Answered step by step

Verified Expert Solution

Question

1 Approved Answer

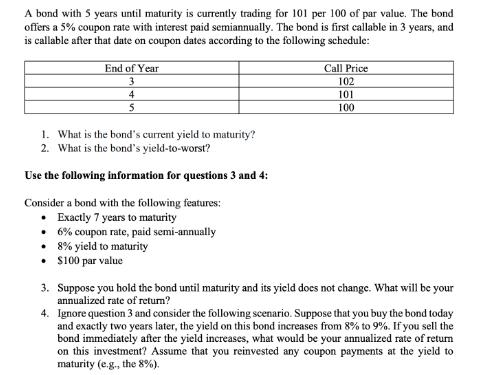

A bond with 5 years until maturity is currently trading for 101 per 100 of par value. The bond offers a 5% coupon rate

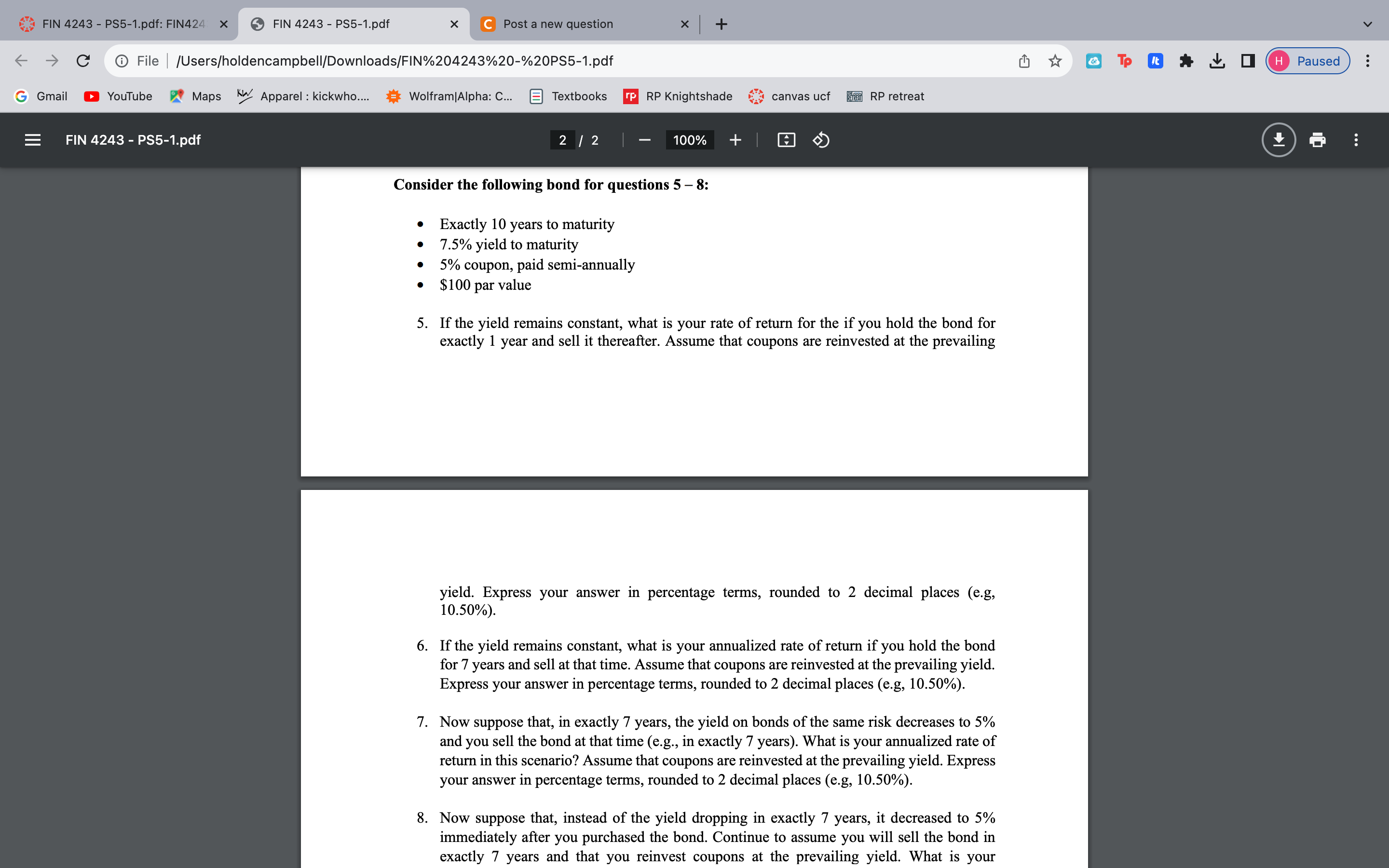

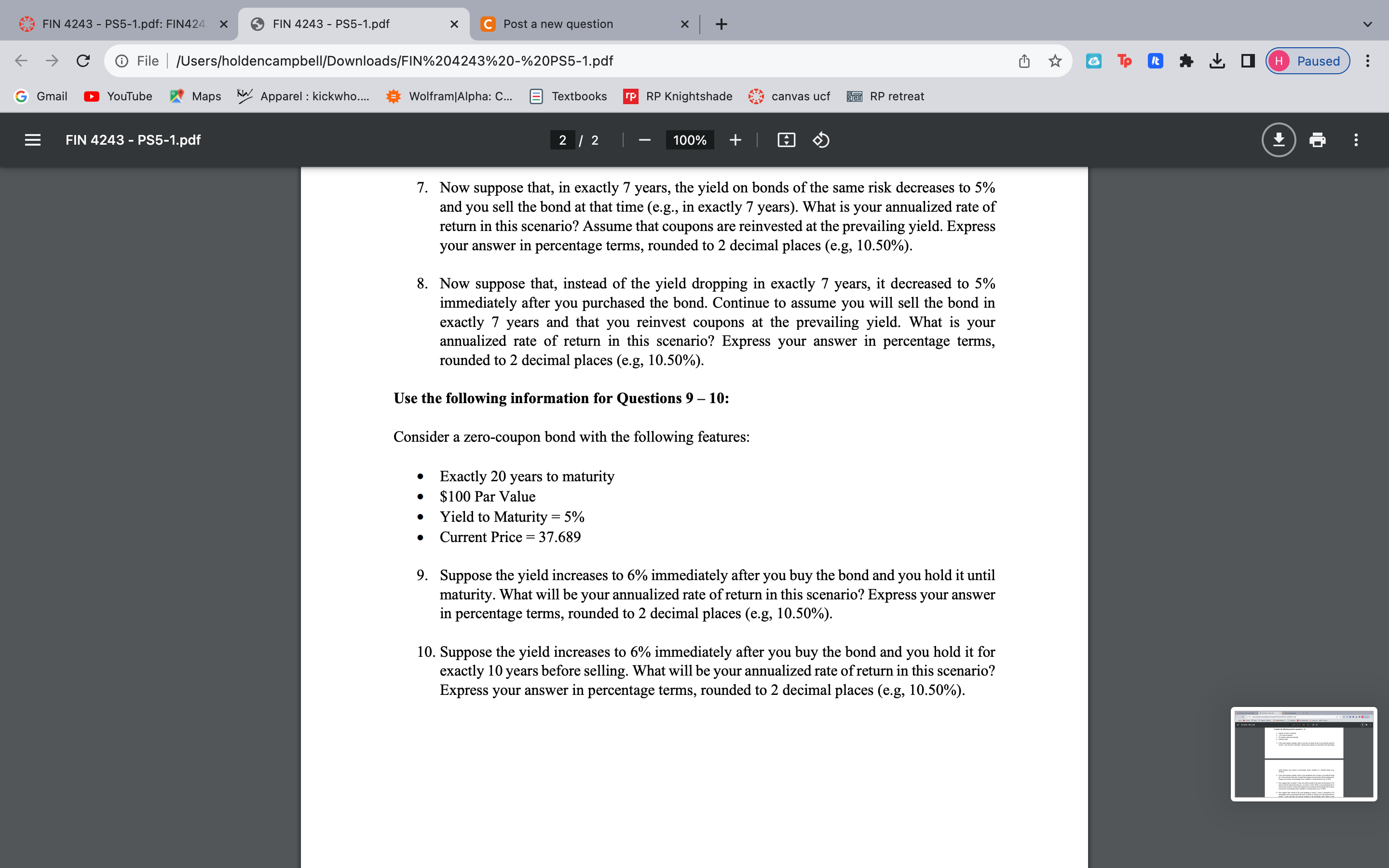

A bond with 5 years until maturity is currently trading for 101 per 100 of par value. The bond offers a 5% coupon rate with interest paid semiannually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule: End of Year 3 4 5 1. What is the bond's current yield to maturity? 2. What is the bond's yield-to-worst? Use the following information for questions 3 and 4: Consider a bond with the following features: Exactly 7 years to maturity 6% coupon rate, paid semi-annually 8% yield to maturity $100 par value Call Price 102 101 100 3. 4. Ignore question 3 and consider the following scenario. Suppose that you buy the bond today and exactly two years later, the yield on this bond increases from 8% to 9%. If you sell the bond immediately after the yield increases, what would be your annualized rate of return on this investment? Assume that you reinvested any coupon payments at the yield to maturity (e.g., the 8%). Suppose you hold the bond until maturity and its yield does not change. What will be your annualized rate of return? FIN 4243 - PS5-1.pdf: FIN424 X G Gmail C File /Users/holdencampbell/Downloads/FIN%204243%20-%20PS5-1.pdf YouTube Maps FIN 4243 - PS5-1.pdf FIN 4243 - PS5-1.pdf KW X C Post a new question Apparel : kickwho.... Wolfram Alpha: C... Textbooks rp RP Knightshade 2/2 | + Exactly 10 years to maturity 7.5% yield to maturity 