Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a bond's price/coupon payment /par value a bond issuer is said liquidation/bankruptcy/default a bond contract sinking fundation provision/call provision/convertible provision a bond's call provision/convertibility provision/call

| a bond's | price/coupon payment /par value |

| a bond issuer is said | liquidation/bankruptcy/default |

| a bond contract | sinking fundation provision/call provision/convertible provision

|

| a bond's | call provision/convertibility provision/call premium |

| if the coupon | fixed rate/floating rate |

| the contract that describe | trustee/debenture/indenture |

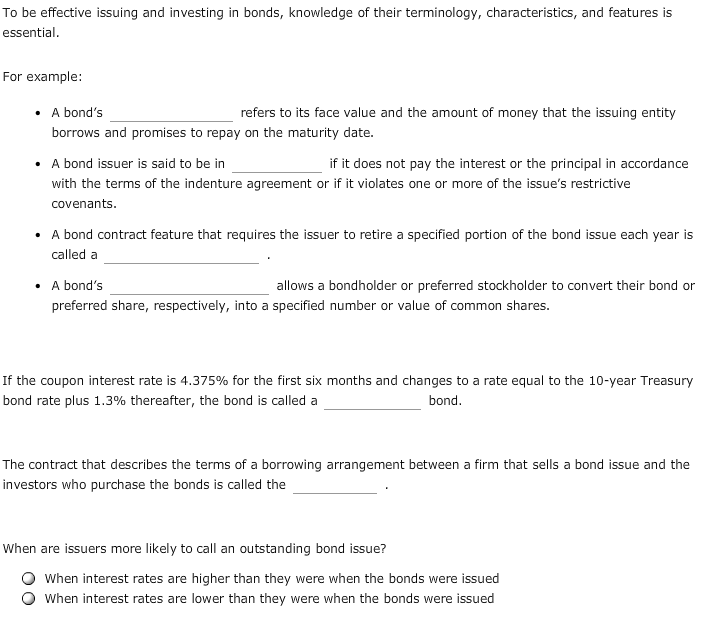

To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential For example refers to its face value and the amount of money that the issuing entity A bond's borrows and promises to repay on the maturity date. if it does not pay the interest or the principal in accordance A bond issuer is said to be in with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants A bond contract feature that requires the issuer to retire a specified portion of the bond issue each year is called a .A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares. If the coupon interest rate is 4.375% for the first six months and changes to a rate equal to the 10-year Treasury bond rate plus 1.3% thereafter, the bond is called a bond The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called the When are issuers more likely to call an outstanding bond issue? O When interest rates are higher than they were when the bonds were issued When interest rates are lower than they were when the bonds were issued

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started