Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A bond had a price of $946.19 at the beginning of the year and a price of $980.30 at the end of the year.

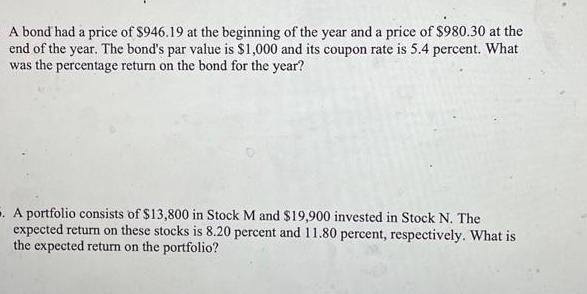

A bond had a price of $946.19 at the beginning of the year and a price of $980.30 at the end of the year. The bond's par value is $1,000 and its coupon rate is 5.4 percent. What was the percentage return on the bond for the year? . A portfolio consists of $13,800 in Stock M and $19,900 invested in Stock N. The expected return on these stocks is 8.20 percent and 11.80 percent, respectively. What is the expected return on the portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the percentage return on the bond for the year you can use the following formula Percen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started