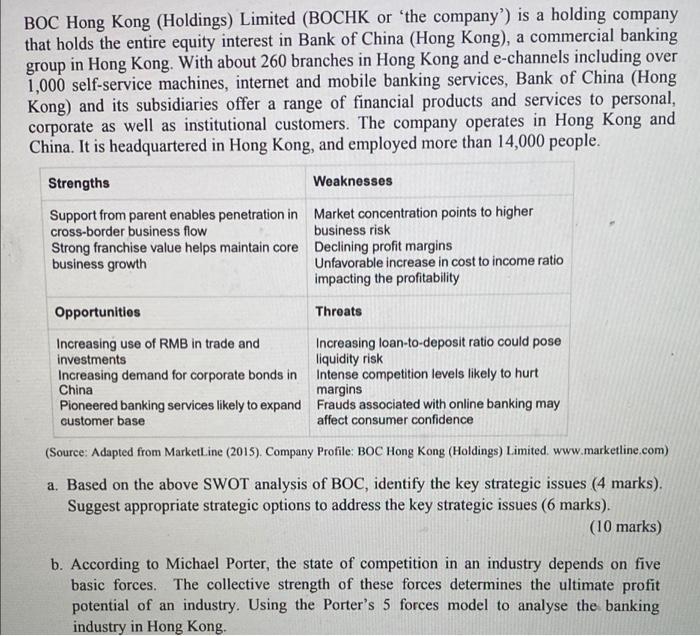

a BOC Hong Kong (Holdings) Limited (BOCHK or 'the company') is a holding company that holds the entire equity interest in Bank of China (Hong Kong), a commercial banking group in Hong Kong. With about 260 branches in Hong Kong and e-channels including over 1,000 self-service machines, internet and mobile banking services, Bank of China (Hong Kong) and its subsidiaries offer a range of financial products and services to personal, corporate as well as institutional customers. The company operates in Hong Kong and China. It is headquartered in Hong Kong, and employed more than 14,000 people. Strengths Weaknesses Support from parent enables penetration in Market concentration points to higher cross-border business flow business risk Strong franchise value helps maintain core Declining profit margins business growth Unfavorable increase in cost to income ratio impacting the profitability Opportunities Throats Increasing use of RMB in trade and Increasing loan-to-deposit ratio could pose investments liquidity risk Increasing demand for corporate bonds in Intense competition levels likely to hurt China margins Pioneered banking services likely to expand Frauds associated with online banking may customer base affect consumer confidence (Source: Adapted from MarketLine (2015). Company Profile: BOC Hong Kong (Holdings) Limited. www.marketline.com) a. Based on the above SWOT analysis of BOC, identify the key strategic issues (4 marks). Suggest appropriate strategic options to address the key strategic issues (6 marks). (10 marks) b. According to Michael Porter, the state of competition in an industry depends on five basic forces. The collective strength of these forces determines the ultimate profit potential of an industry. Using the Porter's 5 forces model to analyse the banking industry in Hong Kong. a BOC Hong Kong (Holdings) Limited (BOCHK or 'the company') is a holding company that holds the entire equity interest in Bank of China (Hong Kong), a commercial banking group in Hong Kong. With about 260 branches in Hong Kong and e-channels including over 1,000 self-service machines, internet and mobile banking services, Bank of China (Hong Kong) and its subsidiaries offer a range of financial products and services to personal, corporate as well as institutional customers. The company operates in Hong Kong and China. It is headquartered in Hong Kong, and employed more than 14,000 people. Strengths Weaknesses Support from parent enables penetration in Market concentration points to higher cross-border business flow business risk Strong franchise value helps maintain core Declining profit margins business growth Unfavorable increase in cost to income ratio impacting the profitability Opportunities Throats Increasing use of RMB in trade and Increasing loan-to-deposit ratio could pose investments liquidity risk Increasing demand for corporate bonds in Intense competition levels likely to hurt China margins Pioneered banking services likely to expand Frauds associated with online banking may customer base affect consumer confidence (Source: Adapted from MarketLine (2015). Company Profile: BOC Hong Kong (Holdings) Limited. www.marketline.com) a. Based on the above SWOT analysis of BOC, identify the key strategic issues (4 marks). Suggest appropriate strategic options to address the key strategic issues (6 marks). (10 marks) b. According to Michael Porter, the state of competition in an industry depends on five basic forces. The collective strength of these forces determines the ultimate profit potential of an industry. Using the Porter's 5 forces model to analyse the banking industry in Hong Kong