Answered step by step

Verified Expert Solution

Question

1 Approved Answer

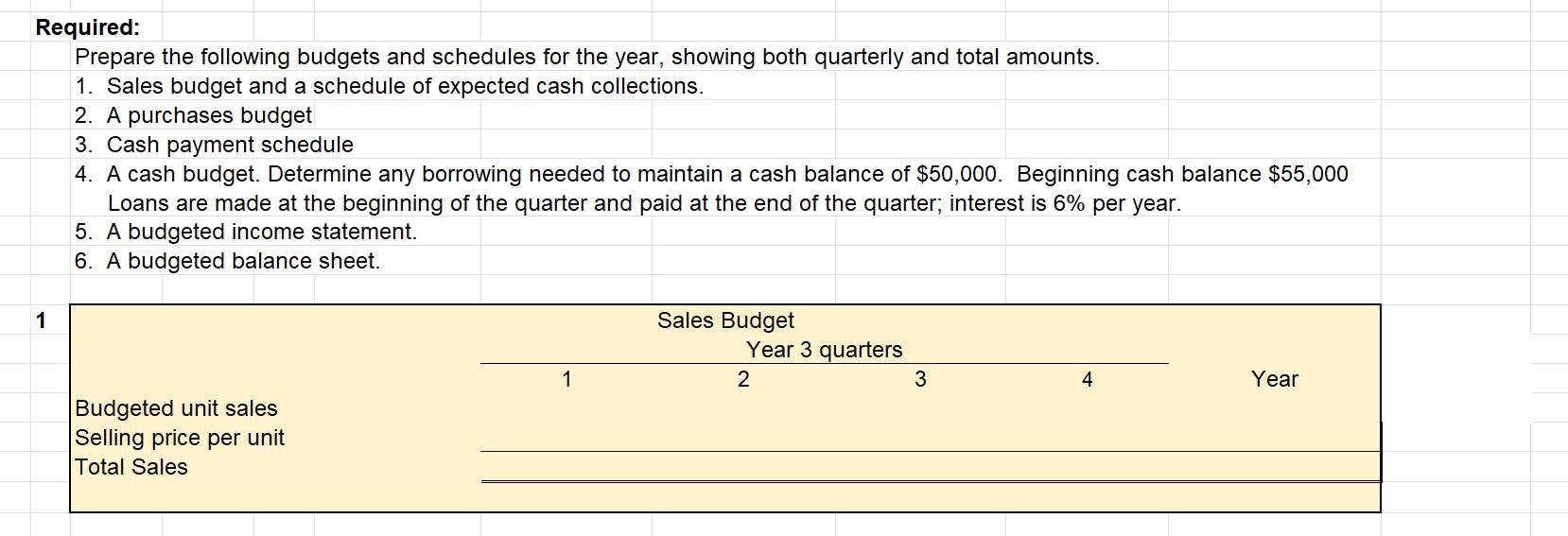

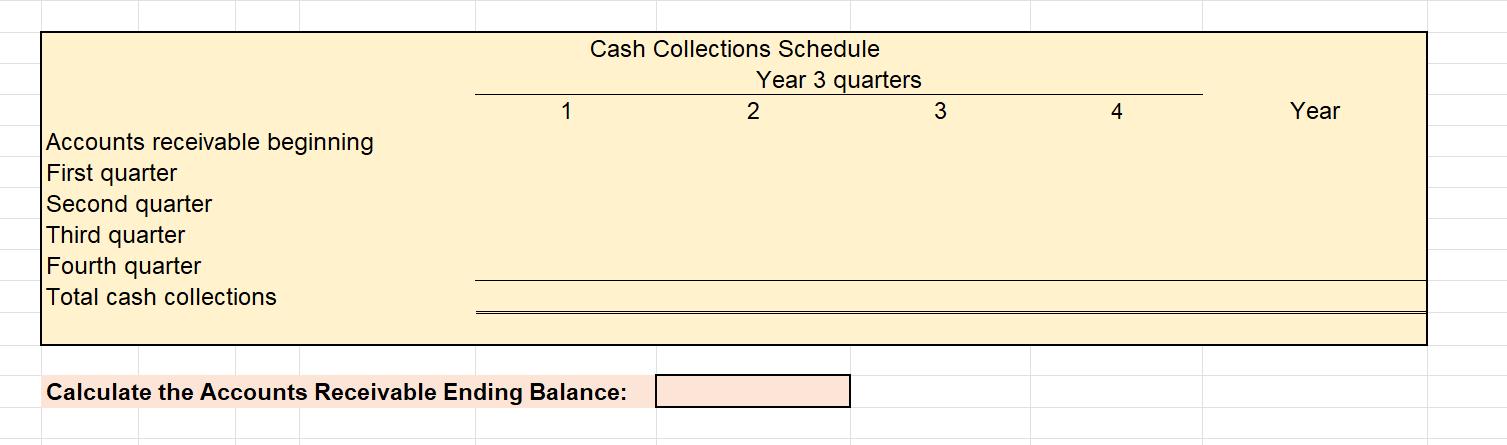

Required: Prepare the following budgets and schedules for the year, showing both quarterly and total amounts. 1. Sales budget and a schedule of expected

