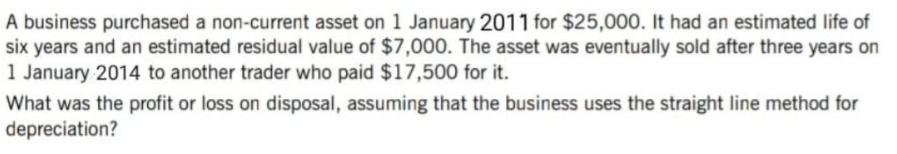

Question

A business purchased a non-current asset on 1 January 2011 for $25,000. It had an estimated life of six years and an estimated residual

A business purchased a non-current asset on 1 January 2011 for $25,000. It had an estimated life of six years and an estimated residual value of $7,000. The asset was eventually sold after three years on 1 January 2014 to another trader who paid $17,500 for it. What was the profit or loss on disposal, assuming that the business uses the straight line method for depreciation?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The gin n sle f sset is lulted by deduting the Bk vlue f sset n ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting For Cambridge International AS And A Level

Authors: Jacqueline Halls Bryan, Peter Hailstone

1st Edition

0198399715, 978-0198399711

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App