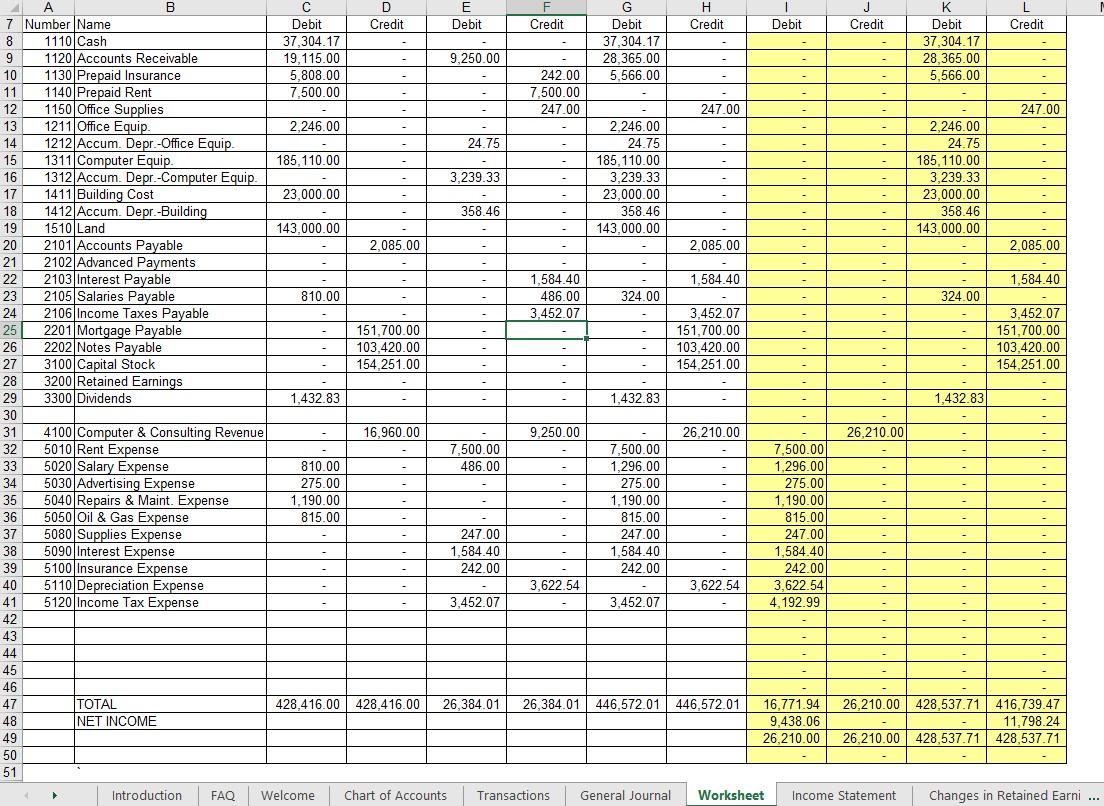

A byte of accounting FAQ 5 Issue, what is wrong with my worksheet it wont let me progress? The income tax payable is correct

| Income taxes are to be computed at the rate of 25 percent of net income before taxes. |