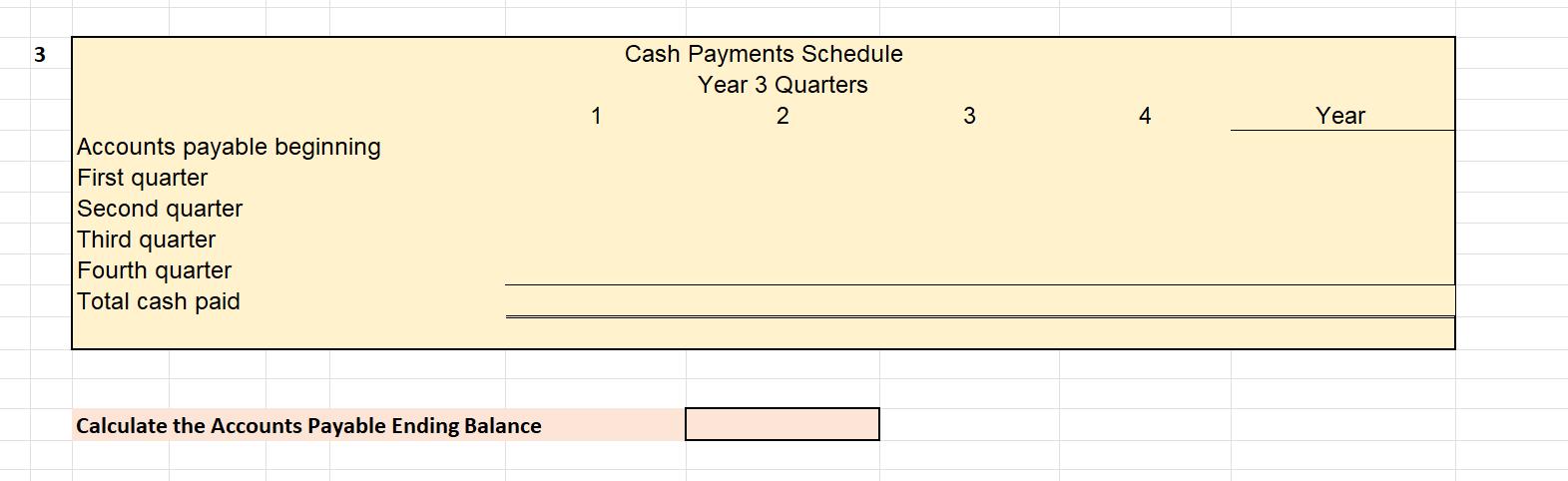

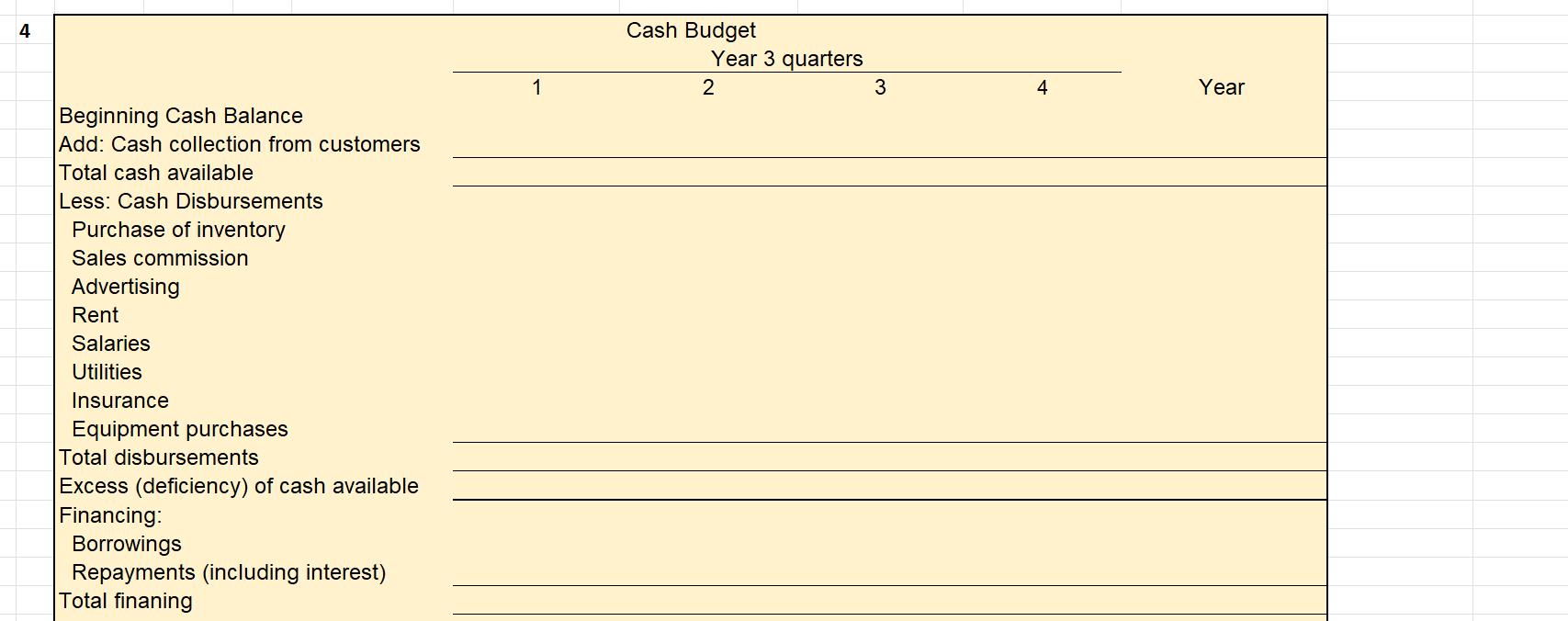

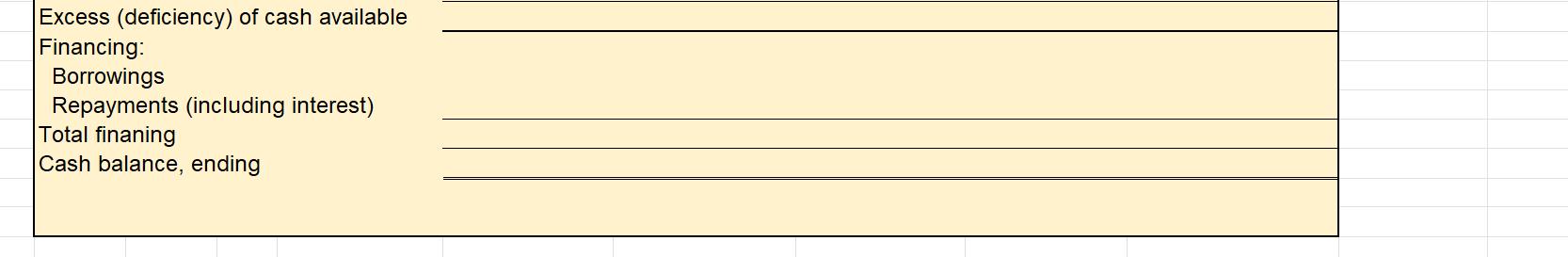

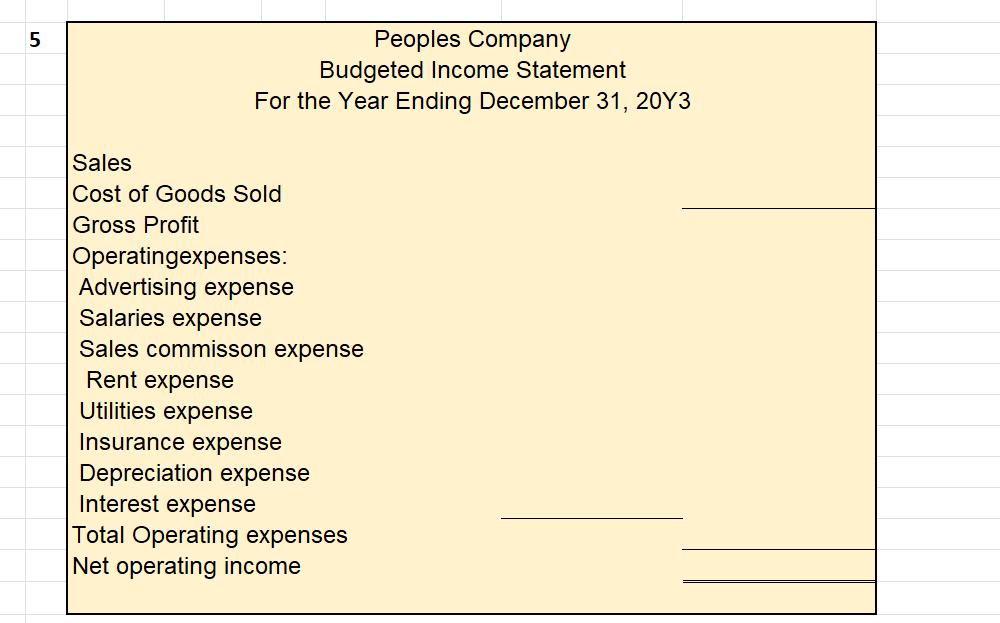

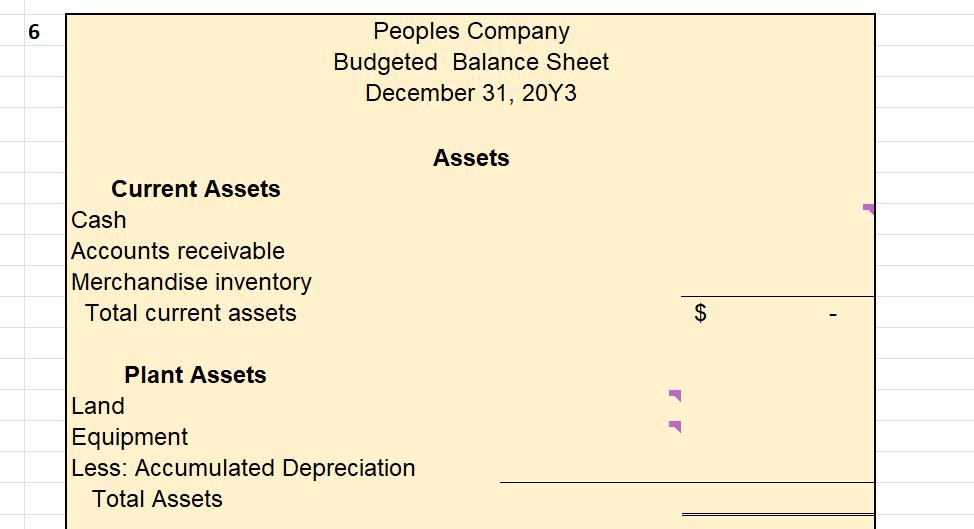

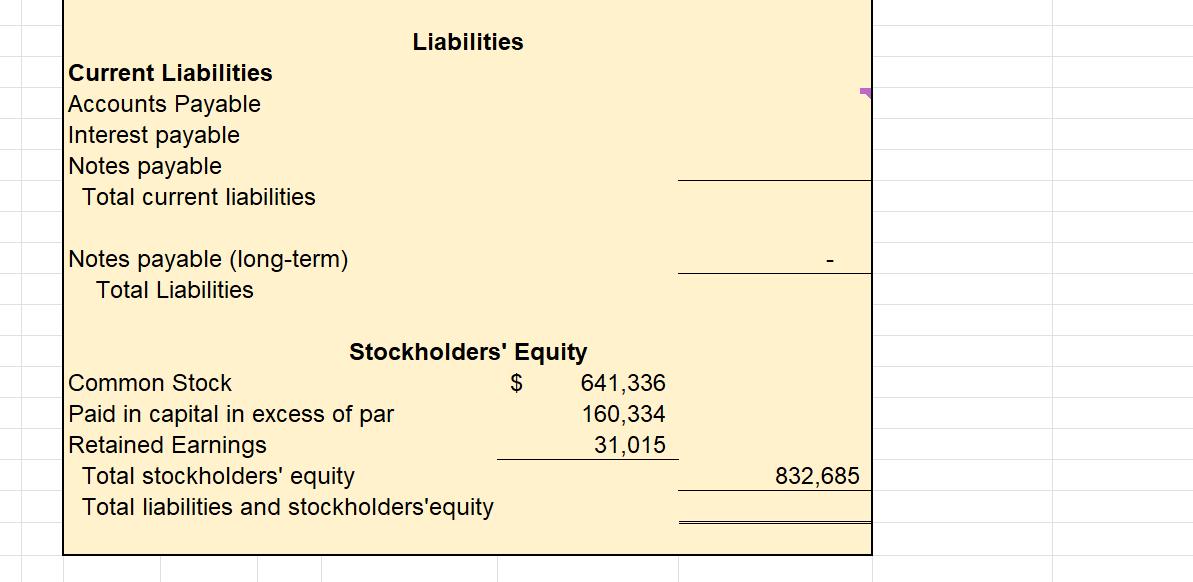

Required: Prepare the following budgets and schedules for the year, showing both quarterly and total amounts. 1. Sales budget and a schedule of expected cash collections. 2. A purchases budget 3. Cash payment schedule 4. A cash budget. Determine any borrowing needed to maintain a cash balance of $50,000. Beginning cash balance $55,000 Loans are made at the beginning of the quarter and paid at the end of the quarter; interest is 6% per year. 5. A budgeted income statement. 6. A budgeted balance sheet. 