Answered step by step

Verified Expert Solution

Question

1 Approved Answer

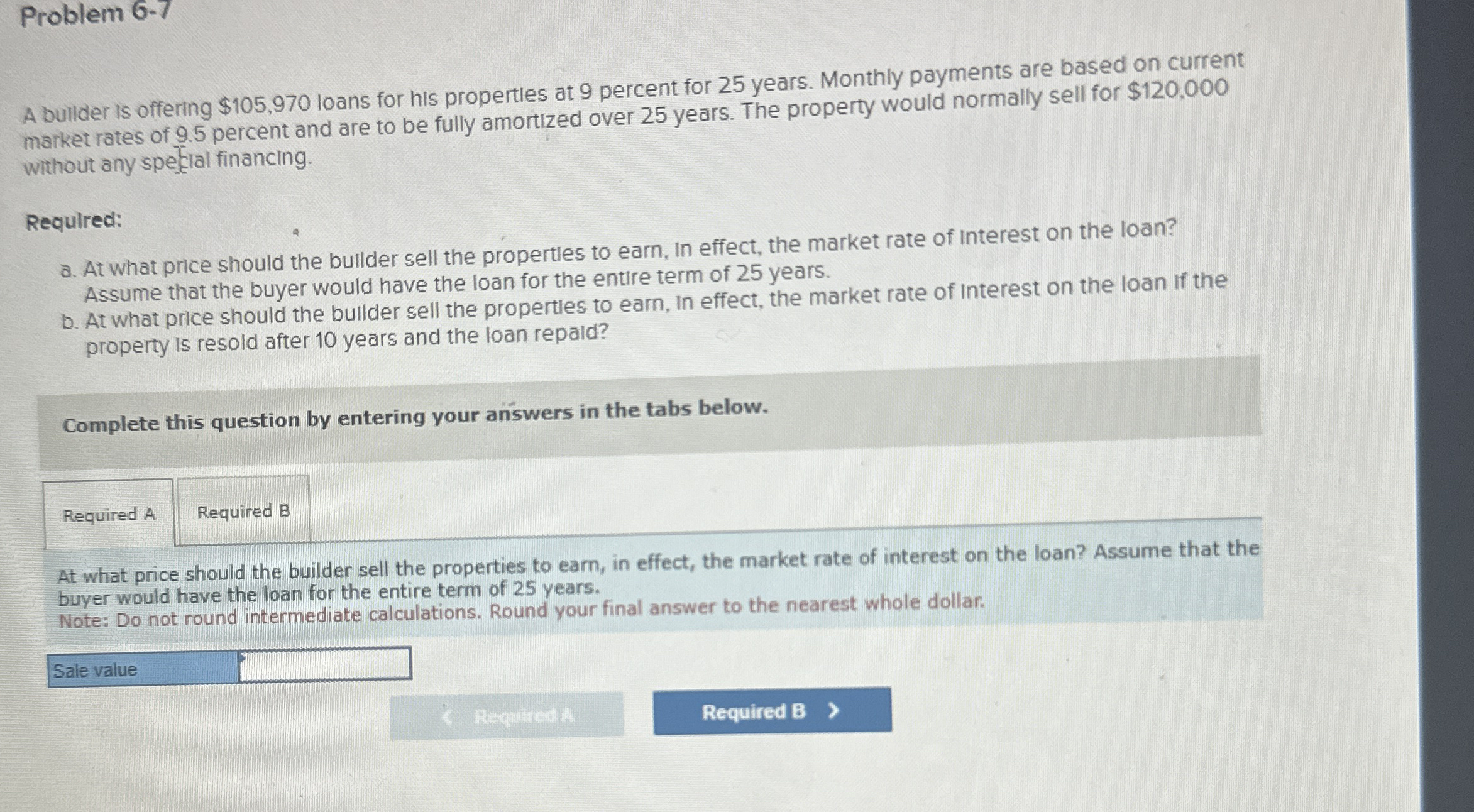

A bulder is offering $ 1 0 5 , 9 7 0 loans for his properties at 9 percent for 2 5 years. Monthly payments

A bulder is offering $ loans for his properties at percent for years. Monthly payments are based on current

market rates of percent and are to be fully amortized over years. The property would normally sell for $

without any speklal financing.

Required:

a At what price should the builder sell the propertles to earn, in effect, the market rate of interest on the loan?

Assume that the buyer would have the loan for the entire term of years.

b At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan if the

property is resold after years and the loan repald?

Complete this question by entering your ans in the tabs below.

At what price should the builder sell the properties to earn, in effect, the market rate of interest on the loan? Assume that the

buyer would have the loan for the entire term of years.

Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar.

Sale value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started