Answered step by step

Verified Expert Solution

Question

1 Approved Answer

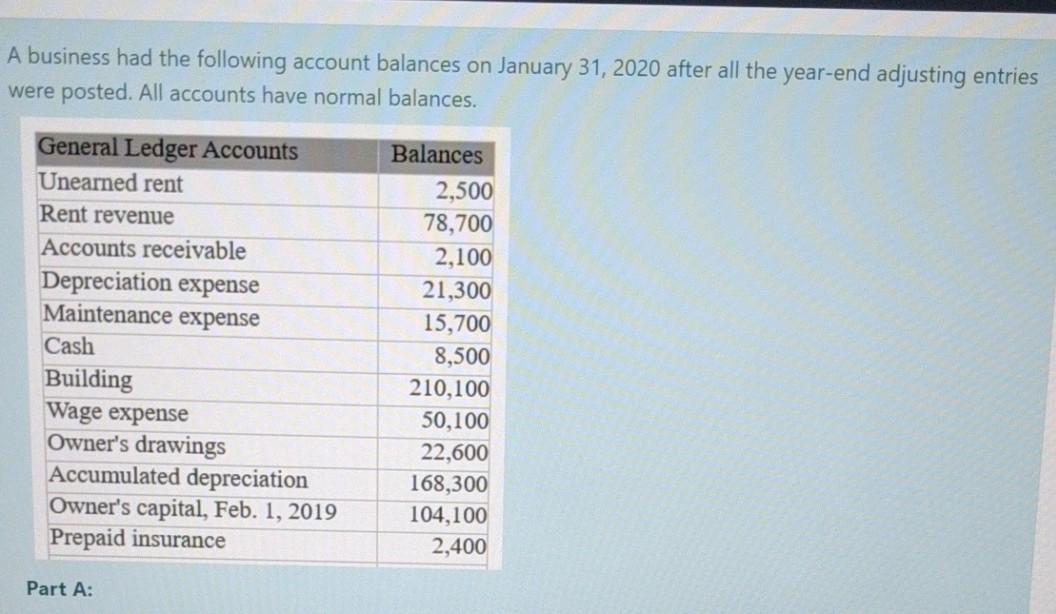

A business had the following account balances on January 31, 2020 after all the year-end adjusting entries were posted. All accounts have normal balances. General

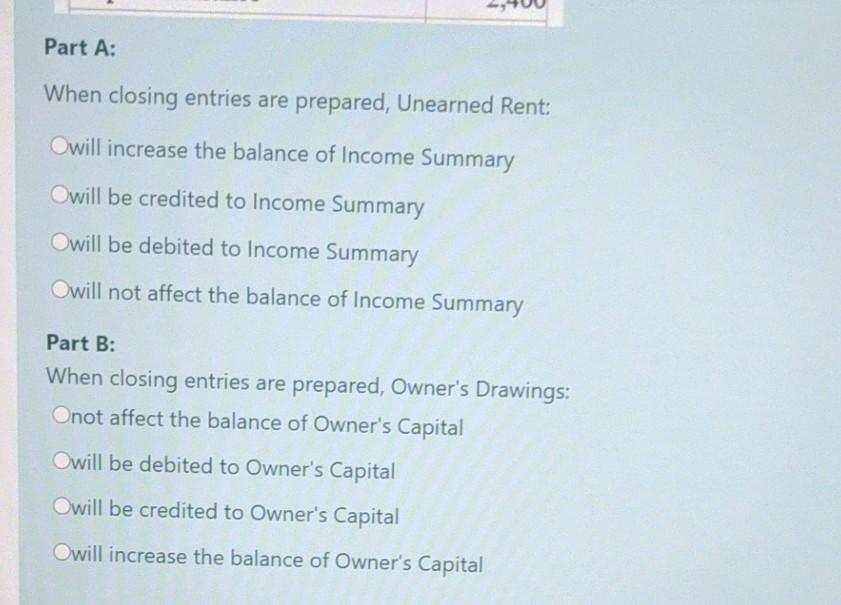

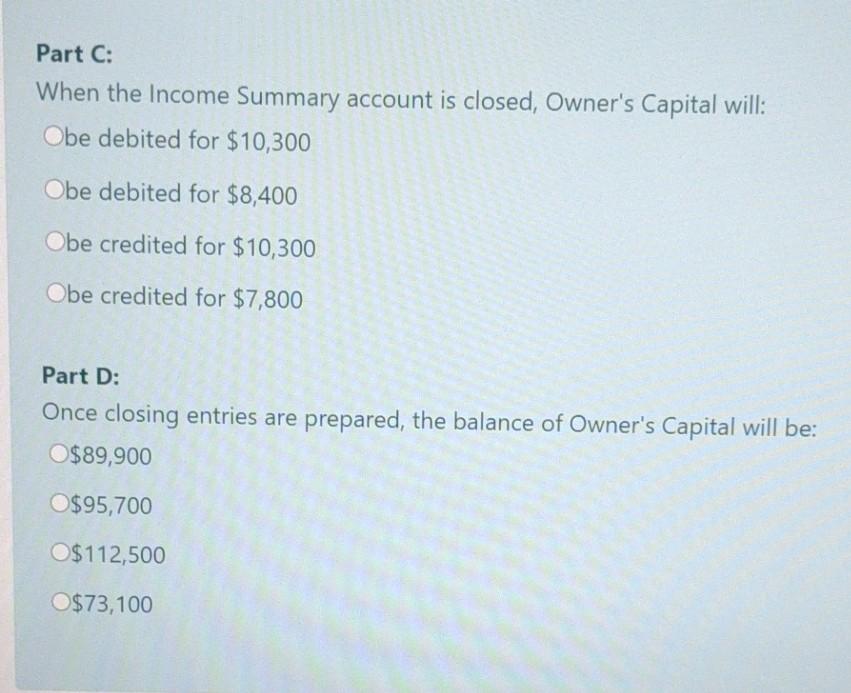

A business had the following account balances on January 31, 2020 after all the year-end adjusting entries were posted. All accounts have normal balances. General Ledger Accounts Balances Unearned rent 2,500 Rent revenue 78,700 Accounts receivable 2,100 Depreciation expense 21,300 Maintenance expense 15,700 Cash 8,500 Building 210,100 Wage expense 50,100 Owner's drawings 22,600 Accumulated depreciation 168,300 Owner's capital, Feb. 1, 2019 104,100 Prepaid insurance 2,400 Part A: Part A: When closing entries are prepared, Unearned Rent: Owill increase the balance of Income Summary Owill be credited to Income Summary Owill be debited to Income Summary Owill not affect the balance of Income Summary Part B: When closing entries are prepared, Owner's Drawings: Onot affect the balance of Owner's Capital Owill be debited to Owner's Capital Owill be credited to Owner's Capital Owill increase the balance of Owner's Capital Part C: When the Income Summary account is closed, Owner's Capital will: Obe debited for $10,300 Obe debited for $8,400 Obe credited for $10,300 Obe credited for $7,800 Part D: Once closing entries are prepared, the balance of Owner's Capital will be: $89,900 O$95,700 $112,500 $73,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started