Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A borrower wants to obtain additional mortgage funds by renegotiating the first mortgage, adding a second mortgage, or taking out a blend and extend

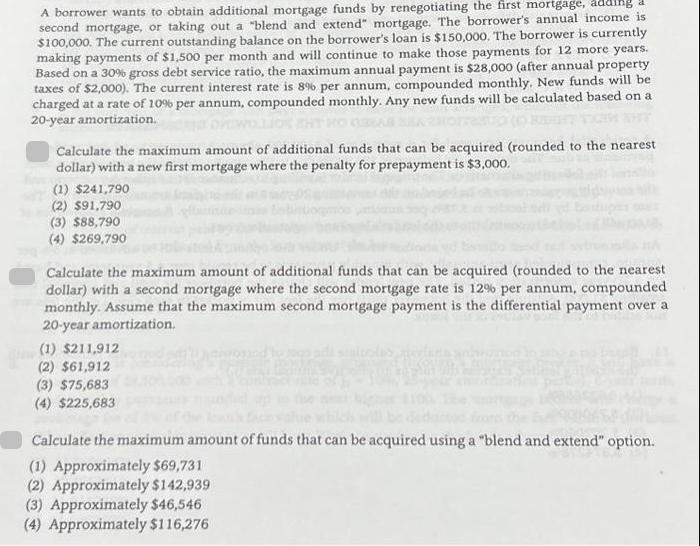

A borrower wants to obtain additional mortgage funds by renegotiating the first mortgage, adding a second mortgage, or taking out a "blend and extend" mortgage. The borrower's annual income is $100,000. The current outstanding balance on the borrower's loan is $150,000. The borrower is currently making payments of $1,500 per month and will continue to make those payments for 12 more years. Based on a 30% gross debt service ratio, the maximum annual payment is $28,000 (after annual property taxes of $2,000). The current interest rate is 8% per annum, compounded monthly. New funds will be charged at a rate of 10% per annum, compounded monthly. Any new funds will be calculated based on a 20-year amortization. Calculate the maximum amount of additional funds that can be acquired (rounded to the nearest dollar) with a new first mortgage where the penalty for prepayment is $3,000. (1) $241,790 (2) $91,790 (3) $88,790 (4) $269,790 Calculate the maximum amount of additional funds that can be acquired (rounded to the nearest dollar) with a second mortgage where the second mortgage rate is 12% per annum, compounded monthly. Assume that the maximum second mortgage payment is the differential payment over a 20-year amortization. (1) $211,912 (2) $61,912 (3) $75,683 (4) $225,683 Calculate the maximum amount of funds that can be acquired using a "blend and extend" option. (1) Approximately $69,731 (2) Approximately $142,939 (3) Approximately $46,546 (4) Approximately $116,276

Step by Step Solution

★★★★★

3.32 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Lets calculate the maximum amount of additional funds that can be acquired with each of the three options a new first mortgage a second mor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started