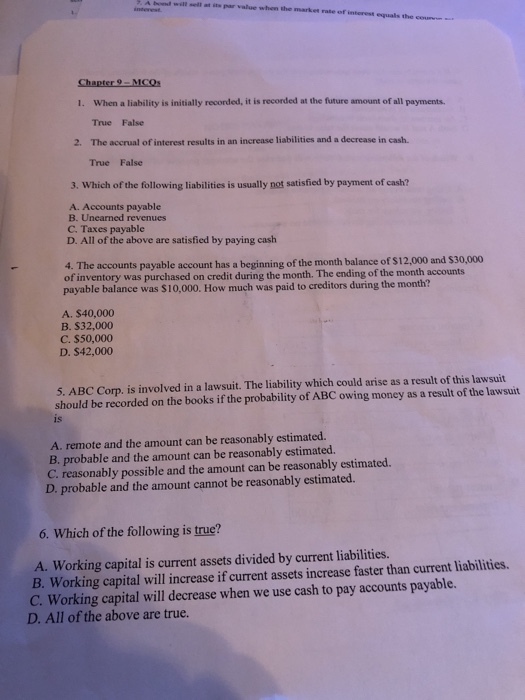

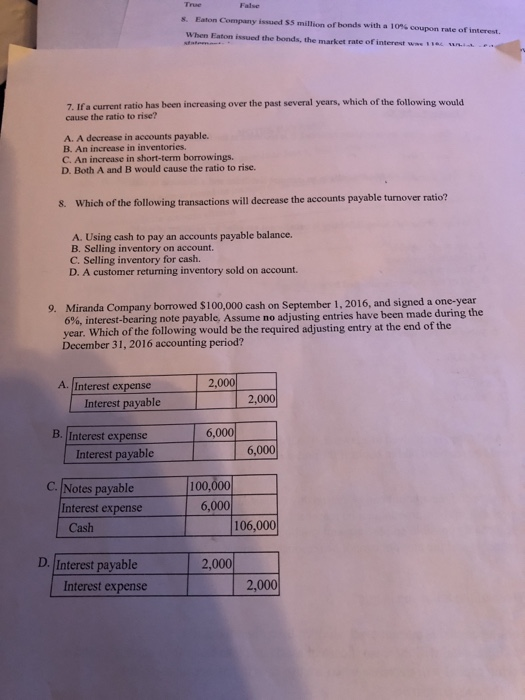

A bond will t sell at its par value when the market rate of interest equals the co Chapter 9-MCO When a liability is initially recorded, it is recorded at the future amount of all payments. True False The accrual of interest results in an increase liabilities and a decrease in cash. True False 1. 2. 3. Which of the following liabilities is usually not satisfied by payment of cash? A. Accounts payable B. Unearned revenues C. Taxes payable D. All of the above are satisfied by paying cash 4. The accounts payable account has a beginning of the month balance of $12,000 and $30,000 of inventory was purchased on credit during the month. The ending of the month accounts payable balance was $10,000. How much was paid to creditors during the month? A. $40,000 B. S32,000 C. $50,000 D. $42,000 5. ABC Corp. is involved in a lawsuit. The liability which could arise as a result of this lawsuit should be recorded on the books if the probability of ABC owing money as a result of the lawsuit is A. remote and the amount can be reasonably estimated. B. probable and the amount can be reasonably estimated. C. reasonably possible and the amount can be reasonably estimated. D. probable and the amount cannot be reasonably estimated. 6. Which of the following is true? A. Working capital is current assets divided by current liabilities. B. Working capital will increase if current assets increase faster than current liabilities. C. Working capital will decrease when we use cash to pay accounts payable. D. All of the above are true. Eaton Company issued $5 million of bonds with a 10% coupon rate of interest. 8. When Eaton issued the bonds, the market rate of interest www 1c 7. If a current ratio has been increasing over the past several years, which of the following would cause the ratio to rise? A. A decrease in accounts payable. B. An increase in inventories. C. An increase in short-term borrowings. D. Both A and B would cause the ratio to rise. Which of the following transactions will decrease the accounts payable turnover ratio? 8. A. Using cash to pay an accounts payable balance. B. Selling inventory on account. C. Selling inventory for cash. D. A customer returning inventory sold on account. Miranda Company borrowed $100,000 cash on September 1, 2016, and signed a one-year 9. interest-bearing note payable, Assume no adjusting entries have been made during the year. Which of the following would be the required adjusting entry at the end of the December 31, 2016 accounting period? 6% 2,000 A. /Interest expense Interest payable2.000 B. Interest expense 6,000 Interest payable 100,000 6,000 C. Notes payable Interest expense 106,000 Cash D. Interest payable 2,000 2,000 Interest expense