Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) Box Expert Company Limited (Company) is engaged in selling plastic display boxes to customers. Horus is the Companys accountant and he received the Companys

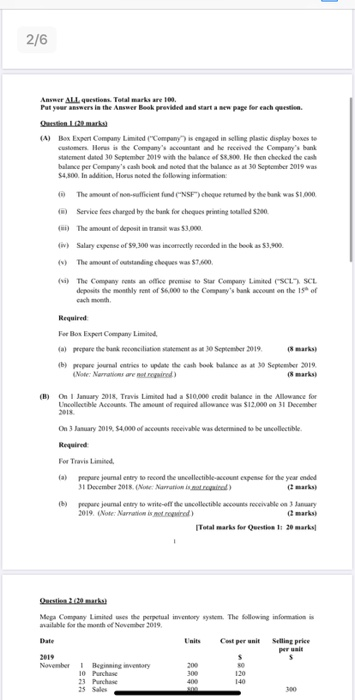

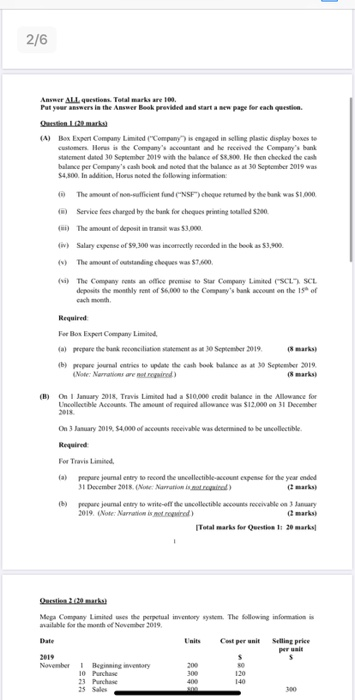

A) Box Expert Company Limited (Company) is engaged in selling plastic display boxes to customers. Horus is the Companys accountant and he received the Companys bank statement dated 30 September 2019 with the balance of $8,800. He then checked the cash balance per Companys cash book and noted that the balance as at 30 September 2019 was $4,800. In addition, Horus noted the following information: (i) The amount of non-sufficient fund (NSF) cheque returned by the bank was $1,000. (ii) Service fees charged by the bank for cheques printing totalled $200. (iii) The amount of deposit in transit was $3,000. (iv) Salary expense of $9,300 was incorrectly recorded in the book as $3,900. (v) The amount of outstanding cheques was $7,600. (vi) The Company rents an office premise to Star Company Limited (SCL). SCL deposits the monthly rent of $6,000 to the Companys bank account on the 15th of each month. Required: For Box Expert Company Limited, (a) prepare the bank reconciliation statement as at 30 September 2019. (8 marks) (b) prepare journal entries to update the cash book balance as at 30 September 2019. (Note: Narrations are not required.) (8 marks) (B) On 1 January 2018, Travis Limited had a $10,000 credit balance in the Allowance for Uncollectible Accounts. The amount of required allowance was $12,000 on 31 December 2018. On 3 January 2019, $4,000 of accounts receivable was determined to be uncollectible. Required: For Travis Limited, (a) prepare journal entry to record the uncollectible-account expense for the year ended 31 December 2018. (Note: Narration is not required.) (2 marks) (b) prepare journal entry to write-off the uncollectible accounts receivable on 3 January 2019. (Note: Narration is not required.)  2/6 Anner ALL questions. Total marks are 100 Put your answers in the AnswerBook provided and start a new page for each question. Duration (A) Bex Expert Company Limited ("Company is engaged in selling plastic display boses to customers. He is the Company's accountant and he received the Company's bank statement dated 30 September 2019 with the balance of 58.800. He then checked the case balance per Company's cash book and noted that the balance as at 30 September 2019 was $4,800. In addition, Horus noted the following information: The amount of non-sufficient fund (NSF) choque returned by the bank was $1,000 Service fees charged by the bank for cheques printing called $300 The amount of deposit in transit was $3,000 V) Salary expense of 99,300 was incorrectly recorded in the book as $1,900 The amount of outstanding cheques was 87.600. (i) The Company at an office promise to Sur Company Limited (SCL) SCL deposits the monthly rent of S6,000 to the Company's bank account on the 15 of cach month Required For Box Expert Company Limited (a) pare the bank reconciliation as 30 September 2019 (b) pere journal tries to play the cash hook balance as at 30 September 3019 (Note: Narrations are not repaired) (% marks) (B) On January 2018, Travis Limited had a $10,000 credit balance in the Allowance for Uncollectible Accounts. The amount of required allowance was $12.000 on 31 December 2018 On 3 January 2019. 4,000 of accounts receivable was determined to be collectible. Required For Travis Limited, (a) prepare journal entry to record the uncollectible-account expense for the year ended 31 December 2016. (Now Narration card prepare journal entry to write-off the collectible accounts receivable ca 3 January 2019. (Note: Narration is not rewed) marksi Total marks for Question 1: 20 marks Onesti (20) Mega Company Limited was the perpetual inventory system. The following information is mailable for the month of November 2019 Dale Cost per unit Selling price PT 2019 $ November Beginning 200 SO 10 Purchase 300 120 23 Purchase 400 140 25 Sales 300

