Answered step by step

Verified Expert Solution

Question

1 Approved Answer

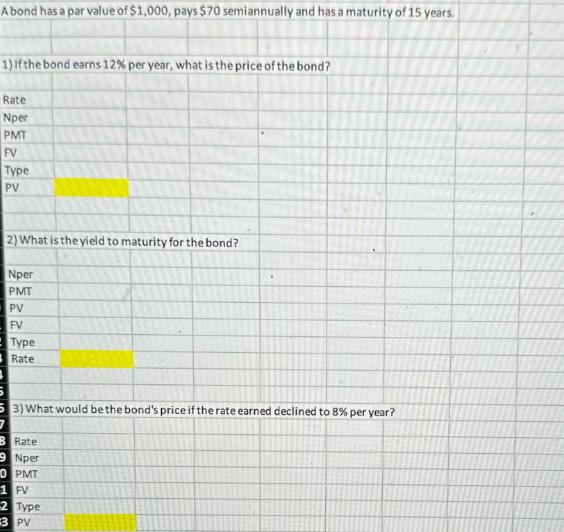

A bond has a par value of $1,000, pays $70 semiannually and has a maturity of 15 years. 1) If the bond earns 12%

A bond has a par value of $1,000, pays $70 semiannually and has a maturity of 15 years. 1) If the bond earns 12% per year, what is the price of the bond? Rate Nper PMT FV Type PV 2) What is the yield to maturity for the bond? Nper PMT PV FV Type Rate 53) What would be the bond's price if the rate earned declined to 8% per year? BRate Nper 0 PMT 1 FV 2 Type 3 PV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the price of the bond we can use the present value formula PV PMT 1 1 rn r FV 1 rn Where PV Present value or price of the bond PMT Period...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dbbf60a5bd_962846.pdf

180 KBs PDF File

663dbbf60a5bd_962846.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started