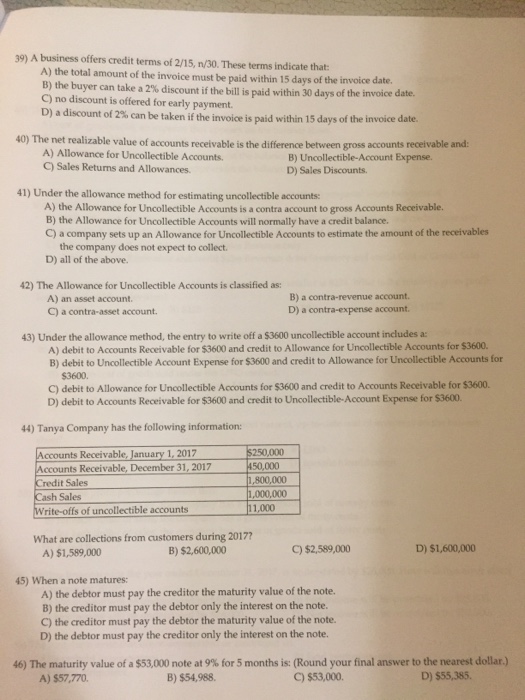

A business offers credit terms of 2/15, n/30. These terms indicated that: A) the total amount of the invoice must be paid within 15 days of the invoice date. B) the buyer can take a 2% discount if the bill paid within 30 days of the invoice date. C) no discount is offered for early payment. D) a discount of 2 % can be taken if the invoice is paid within 15 days of the invoice date. The net realizable value of accounts receivable is the difference between gross accounts receivable and: A) Allowance for Uncollectible Accounts. B) Uncollectible - Account Expense. C) Sales Returns and Allowances. D) Sales Discounts. Under the allowance method for estimating uncollectible accounts: A) the Allowance for Uncollectible Accounts is a contra account to gross Accounts Receivable. B) the Allowance for Uncollectible Accounts will normally have a credit balance. C) a company sets up an Allowance for Uncollectible Accounts to estimate the amount of the receivables the company does not expect to collect. D) all of the above. The Allowance for Uncollectible Accounts is classified as: A) an asset account. B) a contra - revenue account. C) a contra - asset account. D) a contra - expense account. Under the allowance method, the entry to write off a $3600 uncollectible account includes a: A) debit to Accounts Receivable for $3600 and credit to Allowance for Uncollectible Accounts for $3600. B) debit to Uncollectible Account Expense for $3600 and credit to Allowance for Uncollectible Accounts for $3600. C) debit to Allowance for Uncollectible Accounts for $3600 and credit to Accounts Receivable for $3600. D) debit to Accounts Receivable for $3600 and credit to Uncollectible - Account Expense for $3600. 44) Tanya Company has the following information: What are collections from customers during 2017? A) $1, 589,000 B) $2, 600,000 C) $2, 589,000 D) $1, 600,000 When a note matures: A) the debtor must pay the creditor the maturity value of the note. B) the creditor must pay the debtor only the interest on the note. C) the creditor must pay the debtor the maturity value of the note. D) the debtor must pay the creditor only the interest on the note. The maturity value of a $53,000 note at 9% for 5 months is: (Round your final answer to the nearest dollar.) A) $57, 770. B) $54, 988. C) $53,000. D) $55, 385