Answered step by step

Verified Expert Solution

Question

1 Approved Answer

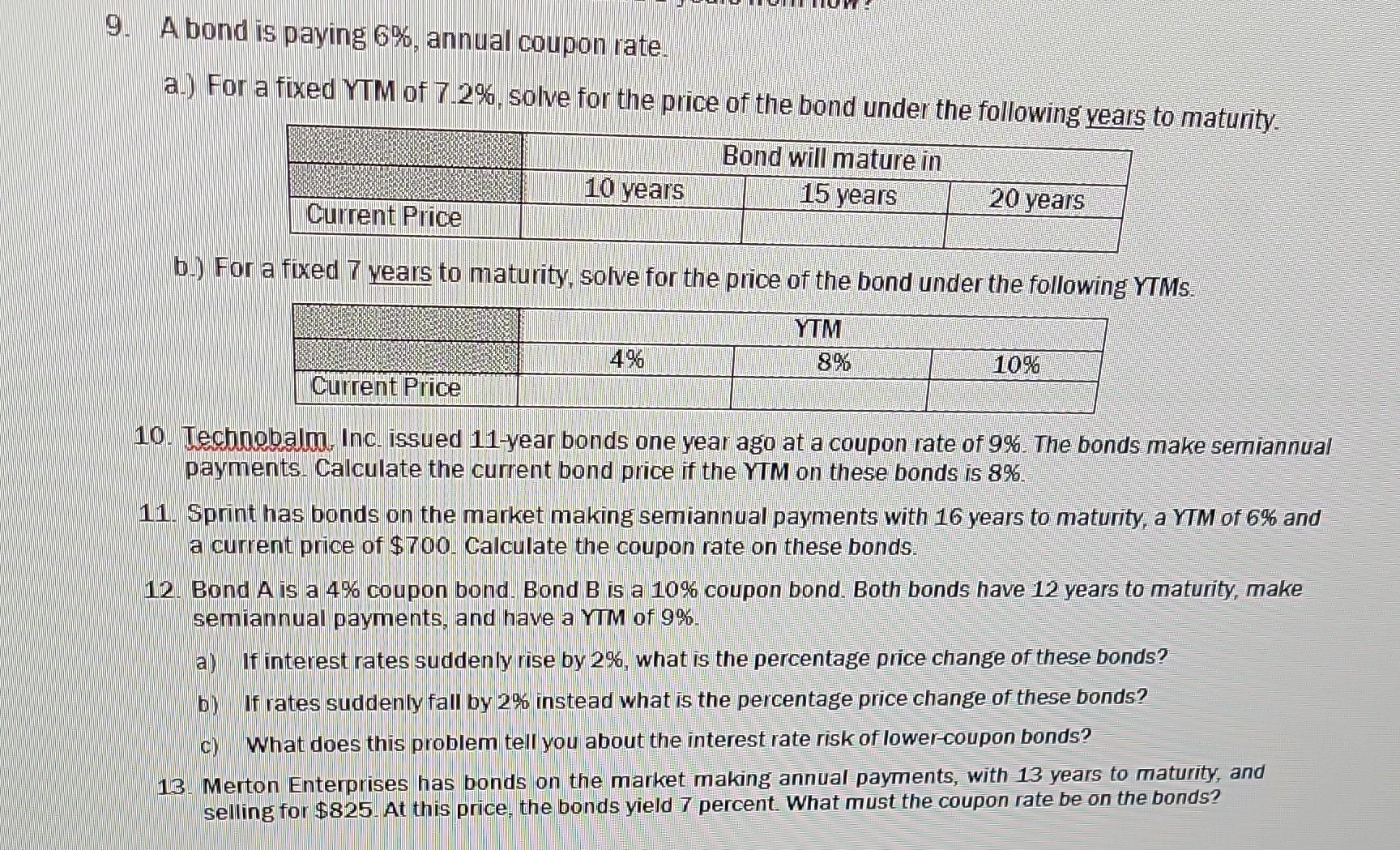

A bond is paying 6%, annual coupon rate. a.) For a fixed YTM of 7.2%, solve for the price of the bond under the following

