Question

A bond is to be purchased today and is offered at a price of $900. The bond has a face value of $1,000. That

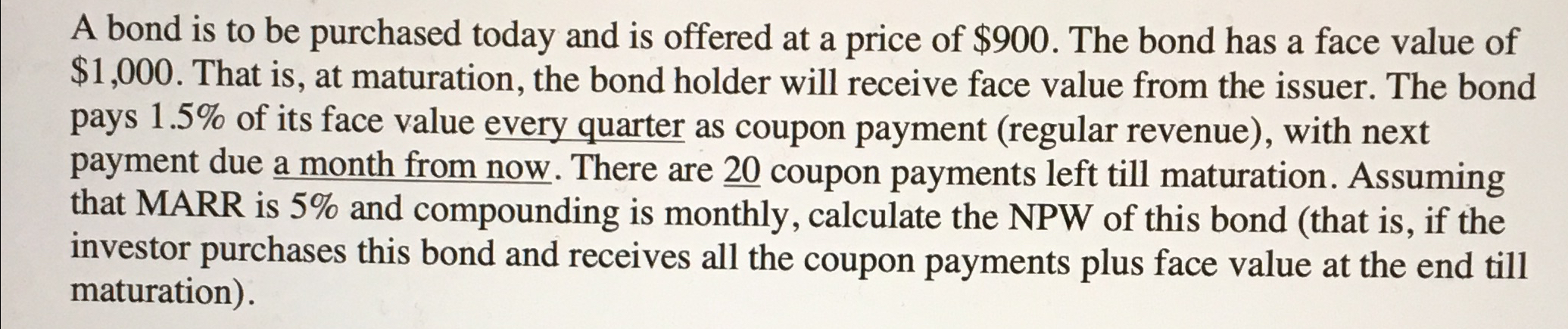

A bond is to be purchased today and is offered at a price of $900. The bond has a face value of $1,000. That is, at maturation, the bond holder will receive face value from the issuer. The bond pays 1.5% of its face value every quarter as coupon payment (regular revenue), with next payment due a month from now. There are 20 coupon payments left till maturation. Assuming that MARR is 5% and compounding is monthly, calculate the NPW of this bond (that is, if the investor purchases this bond and receives all the coupon payments plus face value at the end till maturation).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Operations Research

Authors: Frederick S. Hillier, Gerald J. Lieberman

10th edition

978-0072535105, 72535105, 978-1259162985

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App