Question

A business has applied for a loan of 1 Million Dollars which are intended to finance further expansion. Specifically, the funds would be used to

A business has applied for a loan of 1 Million Dollars which are intended to finance further expansion. Specifically, the funds would be used to purcahse additional gym equipment.

The business has provided Historical financial statements, but the credit analyst wants to see what the Balance sheet will look like if the loan is approved.

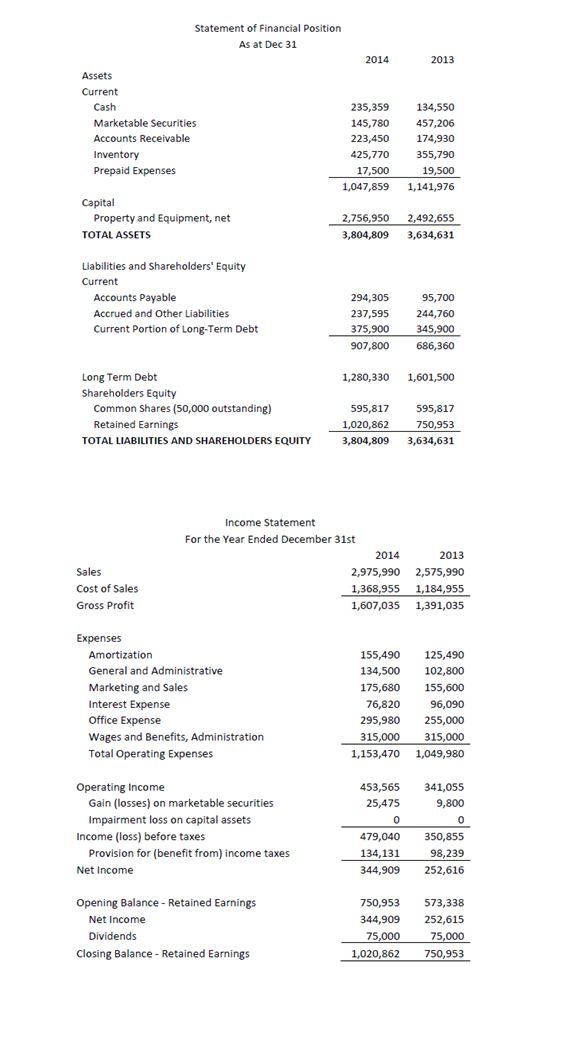

Historical Financial Statements and Information on the use of the loan is provided below:

Exhibit I Historical Financial Statements

Exhibit II Additional Information Regarding the Loan

- The loan will be used to purchase $1 million in additional capital assets. The additional assets will result in an increase in revenue of 20%.

- The loan will bear interest at 6%. Principal payments of $200,000 per annum will be required.

- The company will withhold any dividend payments during the foreseeable future in order to support the debt to equity ratio.

- The capital assets are expected to have a useful life of 15 years with no residual value.

- All other fixed expenses are expected to remain consistent.

- The existing loan will require a principal payment of approximately $375,900 during the upcoming fiscal year. The payment for the following fiscal year is expected to be$300,000.

- Accounts receivable, inventory, prepaid expense, and accounts payable will all increase by 40% as a result of the increased sales.

- The marketable securities will be converted to cash at the beginning of the year.

Please show how the financial statments will be effected if the loan is approved.

Statement of Financial Position As at Dec 31 2014 2013 Assets Current Cash Marketable Securities Accounts Receivable Inventory Prepaid Expenses 235,359 134,550 145,780 457,206 223,450 174,930 425,770355,790 19,500 1,047,859 1,141,976 17,500 Capital Property and Equipment, net 2,756,950 2,492,655 3,804,809 3,634,631 TOTAL ASSETS Liabilities and Shareholders' Equity Current Accounts Payable Accrued and Other Liabilities Current Portion of Long-Term Debt 294,305 95,700 237,595 244,760 345,900 07,800 686,360 375,900 Long Term Debt Shareholders Equity 1,280,330 1,601,500 Common Shares (50,000 outstanding) Retained Earnings 595,817 595,817 1,020,862 750,953 3,804,809 3,634,631 TOTAL LIABILITIES AND SHAREHOLDERS EQUITY Income Statement For the Year Ended December 31st 2014 Sales Cost of Sales Gross Profit 2013 2,975,990 2,575,990 1,368,955 1,184,955 1,607,035 1,391,035 Expenses Amortization General and Administrative Marketing and Sales Interest Expense Office Expense Wages and Benefits, Administration Total Operating Expenses 155,490 125,490 134,500 102,800 175,680 155,600 76,820 96,090 295,980 255,000 15,000315,000 1,153,470 1,049,980 453,565 341,055 9,800 Operating Income Gain (losses) on marketable securities Impairment loss on capital assets 25,475 0 Income (loss) before taxes 479,040 350,855 134,131 344,909 252,616 Provision for (benefit from) income taxes 98,239 Net Income Opening Balance - Retained Earnings 750,953 573,338 344,909 252,615 75,000 1,020,862 750,953 Net Income Dividends 75 Closing Balance Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started