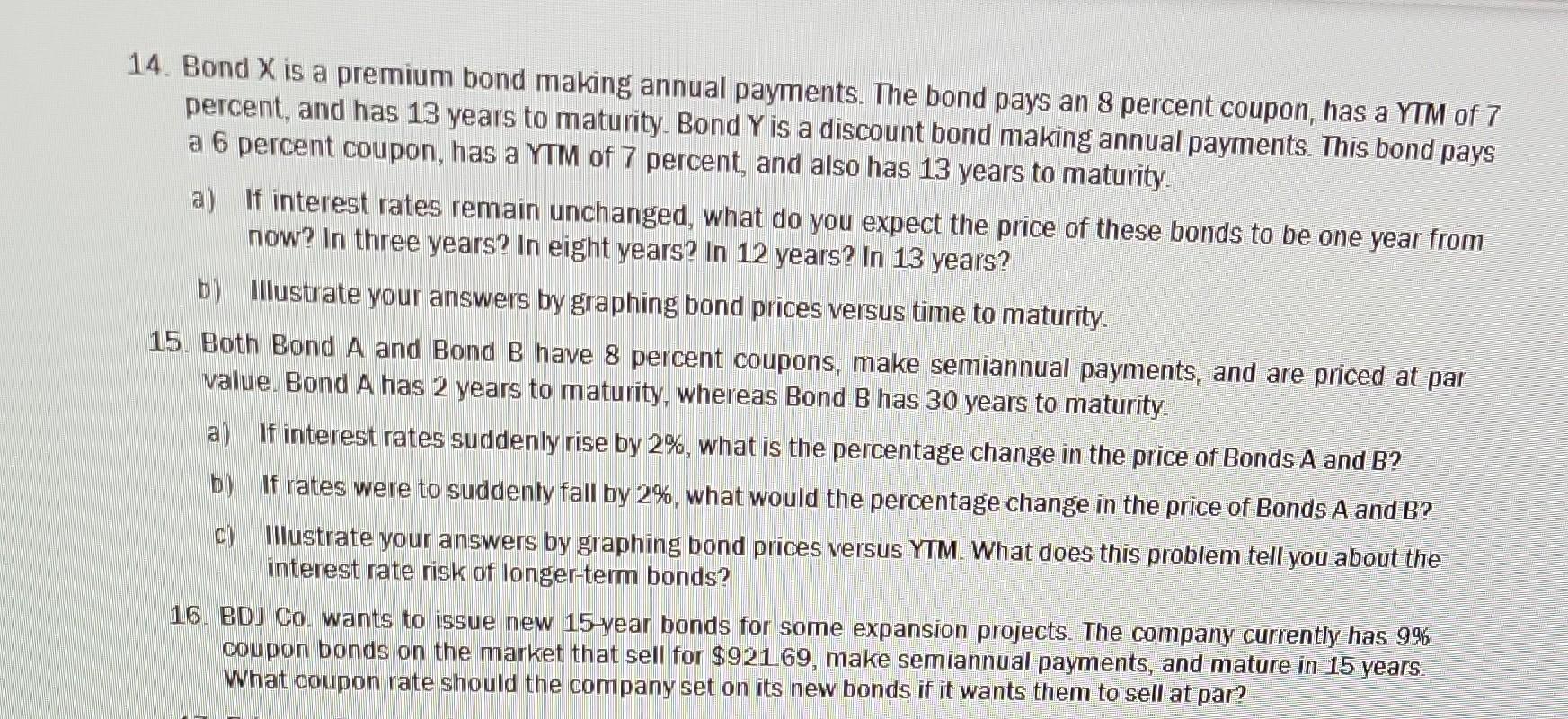

A bond is paying 6%, annual coupon rate. a.) For a fixed YTM of 7.2%, solve for the price of the bond under the following vears to maturity. b.) For a fixed 7 years to maturity, solve for the price of the bond under the following YTMs. 10. Technobaloa Inc. issued 11-year bonds one year ago at a coupon rate of 9%. The bonds make semiannual payments. Calculate the current bond price if the YTM on these bonds is 8%. 11. Sprint has bonds on the market making semiannual payments with 16 years to maturity, a YTM of 6% and a current price of $700. Calculate the coupon rate on these bonds. 12. Bond A is a 4% coupon bond. Bond B is a 10% coupon bond. Both bonds have 12 years to maturity, make semiannual payments, and have a YTM of 9%. a) If interest rates suddenly rise by 2%, what is the percentage price change of these bonds? b) If rates suddenly fall by 2% instead what is the percentage price change of these bonds? c) What does this problem tell you about the interest rate risk of lower-coupon bonds? 13. Merton Enterprises has bonds on the market making annual payments, with 13 years to maturity, and collino forr 4805 At this nrice the bonds vield 7 percent. What must the coupon rate be on the bonds? 14. Bond X is a premium bond making annual payments. The bond pays an 8 percent coupon, has a YTM of 7 percent, and has 13 years to maturity. Bond Y is a discount bond making annual payments. This bond pays a 6 percent coupon, has a YTM of 7 percent, and also has 13 years to maturity. a) If interest rates remain unchanged, what do you expect the price of these bonds to be one year from now? In three years? In eight years? In 12 years? In 13 years? b) Illustrate your answers by graphing bond prices versus time to maturity. 15. Both Bond A and Bond B have 8 percent coupons, make semiannual payments, and are priced at par value. Bond A has 2 years to maturity, whereas Bond B has 30 years to maturity. a) If interest rates suddenly rise by 2%, what is the percentage change in the price of Bonds A and B ? b) If rates were to suddenty fall by 2%, what would the percentage change in the price of Bonds A and B ? c) Illustrate your answers by graphing bond prices versus YTM. What does this problem tell you about the interest rate risk of longer-term bonds? 16. BDJ Co. wants to issue new 15 -year bonds for some expansion projects. The company currently has 9% coupon bonds on the market that sell for $92169, make semiannual payments, and mature in 15 years. What coupon rate should the company set on its new bonds if it wants them to sell at par

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started