5% coupon, paid semi-annually $100 par value 100% + | Consider the following bond for questions 5 - 8: canvas ucf RP retreat 5. If the yield remains constant, what is your rate of return for the if you hold the bond for exactly 1 year and sell it thereafter. Assume that coupons are reinvested at the prevailing yield. Express your answer in percentage terms, rounded to 2 decimal places (e.g, 10.50%). 6. If the yield remains constant, what is your annualized rate of return if you hold the bond for 7 years and sell at that time. Assume that coupons are reinvested at the prevailing yield. Express your answer in percentage terms, rounded to 2 decimal places (e.g, 10.50%). 7. Now suppose that, in exactly 7 years, the yield on bonds of the same risk decreases to 5% and you sell the bond at that time (e.g., in exactly 7 years). What is your annualized rate of return in this scenario? Assume that coupons are reinvested at the prevailing yield. Express your answer in percentage terms, rounded to 2 decimal places (e.g, 10.50%). 8. Now suppose that, instead of the yield dropping in exactly 7 years, it decreased to 5% immediately after you purchased the bond. Continue to assume you will sell the bond in exactly 7 years and that you reinvest coupons at the prevailing yield. What is your & S It * O H Paused : FIN 4243 - PS5-1.pdf: FIN424 X G Gmail C File /Users/holdencampbell/Downloads/FIN%204243%20-%20PS5-1.pdf YouTube Maps FIN 4243 - PS5-1.pdf FIN 4243 - PS5-1.pdf KW Apparel : kickwho.... X C Post a new question Wolfram Alpha: C... Textbooks rp RP Knightshade 2 / 2 | + 100% + | Exactly 20 years to maturity $100 Par Value Yield to Maturity = 5% Current Price = 37.689 