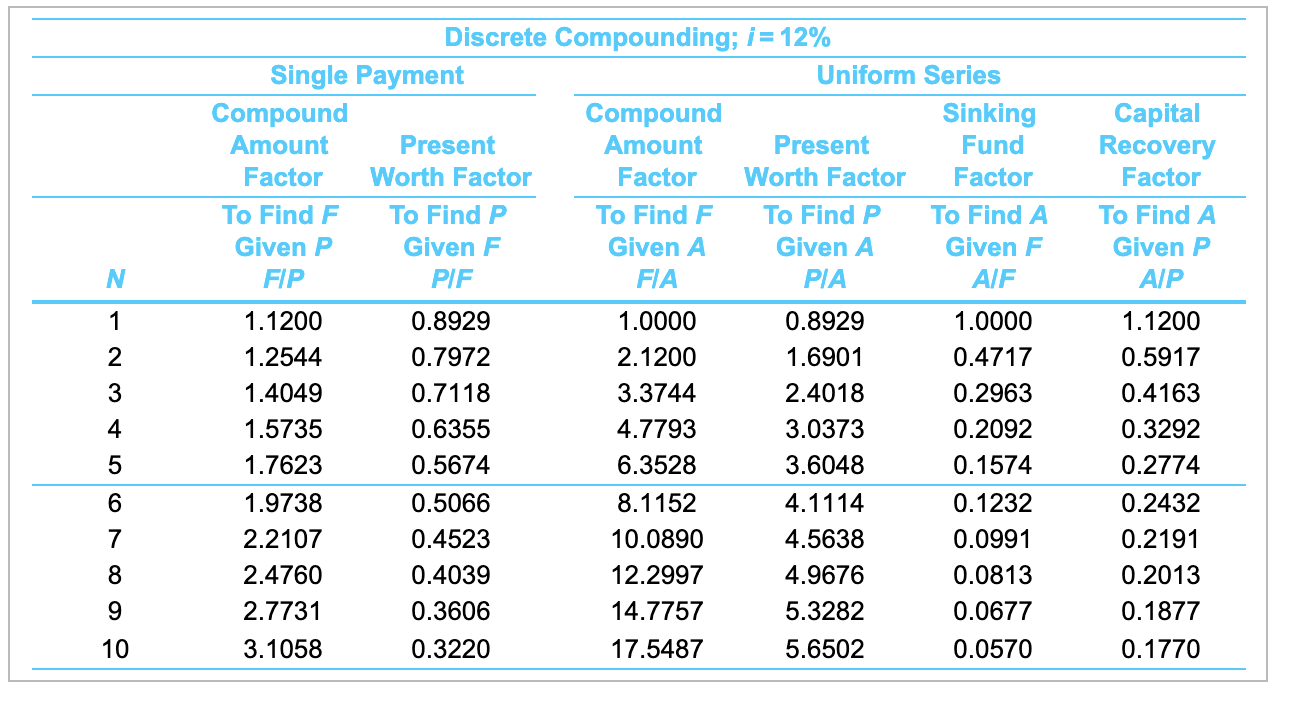

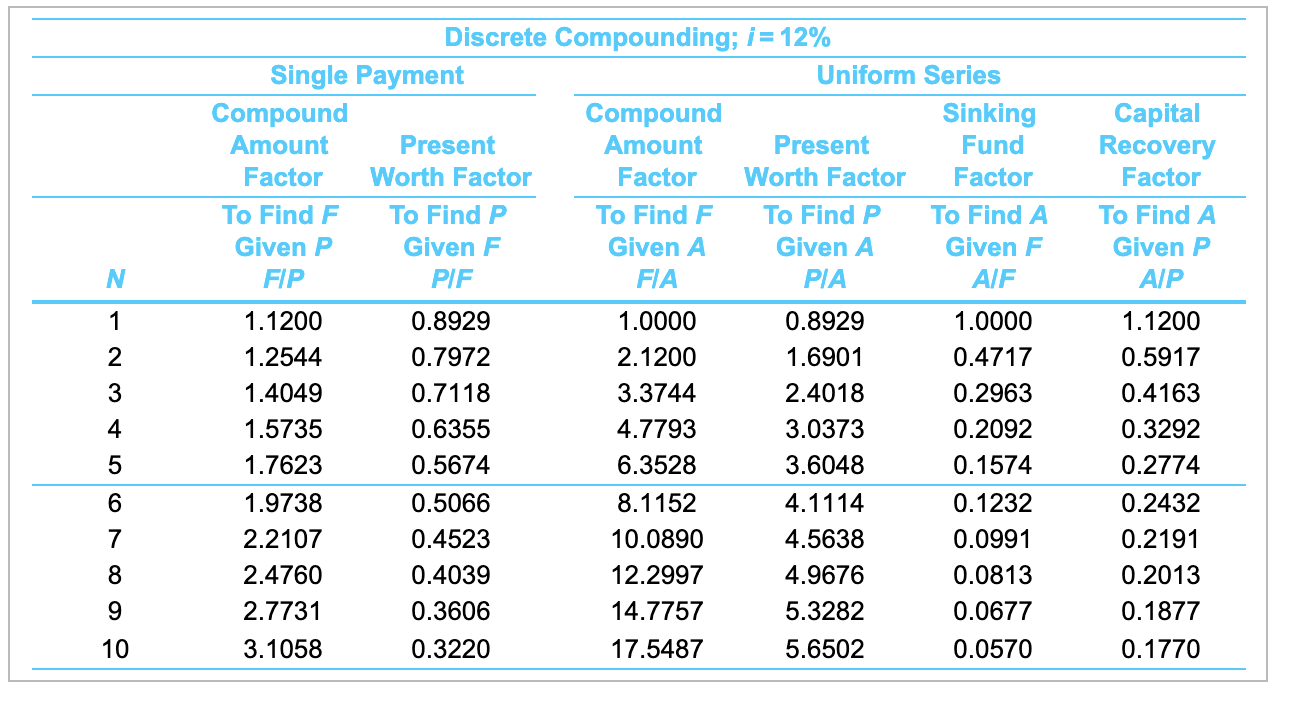

A bridge is to be constructed now as part of a new road. Engineers have determined that traffic density on the new road will justify a two-lane road and a bridge at the present time. Because of uncertainty regarding future use of the road, the time at which an extra two lanes will be required is currently being studied. The two-lane bridge will cost $200,000 and the four-lane bridge, if built initially, will cost $320,000. The future cost of widening a two-lane bridge to four lanes will be an extra $200,000 plus $23,000 for every year that widening is delayed. The MARR used by the highway department is 12% per year. The following estimates have been made of the times at which the four-lane bridge will be required: Pessimistic estimate 4 years Most likely estimate Optimistic estimate In view of these estimates, what would you recommend? List some advantages and disadvantages of this method of preparing estimates. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. 5 years 7 years Calculate the PW value for the Pessimistic Estimate for the two-lane bridge. PW pessimistic (12%) = $1 thousand (Round to one decimal place.) Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF Capital Recovery Factor To Find A Given P AIP N 1 2. 3 - W N 4 5 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 1.0000 0.4717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0677 0.0570 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 6 7 8 9 10 17.5487 A bridge is to be constructed now as part of a new road. Engineers have determined that traffic density on the new road will justify a two-lane road and a bridge at the present time. Because of uncertainty regarding future use of the road, the time at which an extra two lanes will be required is currently being studied. The two-lane bridge will cost $200,000 and the four-lane bridge, if built initially, will cost $320,000. The future cost of widening a two-lane bridge to four lanes will be an extra $200,000 plus $23,000 for every year that widening is delayed. The MARR used by the highway department is 12% per year. The following estimates have been made of the times at which the four-lane bridge will be required: Pessimistic estimate 4 years Most likely estimate Optimistic estimate In view of these estimates, what would you recommend? List some advantages and disadvantages of this method of preparing estimates. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. 5 years 7 years Calculate the PW value for the Pessimistic Estimate for the two-lane bridge. PW pessimistic (12%) = $1 thousand (Round to one decimal place.) Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF Capital Recovery Factor To Find A Given P AIP N 1 2. 3 - W N 4 5 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 1.0000 0.4717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0677 0.0570 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 6 7 8 9 10 17.5487