Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A British food distribution conglomerate purchased a Canadian food store chain for $75 million (U.S.) three years ago. There was a net loss of

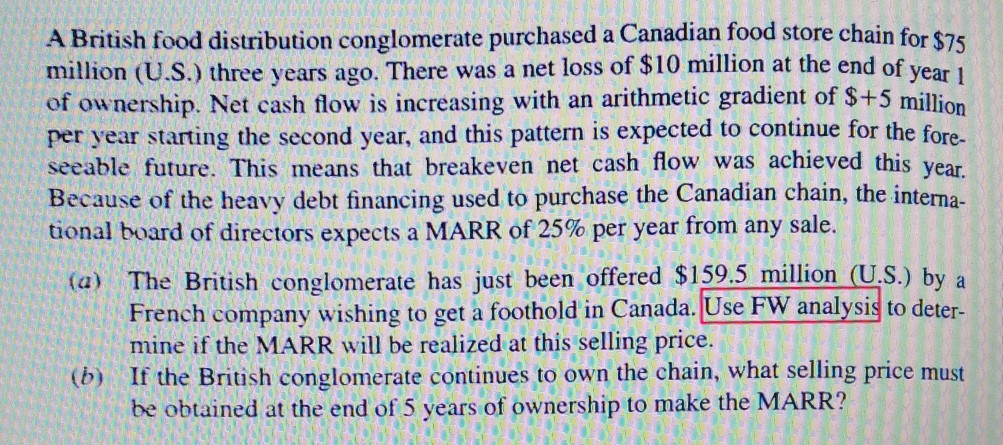

A British food distribution conglomerate purchased a Canadian food store chain for $75 million (U.S.) three years ago. There was a net loss of $10 million at the end of year 1 of ownership. Net cash flow is increasing with an arithmetic gradient of $+5 million per year starting the second year, and this pattern is expected to continue for the fore- seeable future. This means that breakeven net cash flow was achieved this year. Because of the heavy debt financing used to purchase the Canadian chain, the interna- tional board of directors expects a MARR of 25% per year from any sale. (a) The British conglomerate has just been offered $159.5 million (U.S.) by a French company wishing to get a foothold in Canada. Use FW analysis to deter- mine if the MARR will be realized at this selling price. (b) If the British conglomerate continues to own the chain, what selling price must be obtained at the end of 5 years of ownership to make the MARR?

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started