canvas ucf 7. Now suppose that, in exactly 7 years, the yield on bonds of the same risk decreases to 5% and you sell the bond at that time (e.g., in exactly 7 years). What is your annualized rate of return in this scenario? Assume that coupons are reinvested at the prevailing yield. Express your answer in percentage terms, rounded to 2 decimal places (e.g, 10.50%). RP retreat 8. Now suppose that, instead of the yield dropping in exactly 7 years, it decreased to 5% immediately after you purchased the bond. Continue to assume you will sell the bond in exactly 7 years and that you reinvest coupons at the prevailing yield. What is your annualized rate of return in this scenario? Express your answer in percentage terms, rounded to 2 decimal places (e.g, 10.50%). Use the following information for Questions 9 - 10: Consider a zero-coupon bond with the following features: 9. Suppose the yield increases to 6% immediately after you buy the bond and you hold it until maturity. What will be your annualized rate of return in this scenario? Express your answer in percentage terms, rounded to 2 decimal places (e.g, 10.50%). 10. Suppose the yield increases to 6% immediately after you buy the bond and you hold it for exactly 10 years before selling. What will be your annualized rate of return in this scenario? Express your answer in percentage terms, rounded to 2 decimal places (e.g, 10.50%). & S It * O H Paused , (amar Man :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the different yields for the given bonds 1 For the bond with 5 years until maturity and currently trading at 101 with a 5 coupon rate a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started