Question: Budget Problem Solutions 1. Sales budget: $ 9,500,000 2. schedule of expected cash collections: $9,482,500 2. A purchases budget: $5,377,500 3. Cash payment schedule:

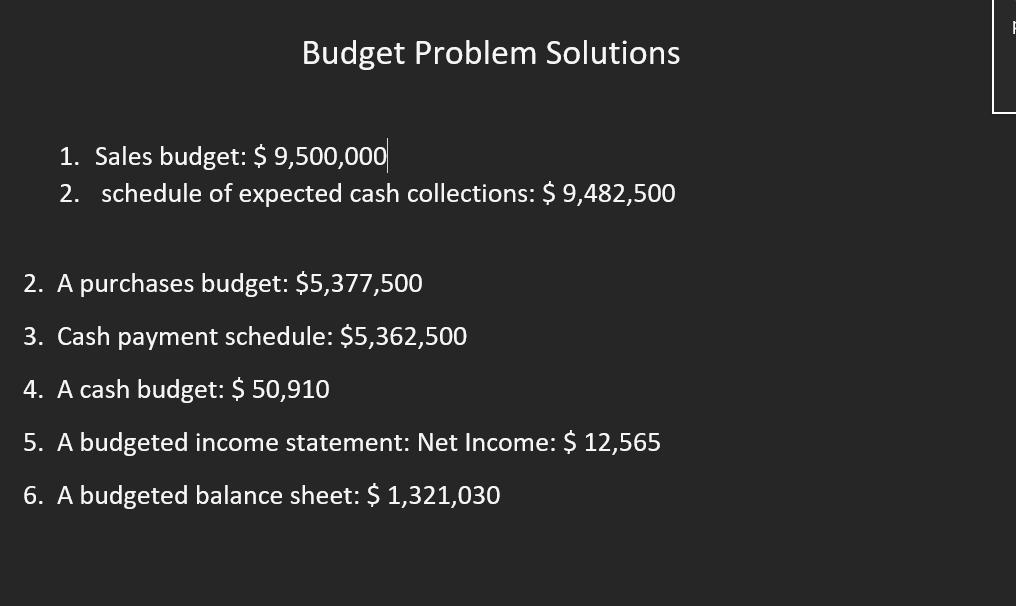

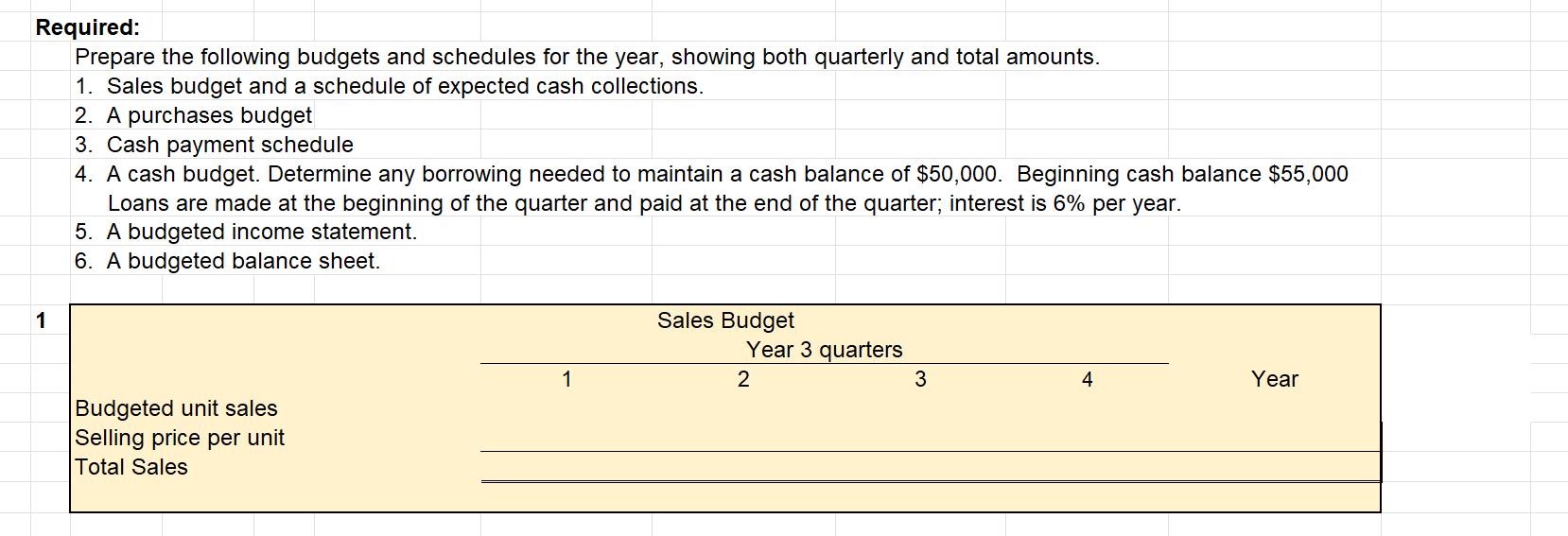

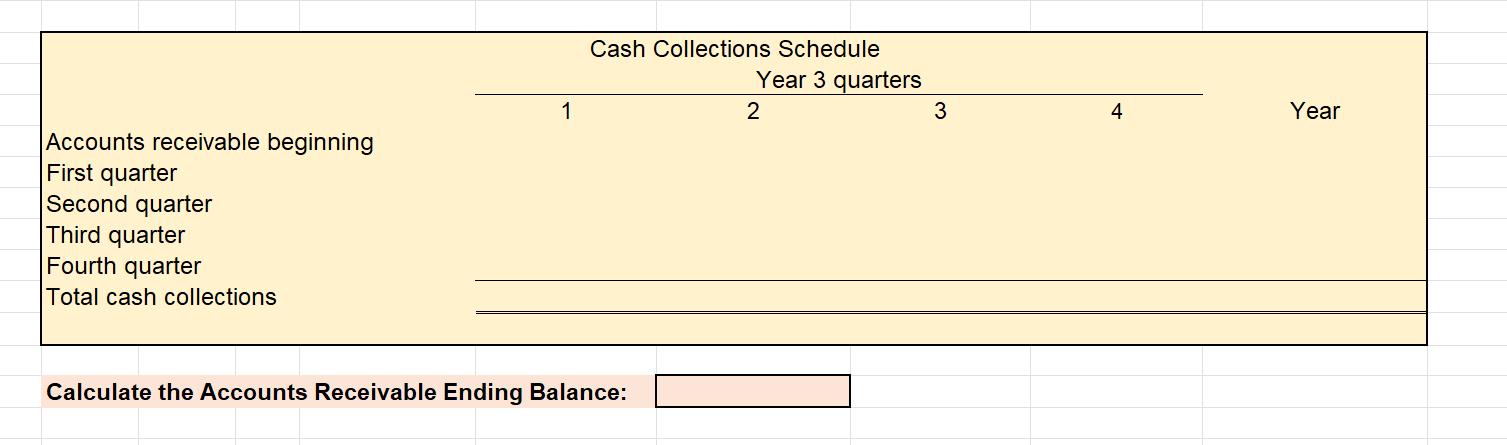

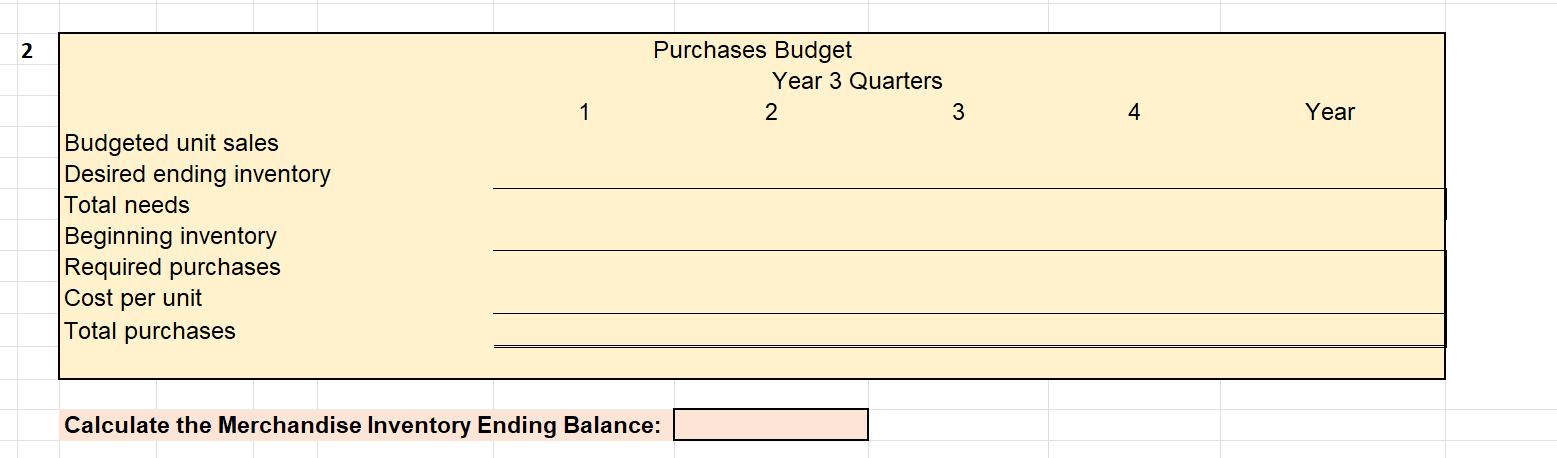

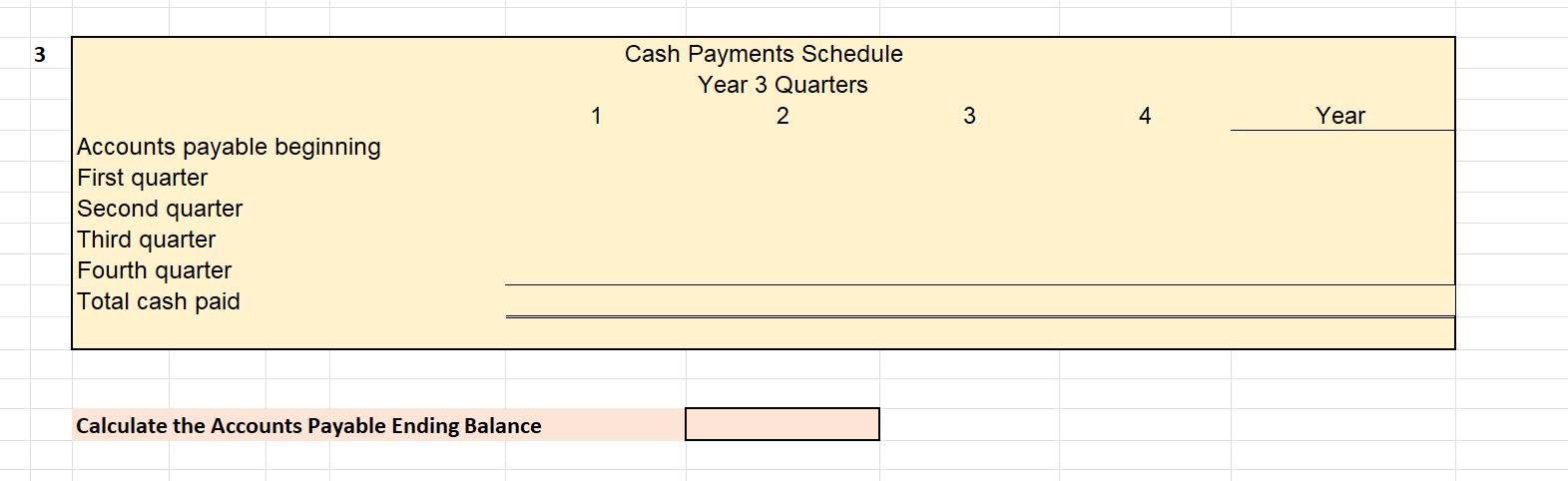

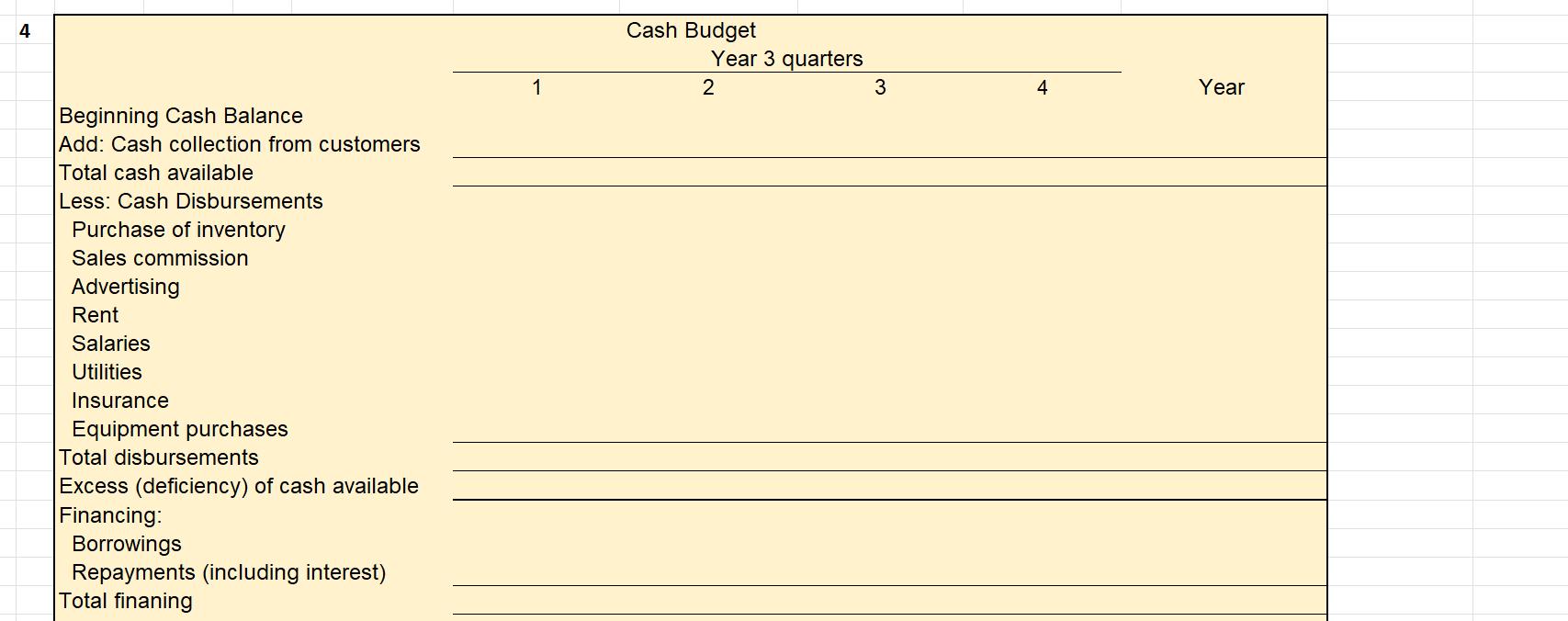

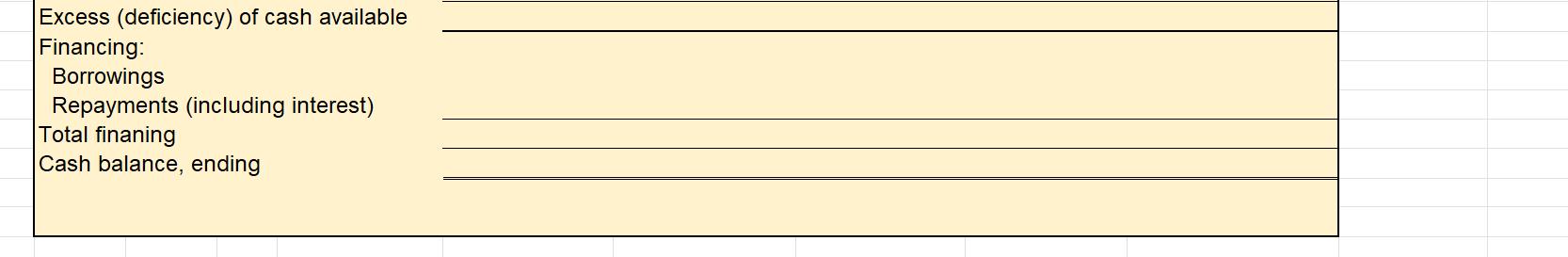

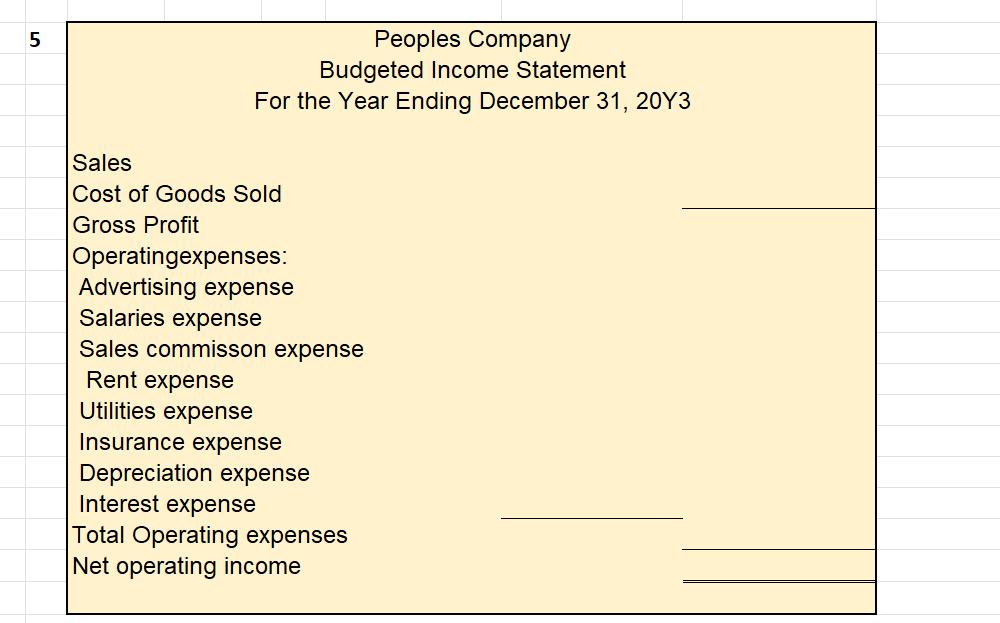

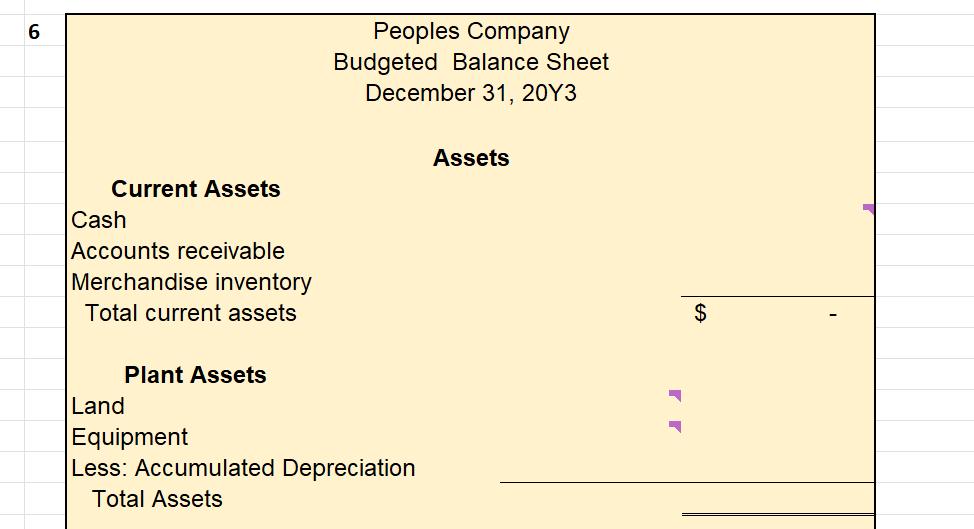

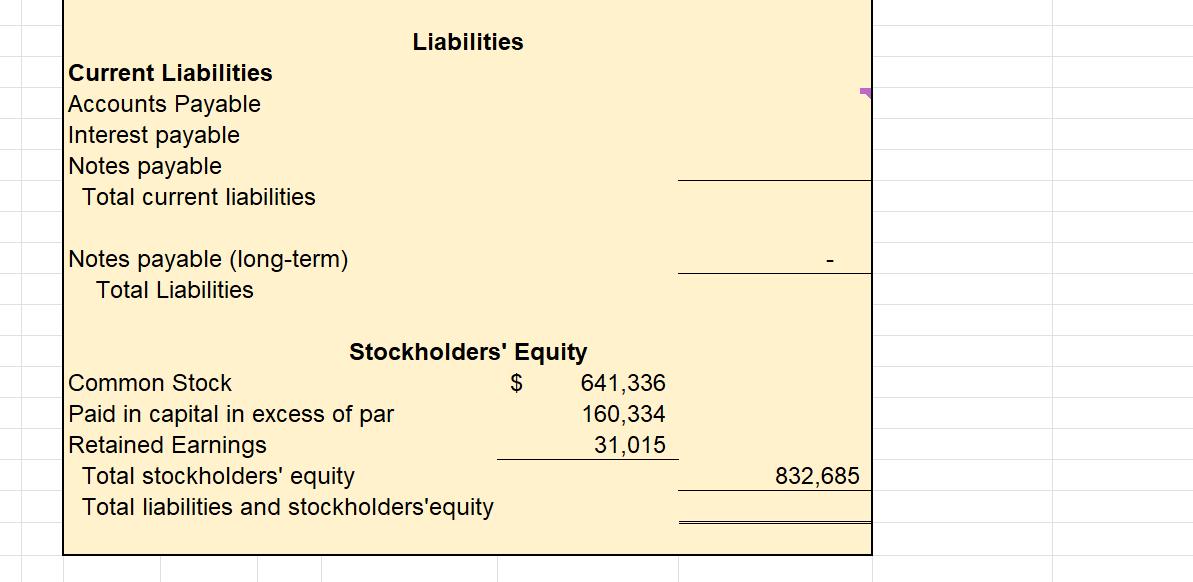

