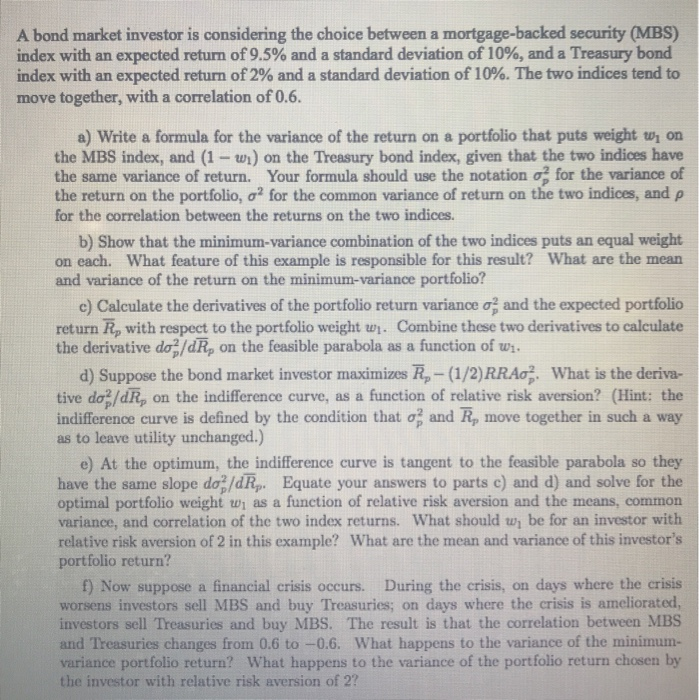

A bond market investor is considering the choice between a mortgage-backed security (MBS) index with an expected return of 9.5% and a standard deviation of 10%, and a Treasury bond index with an expected return of 2% and a standard deviation of 10%. The two indices tend to move together, with a correlation of 0.6. a) Write a formula for the variance of the return on a portfolio that puts weight w, on the MBS index, and (1-w) on the Treasury bond index, given that the two indices have the same variance of return. Your formula should use the notation o; for the variance of the return on the portfolio, o2 for the common variance of return on the two indices, and p for the correlation between the returns on the two indices. b) Show that the minimum-variance combination of the two indices puts an equal weight on each. What feature of this example is responsible for this result? What are the mean and variance of the return on the minimum-variance portfolio? c) Calculate the derivatives of the portfolio return variance o; and the expected portfolio return R, with respect to the portfolio weight w. Combine these two derivatives to calculate the derivative do/dRon the feasible parabola as a function of wi. d) Suppose the bond market investor maximizes R, - (1/2)RRA; What is the deriva- tive do?/dR, on the indifference curve, as a function of relative risk aversion? (Hint: the indifference curve is defined by the condition that o? and R, move together in such a way as to leave utility unchanged.) e) At the optimum, the indifference curve is tangent to the feasible parabola so they have the same slope do/dry Equate your answers to parts c) and d) and solve for the optimal portfolio weight w, as a function of relative risk aversion and the means, common variance, and correlation of the two index returns. What should w, be for an investor with relative risk aversion of 2 in this example? What are the mean and variance of this investor's portfolio return? f) Now suppose a financial crisis occurs. During the crisis, on days where the crisis worsens investors sell MBS and buy Treasuries; on days where the crisis is ameliorated, investors sell Treasuries and buy MBS. The result is that the correlation between MBS and Treasuries changes from 0.6 to -0.6. What happens to the variance of the minimum- variance portfolio return? What happens to the variance of the portfolio return chosen by the investor with relative risk aversion of 2? A bond market investor is considering the choice between a mortgage-backed security (MBS) index with an expected return of 9.5% and a standard deviation of 10%, and a Treasury bond index with an expected return of 2% and a standard deviation of 10%. The two indices tend to move together, with a correlation of 0.6. a) Write a formula for the variance of the return on a portfolio that puts weight w, on the MBS index, and (1-w) on the Treasury bond index, given that the two indices have the same variance of return. Your formula should use the notation o; for the variance of the return on the portfolio, o2 for the common variance of return on the two indices, and p for the correlation between the returns on the two indices. b) Show that the minimum-variance combination of the two indices puts an equal weight on each. What feature of this example is responsible for this result? What are the mean and variance of the return on the minimum-variance portfolio? c) Calculate the derivatives of the portfolio return variance o; and the expected portfolio return R, with respect to the portfolio weight w. Combine these two derivatives to calculate the derivative do/dRon the feasible parabola as a function of wi. d) Suppose the bond market investor maximizes R, - (1/2)RRA; What is the deriva- tive do?/dR, on the indifference curve, as a function of relative risk aversion? (Hint: the indifference curve is defined by the condition that o? and R, move together in such a way as to leave utility unchanged.) e) At the optimum, the indifference curve is tangent to the feasible parabola so they have the same slope do/dry Equate your answers to parts c) and d) and solve for the optimal portfolio weight w, as a function of relative risk aversion and the means, common variance, and correlation of the two index returns. What should w, be for an investor with relative risk aversion of 2 in this example? What are the mean and variance of this investor's portfolio return? f) Now suppose a financial crisis occurs. During the crisis, on days where the crisis worsens investors sell MBS and buy Treasuries; on days where the crisis is ameliorated, investors sell Treasuries and buy MBS. The result is that the correlation between MBS and Treasuries changes from 0.6 to -0.6. What happens to the variance of the minimum- variance portfolio return? What happens to the variance of the portfolio return chosen by the investor with relative risk aversion of 2