1 Budgeted unit sales Selling price per unit Total Sales Sales Budget Year 3 quarters 1 2 3 4 Year Accounts receivable beginning First quarter Second quarter Third quarter Fourth quarter Total cash collections 1 Cash Collections Schedule Year 3 quarters Calculate the Accounts Receivable Ending Balance: 2 3 4 Year 2 Budgeted unit sales Desired ending inventory Total needs Beginning inventory Required purchases Cost per unit Total purchases Purchases Budget 1 Year 3 Quarters 2 3 4 Year Calculate the Merchandise Inventory Ending Balance: 3 Accounts payable beginning First quarter Second quarter Third quarter Fourth quarter Total cash paid Calculate the Accounts Payable Ending Balance 1 Cash Payments Schedule Year 3 Quarters 2 3 4 Year 4 Beginning Cash Balance Add: Cash collection from customers Total cash available Less: Cash Disbursements Purchase of inventory Sales commission Advertising Rent Salaries Utilities Insurance Equipment purchases Total disbursements Excess (deficiency) of cash available Financing: Borrowings Repayments (including interest) Total finaning 1 Cash Budget Year 3 quarters 2 3 4 Year Excess (deficiency) of cash available Financing: Borrowings Repayments (including interest) Total finaning Cash balance, ending 5 Peoples Company Budgeted Income Statement For the Year Ending December 31, 20Y3 Sales Cost of Goods Sold Gross Profit Operatingexpenses: Advertising expense Salaries expense Sales commisson expense Rent expense Utilities expense Insurance expense Depreciation expense Interest expense Total Operating expenses Net operating income 6 Peoples Company Budgeted Balance Sheet December 31, 20Y3 Assets Current Assets Cash Accounts receivable Merchandise inventory Total current assets Land Plant Assets Equipment Less: Accumulated Depreciation Total Assets $ Current Liabilities Accounts Payable Interest payable Notes payable Total current liabilities Notes payable (long-term) Total Liabilities Liabilities Stockholders' Equity Common Stock $ 641,336 Paid in capital in excess of par 160,334 Retained Earnings 31,015 Total stockholders' equity Total liabilities and stockholders'equity 832,685

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets work through the required budgets and schedules for the year 1 Sales Budget and Cash Colle...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started