A business -use car is classified as what section property?

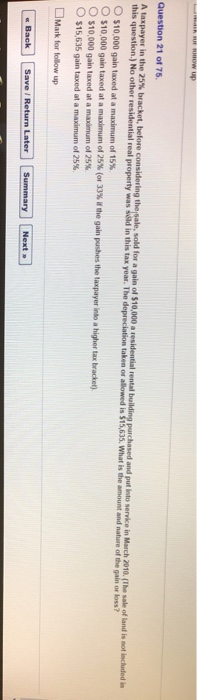

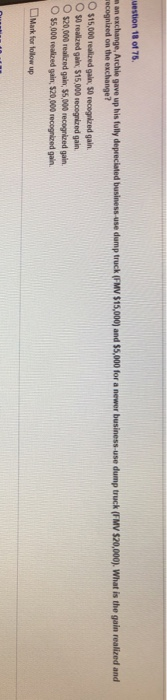

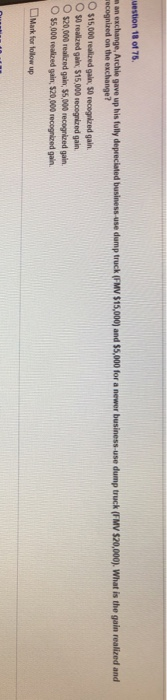

Question 21 of 75 in the 25% bracket, before considering the sale, sold for a gain of $10,000 a residential rental building purchased and put into A taxpayer this question.) No other residential real property was sild in this tax year. The depreciation taken or allowed is $15,635. What is the amount and nature of o s 10,000 gain taxed at a maximum of 15% osooa gain tax service in March 2010. (The sale of land is not included in the gain or loss? ed at a maximum of 25% (or 33% "he gain pushes the taxpayer into a higher tax bracket) $10,000 gain taxed at a maximum of 25%. O s15,G35 gain taxed at a maximum, of 25%. Mark for follow up Back Save / Return Later S uestion 18 of 75 n an exchange, Archle gave up his fully depreciated business-use dump truck (FMV $15,000) and $5,000 for a newer business-use dump truck (FMV $20,000). What is the gain realized and ecognized on the exchange? O $15,000 realized gain: 50 recognized gain O S0 realized gain $15,000 recognized gain. O $20,000 realized gain, $5,000 recognized gain O $5,000 realized gain, $20,000 recognized gain. Mark for folow up Question 21 of 75 in the 25% bracket, before considering the sale, sold for a gain of $10,000 a residential rental building purchased and put into A taxpayer this question.) No other residential real property was sild in this tax year. The depreciation taken or allowed is $15,635. What is the amount and nature of o s 10,000 gain taxed at a maximum of 15% osooa gain tax service in March 2010. (The sale of land is not included in the gain or loss? ed at a maximum of 25% (or 33% "he gain pushes the taxpayer into a higher tax bracket) $10,000 gain taxed at a maximum of 25%. O s15,G35 gain taxed at a maximum, of 25%. Mark for follow up Back Save / Return Later S uestion 18 of 75 n an exchange, Archle gave up his fully depreciated business-use dump truck (FMV $15,000) and $5,000 for a newer business-use dump truck (FMV $20,000). What is the gain realized and ecognized on the exchange? O $15,000 realized gain: 50 recognized gain O S0 realized gain $15,000 recognized gain. O $20,000 realized gain, $5,000 recognized gain O $5,000 realized gain, $20,000 recognized gain. Mark for folow up