2/6 Anner ALL questions. Total marks are 100 Put your answers in the AnswerBook provided and start a new page for each question. Duration (A) Bex Expert Company Limited ("Company is engaged in selling plastic display boses to customers. He is the Company's accountant and he received the Company's bank statement dated 30 September 2019 with the balance of 58.800. He then checked the case balance per Company's cash book and noted that the balance as at 30 September 2019 was $4,800. In addition, Horus noted the following information: The amount of non-sufficient fund (NSF) choque returned by the bank was $1,000 Service fees charged by the bank for cheques printing called $300 The amount of deposit in transit was $3,000 V) Salary expense of 99,300 was incorrectly recorded in the book as $1,900 The amount of outstanding cheques was 87.600. (i) The Company at an office promise to Sur Company Limited (SCL) SCL deposits the monthly rent of S6,000 to the Company's bank account on the 15 of cach month Required For Box Expert Company Limited (a) pare the bank reconciliation as 30 September 2019 (b) pere journal tries to play the cash hook balance as at 30 September 3019 (Note: Narrations are not repaired) (% marks) (B) On January 2018, Travis Limited had a $10,000 credit balance in the Allowance for Uncollectible Accounts. The amount of required allowance was $12.000 on 31 December 2018 On 3 January 2019. 4,000 of accounts receivable was determined to be collectible. Required For Travis Limited, (a) prepare journal entry to record the uncollectible-account expense for the year ended 31 December 2016. (Now Narration card prepare journal entry to write-off the collectible accounts receivable ca 3 January 2019. (Note: Narration is not rewed) marksi Total marks for Question 1: 20 marks Onesti (20) Mega Company Limited was the perpetual inventory system. The following information is mailable for the month of November 2019 Dale Cost per unit Selling price PT 2019 $ November Beginning 200 SO 10 Purchase 300 120 23 Purchase 400 140 25 Sales 300

A) Box Expert Company Limited (Company) is engaged in selling plastic display boxes to customers. Horus is the Companys accountant and he received the Companys bank statement dated 30 September 2019 with the balance of $8,800. He then checked the cash balance per Companys cash book and noted that the balance as at 30 September 2019 was $4,800. In addition, Horus noted the following information:

(i) The amount of non-sufficient fund (NSF) cheque returned by the bank was $1,000.

(ii) Service fees charged by the bank for cheques printing totalled $200.

(iii) The amount of deposit in transit was $3,000.

(iv) Salary expense of $9,300 was incorrectly recorded in the book as $3,900.

(v) The amount of outstanding cheques was $7,600.

(vi) The Company rents an office premise to Star Company Limited (SCL). SCL deposits the monthly rent of $6,000 to the Companys bank account on the 15th of each month.

Required:

For Box Expert Company Limited,

(a) prepare the bank reconciliation statement as at 30 September 2019. (8 marks)

(b) prepare journal entries to update the cash book balance as at 30 September 2019. (Note: Narrations are not required.) (8 marks)

(B) On 1 January 2018, Travis Limited had a $10,000 credit balance in the Allowance for Uncollectible Accounts. The amount of required allowance was $12,000 on 31 December 2018.

On 3 January 2019, $4,000 of accounts receivable was determined to be uncollectible.

Required:

For Travis Limited,

(a) prepare journal entry to record the uncollectible-account expense for the year ended 31 December 2018. (Note: Narration is not required.) (2 marks)

(b) prepare journal entry to write-off the uncollectible accounts receivable on 3 January 2019. (Note: Narration is not required.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started