Budget Problem Solutions 1. Sales budget: $ 9,500,000 2. schedule of expected cash collections: $9,482,500 2. A purchases budget: $5,377,500 3. Cash payment schedule: $5,362,500 4. A cash budget: $ 50,910 5. A budgeted income statement: Net Income: $ 12,565 6. A budgeted balance sheet: $ 1,321,030 Required: Prepare the following budgets and schedules for the year, showing both quarterly and total amounts. 1. Sales budget and a schedule of expected cash collections. 2. A purchases budget 3. Cash payment schedule 4. A cash budget. Determine any borrowing needed to maintain a cash balance of $50,000. Beginning cash balance $55,000 Loans are made at the beginning of the quarter and paid at the end of the quarter; interest is 6% per year. 5. A budgeted income statement. 6. A budgeted balance sheet. 1 Budgeted unit sales Selling price per unit Total Sales Sales Budget Year 3 quarters 1 2 3 4 Year Accounts receivable beginning First quarter Second quarter Third quarter Fourth quarter Total cash collections 1 Cash Collections Schedule Year 3 quarters Calculate the Accounts Receivable Ending Balance: 2 3 4 Year 2 Budgeted unit sales Desired ending inventory Total needs Beginning inventory Required purchases Cost per unit Total purchases Purchases Budget 1 Year 3 Quarters 2 3 4 Year Calculate the Merchandise Inventory Ending Balance: 