A buyer is purchasing a home for $200,000. The closing date is on June 15, 2021 and the buyer is responsible for all costs

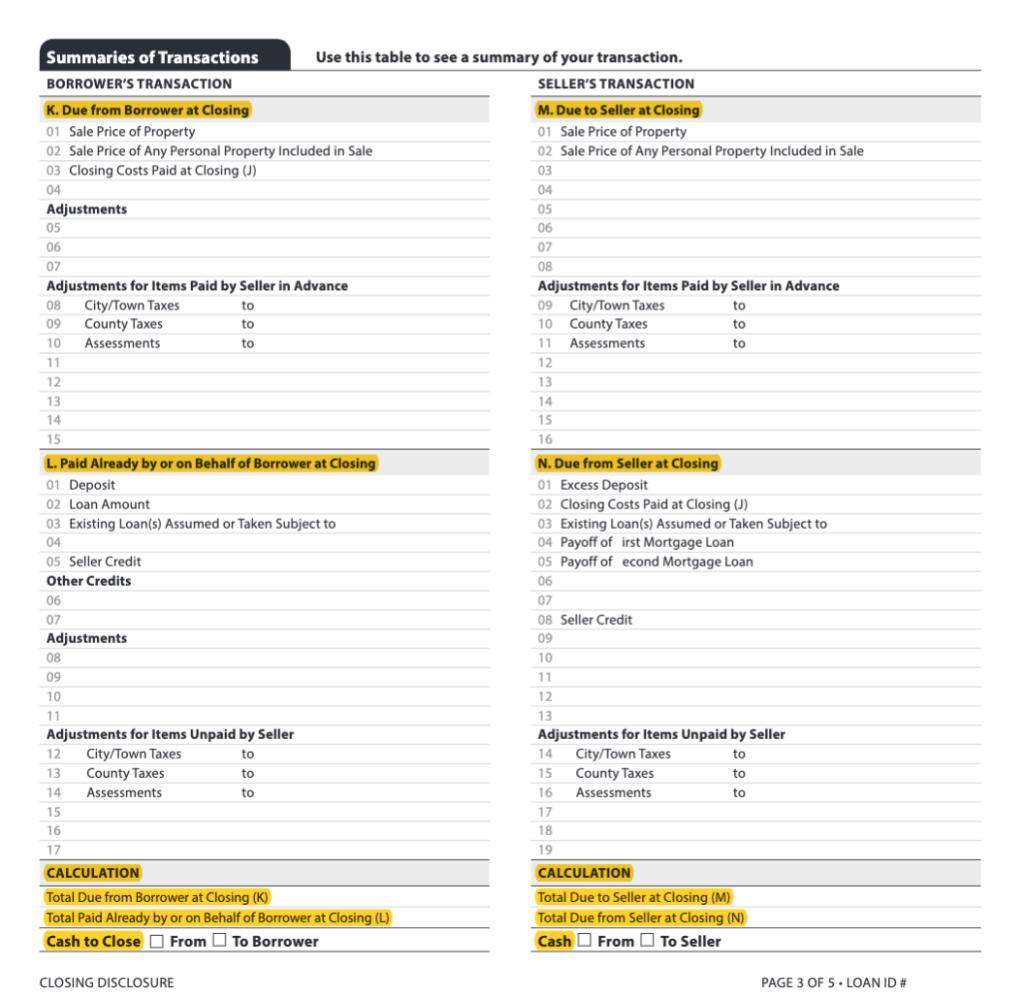

A buyer is purchasing a home for $200,000. The closing date is on June 15, 2021 and the buyer is responsible for all costs on the closing date. The buyer provided $5,000 as a deposit that is being held in escrow and is obtaining a loan for $180,000. The seller has a mortgage on the property with an outstanding balance of $92,000. Total settlement charges for the buyer is $7,200 and for the seller is $12,000. The county taxes for 2021 are due on November 1 and have not been paid. The total county tax amount due for the year is $4,380. The home inspection report indicated the A/C unit will need repaired and the seller has agreed to provide a $1,000 credit to the buyer, which the lender has approved. Use Page 3 of the closing disclosure to account for the information above and upload this page to be graded in Module 15 quiz if you are selecting the asynchronous option. There should be 21 numbers on this page and each number will count for one point with the opportunity for one extra credit point. Summaries of Transactions BORROWER'S TRANSACTION K. Due from Borrower at Closing 01 Sale Price of Property 02 Sale Price of Any Personal Property Included in Sale 03 Closing Costs Paid at Closing (J) 04 Adjustments 05 06 07 Adjustments for Items Paid by Seller in Advance City/Town Taxes to County Taxes to Assessments to 08 09 10 11 12 13 14 15 L. Paid Already by or on Behalf of Borrower at Closing 01 Deposit 02 Loan Amount 03 Existing Loan(s) Assumed or Taken Subject to 04 05 Seller Credit Other Credits 06 07 Adjustments 08 09 10 11 Use this table to see a summary of your transaction. SELLER'S TRANSACTION Adjustments for Items Unpaid by Seller City/Town Taxes to County Taxes Assessments 12 13 14 15 16 17 to to CLOSING DISCLOSURE CALCULATION Total Due from Borrower at Closing (K) Total Paid Already by or on Behalf of Borrower at Closing (L) Cash to Close From To Borrower M. Due to Seller at Closing 01 Sale Price of Property 02 Sale Price of Any Personal Property Included in Sale 03 04 05 06 07 08 Adjustments for Items Paid by Seller in Advance City/Town Taxes to County Taxes to Assessments to 09 10 11 12 13 14 15 16 N. Due from Seller at Closing 01 Excess Deposit 02 Closing Costs Paid at Closing (J) 03 Existing Loan(s) Assumed or Taken Subject to 04 Payoff of irst Mortgage Loan 05 Payoff of econd Mortgage Loan 06 07 08 Seller Credit 09 10 11 12 13 Adjustments for Items Unpaid by Seller City/Town Taxes to County Taxes to Assessments to 14 15 16 17 18 19 CALCULATION Total Due to Seller at Closing (M) Total Due from Seller at Closing (N) Cash From To Seller PAGE 3 OF 5. LOAN ID #

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Question Adjustments 8 9 M Adjustments for item unpaid by seller 12 City Town Taxes to ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started