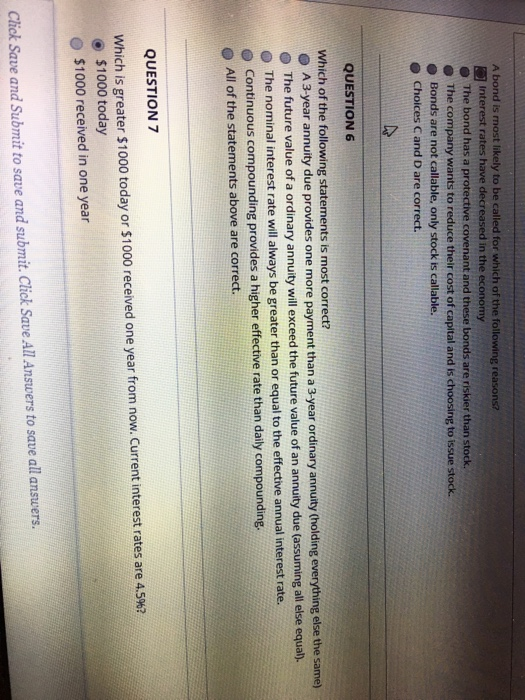

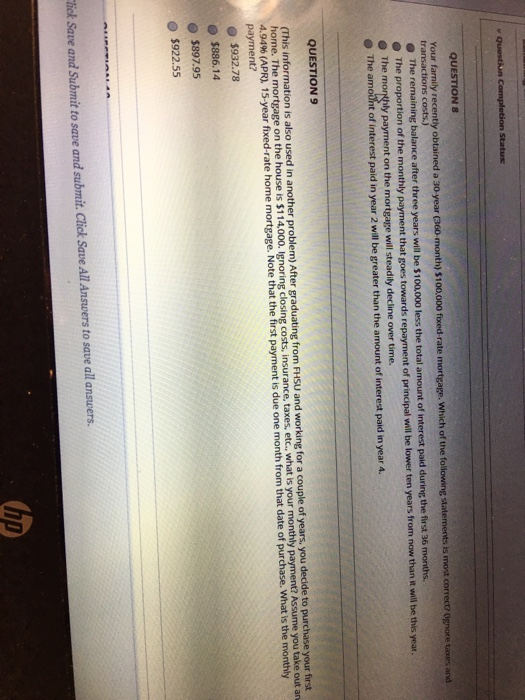

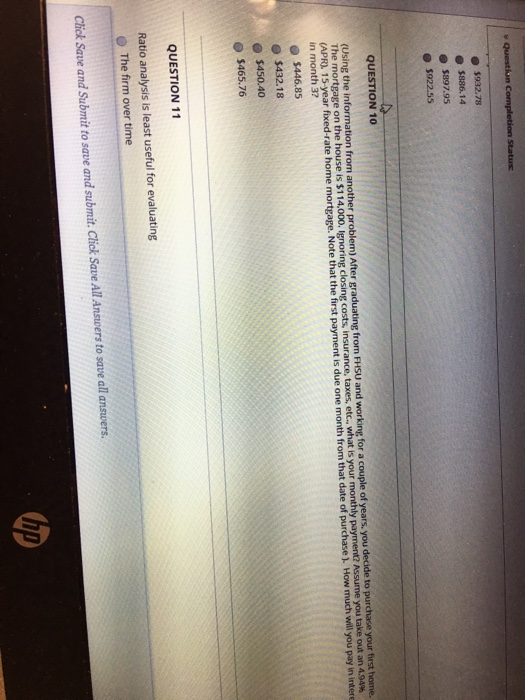

A bond is most likely to be called for which of the following reasons? Interest rates have decreased in the economy The bond has a protective covenant and these bonds are riskier than stock. The company wants to reduce their cost of capital and is choosing to issue stock. Bonds are not callable, only stock is callable. Choices C and D are correct. QUESTION 6 Which of the following statements is most correct? O A 3-year annuity due provides one more payment than a 3-year ordinary annuity (holding everything else the same) The future value of a ordinary annuity will exceed the future value of an annuity due (assuming all else equal). The nominal interest rate will always be greater than or equal to the effective annual interest rate. Continuous compounding provides a higher effective rate than daily compounding. All of the statements above are correct. QUESTION 7 Which is greater $1000 today or $1000 received one year from now. Current interest rates are 4.5%? $1000 today $1000 received in one year Click Save and Submit to save and submit. Click Save All Answers to save all answers. Question Completion Status QUESTIONS Your family recently obtained a 30 year (360 month) $100,000 fixed rate mortgage. Which of the following statements is most correct? Ognore taxes and transactions costs.) The remaining balance after three years will be $100.000 less the total amount of interest paid during the first 36 months. The proportion of the monthly payment that goes towards repayment of principal will be lower ten years from now than it will be this year. The monthly payment on the mortgage will steadily decline over time. The amount of interest paid in year 2 will be greater than the amount of interest paid in year 4. QUESTION 9 (This information is also used in another problem) After graduating from FHSU and working for a couple of years, you decide to purchase your first home. The mortgage on the house is $114,000. Ignoring closing costs, insurance, taxes, etc., what is your monthly payment? Assume you take out an 4.94% (APR), 15-year fixed-rate home mortgage. Note that the first payment is due one month from that date of purchase. What is the monthly payment? $932.78 $886.14 $897.95 $922.55 Click Save and Submit to save and submit. Click Save All Answers to save all answers. (hp Question Completion Status $932.78 5886.14 $897.95 $922.55 QUESTION 10 (Using the information from another problem) After graduating from FHSU and working for a couple of years. you decide to purchase your first home. The mortgage on the house is $114,000. Ignoring closing costs, insurance, taxes, etc., what is your monthly payment? Assume you take out an 4.94% (APR), 15-year fixed-rate home mortgage. Note that the first payment is due one month from that date of purchase ). How much will you pay in intere in month 3? $446.85 $432.18 $450.40 $465.76 QUESTION 11 Ratio analysis is least useful for evaluating The firm over time Click Save and Submit to