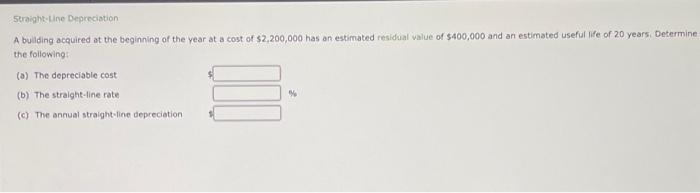

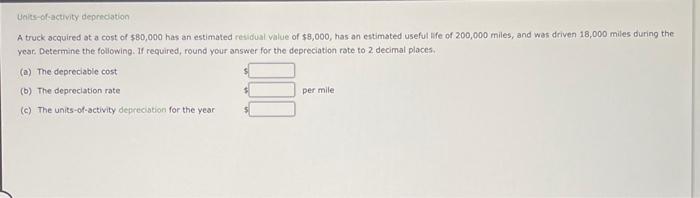

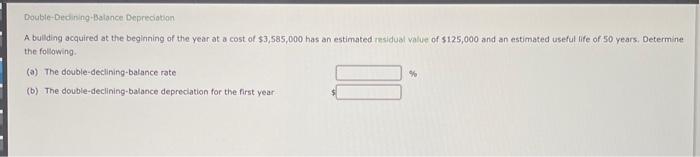

A buliding acquired at the beginning of the year at a cost of $2,200,000 has an estimated residual value of $400,000 and an estimated useful life of 20 years, Determine the following: Ueits-of-activity deprecation A truck acquired at a cost of $80,000 has an estimated residual value of $8,000, has an estimated useful bfe of 200,000 miles, and was driven 18,000 miles during the year. Determine the following. If required, round your answer for the depreciation rate to 2 decimal ploces. (a) The depreclable cost (b) The depecelation rate (c) The units-of-activity depreciation for the year Double-Dedining-Batance Depreciation A bullding acquired at the beginning of the year at a cost of $3,585,000 has an estimated residual value of $125,000 and an estimated useful life of 50 years. Determine the following. (a) The double-decilining-balance rate (b) The double-declining-balance depreciation for the first year- On February 14, Garcia Associates Co. paid $2,300 to repair the transmission on one of its delivery vans. In addition, Garcia paid $450 to install a GPS system in its van. Joumalize the entry for the transmission expenditure. If an amount box does not require an entry, leave it blank. Fostack - creck Mrwork Journalize the entry for the GPS system expenditure. If on amount box does not require an entry, leave it blank. Feb, 14 On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $90,000 in cash and giving a. short-term note for $50,000. Legal fees paid were $1,750, delinquent taxes assumed were $25,000, and fees paid to remove an old building from the land were $9,000, Materials salvaged from the demolition of the building were sold for $1,000. A contractor was paid $415,000 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. Partial:Year. Depreciation Equipment acquired at a cost of $105,000 has an estimated residual value. of $12,000 and an estimated useful life of 10 years. It was placed into service on May 1 of the current fiscal yeat, which ends on December 31 . New ithographic equipment, acquired at a cost of $800,000 on March 1 at the beginning of a fiscal yeat, has an estimated useful lte of five years and an estimated tesidual vinue of 590.000. The manager requested inlormation regarding the eflect of alternative methods on the arnount of depreciation expense each year. In the first week of the filth yeas, on March 4, the equpment was sold for $135,000. Required: 1. Determine the annual depreciation expense for exch of the estimated five years of use, the accumulated deprociation at the end of each yoar, and the book vatie of the equipment at the end of each year by (a) the straight line meithod and (b) the double-declining-balance method 2. Joumalze the entry to record the sabe assuming the manager chose the double-declining balance me thod. Refor to the Chait of Accounts for exact wording of account tites. 3. Joumalize the entry to record the saie in (2), assuming that the equipment was sold for 588,750 instead of $135,000. Aeler to the Chart of Accounts for exact wording of accoint tales. Depreciation by two methods; sale of fixed asset Instructions Chart of Accounts Starting Questions Journal Chart of Accounts 126 Accumulated Depreciation-Equipment 529 Selling Expenses 130 Mineral Rights 531 Rent Expense 131 Accumulated Depletion 532 Depreciation Expense-Equipment 132 Goodwill 533 Depletion Expense 133 Patents 534 Amortization Expense-Patents 535 Insurance Expense LIABILITIES 536 Supplies Expense 210 Accounts Payable 539 Miscellaneous Expense 211 Salaries Payable 710 Interest Expense 213 Sales Tax Payable 720 Loss on Sale of Delivery Truck 214 Interest Payable 721 Loss on Sale of Equipment 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 1. Dotormine the annual depreciaton expense for each of the estimated five years of use, the accumulared depreciation at the end of each year, and the book value of the equipment at the end of each yoar by (a) the straight-Aine method and (b) the double-declining balance method. Enter all amounts as a positive numbers. a. Siraight-line method b. Double-declining-balance method 2. On March 4, journatize the entry to record the sale assuming the manager chase the double-declining-balance method. Refer to the Chart of Accounts for exact wording of account 3. On March 4, journalize the entry to recard the sale in (2), assuming that the equipment was sald for $89,750 instead of $135,000. Rofor to the Chart of Accounts for exact warding o acogent fities 3. On March 4, foumalize the ontry to rocard the sab in (2), assuming that the equipment was sold for $88,750 instead of $135,000. Aofer to the Chart of Accounts for exact wording account titles