Question

A bond payable is dated January 1, 2017, and is issued on that date. The face value of the bond is $75,000, and the face

A bond payable is dated January 1, 2017, and is issued on that date. The face value of the bond is $75,000, and the face rate of interest is 8%. The bond pays interest semiannually. The bond will mature in five years.

Use the appropriate present value table:

PV of $1 and PV of Annuity of $1

Required:

If required, round your answers to nearest dollar.

1. What will be the issue price of the bond if the market rate of interest is 6% at the time of issuance? $_______________

2. What will be the issue price of the bond if the market rate of interest is 8% at the time of issuance? $_______________

3. What will be the issue price of the bond if the market rate of interest is 10% at the time of issuance? $_______________

2) Gain or Loss on Bonds

Bonds payable are dated January 1, 2017, and are issued on that date. The face value of the bonds is $150,000, and the face rate of interest is 10%. The bonds pay interest semiannually. The bonds will mature in five years. The market rate of interest at the time of issuance was 8%. Assume that the bonds are redeemed on December 31, 2017, at 105, when carrying value was $160,098.75.

Use the appropriate present value table:

PV of $1 and PV of Annuity of $1

Required:

Question Content Area

1. Calculate the gain or loss on bond redemption. Round your answer to two decimal places.

$_______________

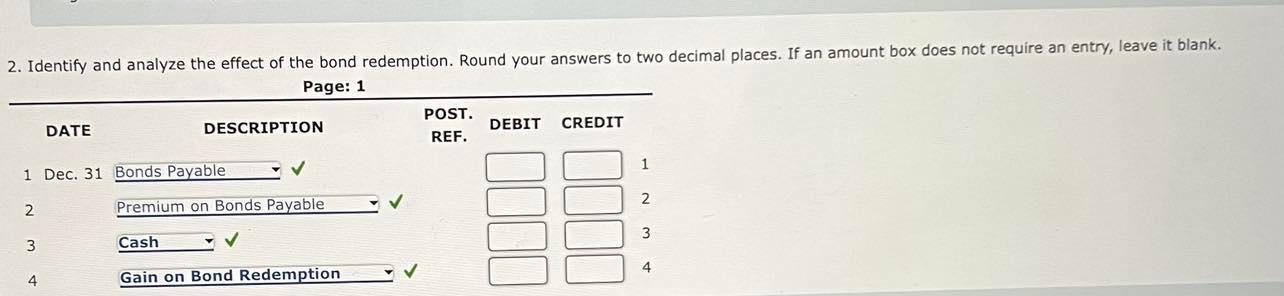

Identify and analyze the effect of the bond redemption. Round your answers to two decimal places. If an amount box does not require an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started