save and submit. Click Save All Answers to save all answers. Chp A bond is most likely to be called for which of the following reasons? Interest rates have decreased in the economy The bond has a protective covenant and these bonds are riskier than stock. The company wants to reduce their cost of capital and is choosing to issue stock. Bonds are not callable, only stock is callable. Choices C and D are correct. QUESTION 6 Which of the following statements is most correct? O A 3-year annuity due provides one more payment than a 3-year ordinary annuity (holding everything else the same) The future value of a ordinary annuity will exceed the future value of an annuity due (assuming all else equal). The nominal interest rate will always be greater than or equal to the effective annual interest rate. Continuous compounding provides a higher effective rate than daily compounding. All of the statements above are correct. QUESTION 7 Which is greater $1000 today or $1000 received one year from now. Current interest rates are 4.5%? $1000 today $1000 received in one year Click Save and Submit to save and submit. Click Save All Answers to save all answers. Question Completion Status QUESTIONS Your family recently obtained a 30 year (360 month) $100,000 fixed rate mortgage. Which of the following statements is most correct? Ognore taxes and transactions costs.) The remaining balance after three years will be $100.000 less the total amount of interest paid during the first 36 months. The proportion of the monthly payment that goes towards repayment of principal will be lower ten years from now than it will be this year. The monthly payment on the mortgage will steadily decline over time. The amount of interest paid in year 2 will be greater than the amount of interest paid in year 4. QUESTION 9 (This information is also used in another problem) After graduating from FHSU and working for a couple of years, you decide to purchase your first home. The mortgage on the house is $114,000. Ignoring closing costs, insurance, taxes, etc., what is your monthly payment? Assume you take out an 4.94% (APR), 15-year fixed-rate home mortgage. Note that the first payment is due one month from that date of purchase. What is the monthly payment? $932.78 $886.14 $897.95 $922.55 Click Save and Submit to save and submit. Click Save All Answers to save all answers. (hp Question Completion Status $932.78 5886.14 $897.95 $922.55 QUESTION 10 (Using the information from another problem) After graduating from FHSU and working for a couple of years. you decide to purchase your first home. The mortgage on the house is $114,000. Ignoring closing costs, insurance, taxes, etc., what is your monthly payment? Assume you take out an 4.94% (APR), 15-year fixed-rate home mortgage. Note that the first payment is due one month from that date of purchase ). How much will you pay in intere in month 3? $446.85 $432.18 $450.40 $465.76 QUESTION 11 Ratio analysis is least useful for evaluating The firm over time Click Save and Submit to save and submit. Click Save All Answers to save all answers. Chp