Answered step by step

Verified Expert Solution

Question

1 Approved Answer

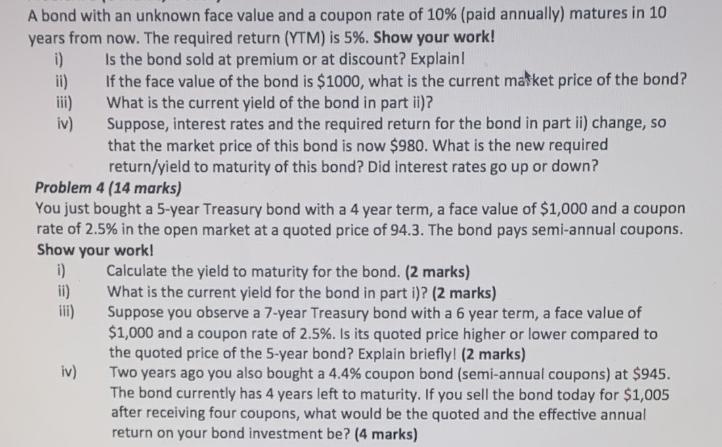

A bond with an unknown face value and a coupon rate of 10% (paid annually) matures in 10 years from now. The required return

A bond with an unknown face value and a coupon rate of 10% (paid annually) matures in 10 years from now. The required return (YTM) is 5%. Show your work! i) Is the bond sold at premium or at discount? Explain! ii) If the face value of the bond is $1000, what is the current market price of the bond? What is the current yield of the bond in part ii)? Suppose, interest rates and the required return for the bond in part ii) change, so that the market price of this bond is now $980. What is the new required iv) return/yield to maturity of this bond? Did interest rates go up or down? Problem 4 (14 marks) You just bought a 5-year Treasury bond with a 4 year term, a face value of $1,000 and a coupon rate of 2.5% in the open market at a quoted price of 94.3. The bond pays semi-annual coupons. Show your work! i) Calculate the yield to maturity for the bond. (2 marks) ii) iii) 3 iv) What is the current yield for the bond in part i)? (2 marks) Suppose you observe a 7-year Treasury bond with a 6 year term, a face value of $1,000 and a coupon rate of 2.5%. Is its quoted price higher or lower compared to the quoted price of the 5-year bond? Explain briefly! (2 marks) Two years ago you also bought a 4.4% coupon bond (semi-annual coupons) at $945. The bond currently has 4 years left to maturity. If you sell the bond today for $1,005 after receiving four coupons, what would be the quoted and the effective annual return on your bond investment be? (4 marks)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

i To determine whether the bond is sold at a premium or a discount we compare the coupon rate to the yield to maturity YTM In this case the coupon rate is 10 and the required return YTM is 5 Since the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started