3 Accounts payable beginning First quarter Second quarter Third quarter Fourth quarter Total cash paid Calculate the Accounts Payable Ending Balance 1 Cash Payments Schedule Year 3 Quarters 2 3 4 Year 4 Beginning Cash Balance Add: Cash collection from customers Total cash available Less: Cash Disbursements Purchase of inventory Sales commission Advertising Rent Salaries Utilities Insurance Equipment purchases Total disbursements Excess (deficiency) of cash available Financing: Borrowings Repayments (including interest) Total finaning 1 Cash Budget Year 3 quarters 2 3 4 Year Excess (deficiency) of cash available Financing: Borrowings Repayments (including interest) Total finaning Cash balance, ending 5 Peoples Company Budgeted Income Statement For the Year Ending December 31, 20Y3 Sales Cost of Goods Sold Gross Profit Operatingexpenses: Advertising expense Salaries expense Sales commisson expense Rent expense Utilities expense Insurance expense Depreciation expense Interest expense Total Operating expenses Net operating income 6 Peoples Company Budgeted Balance Sheet December 31, 20Y3 Assets Current Assets Cash Accounts receivable Merchandise inventory Total current assets Land Plant Assets Equipment Less: Accumulated Depreciation Total Assets $ Current Liabilities Accounts Payable Interest payable Notes payable Total current liabilities Notes payable (long-term) Total Liabilities Liabilities Stockholders' Equity Common Stock $ 641,336 Paid in capital in excess of par 160,334 Retained Earnings 31,015 Total stockholders' equity Total liabilities and stockholders'equity 832,685

Step by Step Solution

There are 3 Steps involved in it

To address the requirements we will prepare the following budgets and schedules Sales Budget and Schedule of Expected Cash Collections Purchases Budget Cash Payment Schedule Cash Budget Budgeted Incom... View full answer

Get step-by-step solutions from verified subject matter experts