Answered step by step

Verified Expert Solution

Question

1 Approved Answer

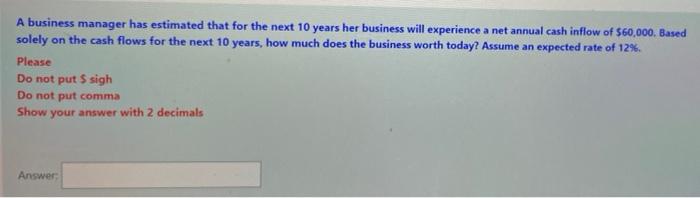

A business manager has estimated that for the next 10 years her business will experience a net annual cash inflow of S60,000. Based solely

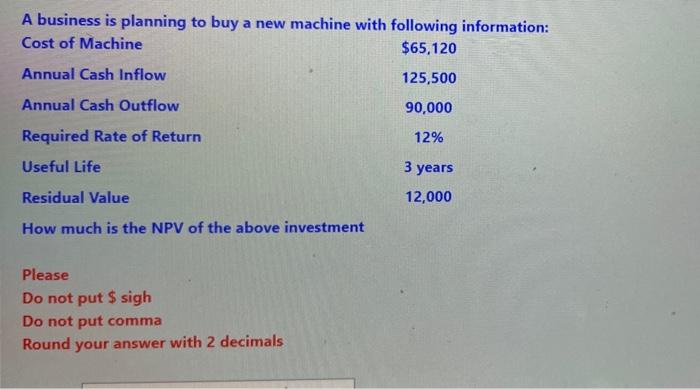

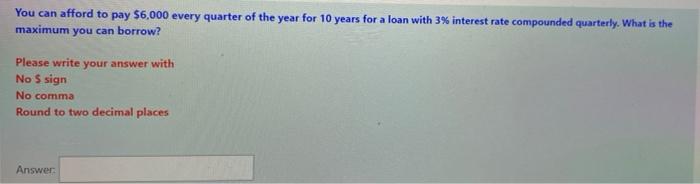

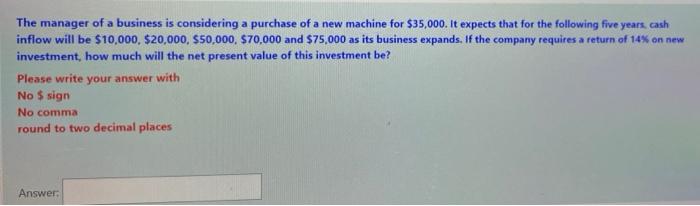

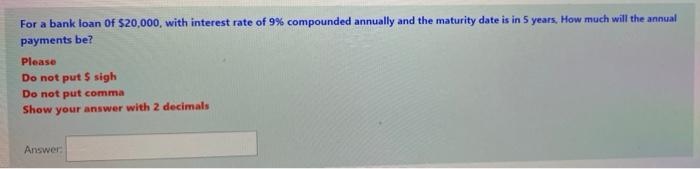

A business manager has estimated that for the next 10 years her business will experience a net annual cash inflow of S60,000. Based solely on the cash flows for the next 10 years, how much does the business worth today? Assume an expected rate of 12%. Please Do not put $ sigh Do not put comma Show your answer with 2 decimals Answer: A business is planning to buy a new machine with following information: Cost of Machine $65,120 Annual Cash Inflow 125,500 Annual Cash Outflow 90,000 Required Rate of Return 12% Useful Life 3 years Residual Value 12,000 How much is the NPV of the above investment Please Do not put $ sigh Do not put comma Round your answer with 2 decimals You can afford to pay $6,000 every quarter of the year for 10 years for a loan with 3% interest rate compounded quarterly. What is the maximum you can borrow? Please write your answer with No S sign No comma Round to two decimal places Answer: The manager of a business is considering a purchase of a new machine for $35,000. It expects that for the following five years cash inflow will be $10,000, $20,000, $50,000, $70,000 and $75,000 as its business expands. If the company requires a return of 14% on new investment, how much will the net present value of this investment be? Please write your answer with No $ sign No comma round to two decimal places Answer: For a bank loan Of $20,000, with interest rate of 9% compounded annually and the maturity date is in 5 years, How much will the annual payments be? Please Do not put $ sigh Do not put comma Show your answer with 2 decimals Answer:

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

624ec4abede4a_Book222.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started