| [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] |

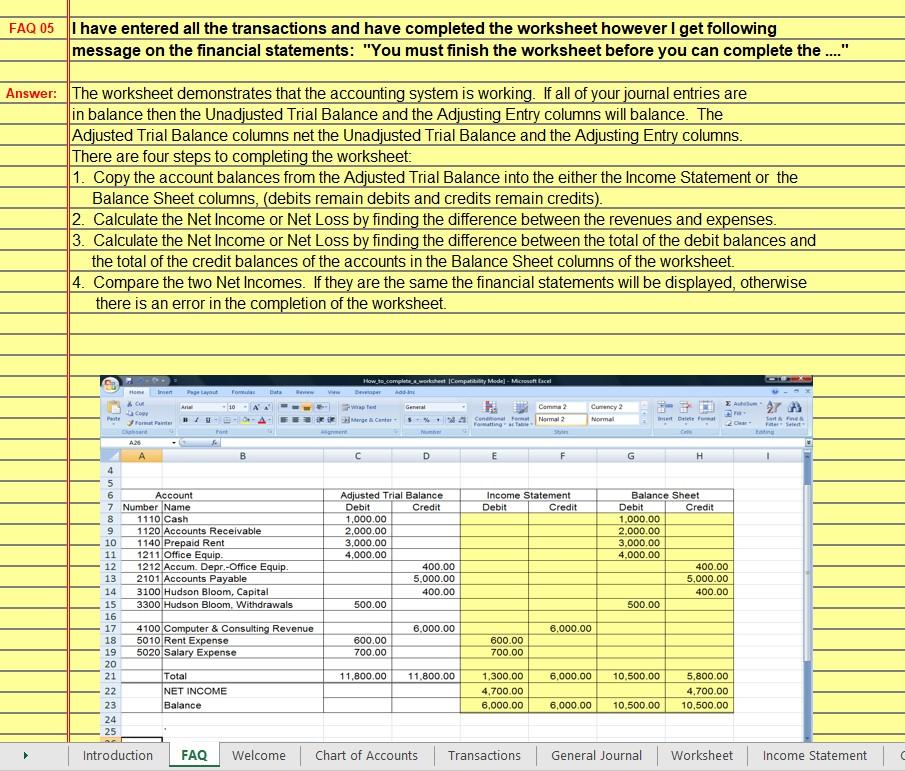

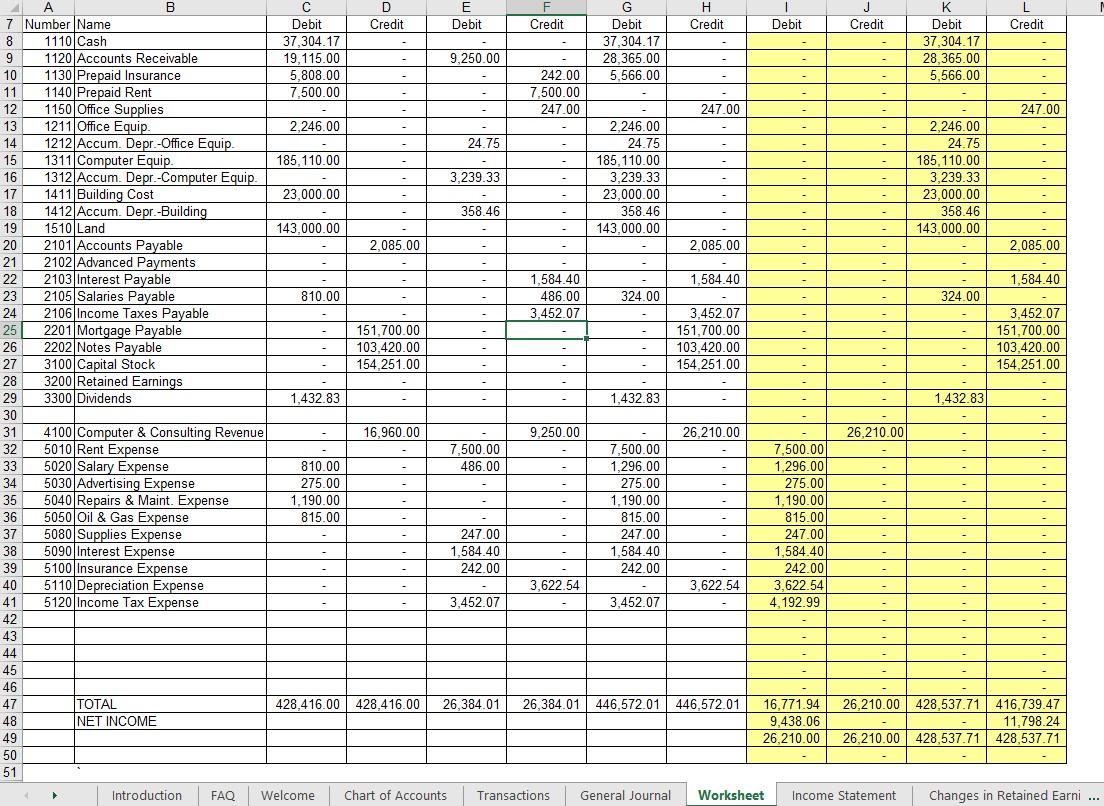

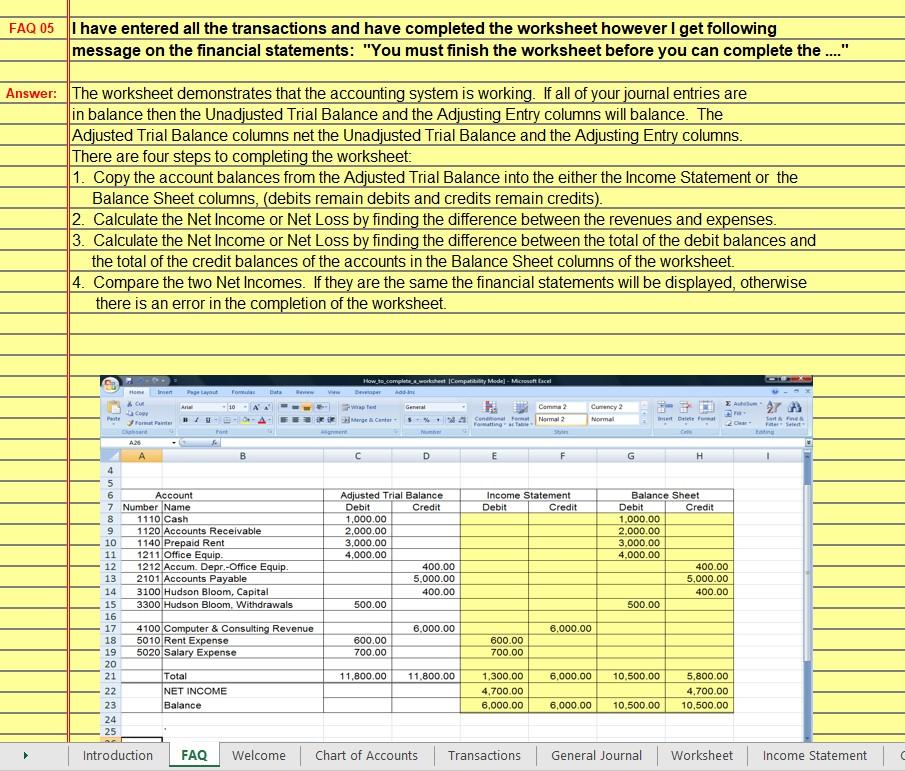

FAQ 05 I have entered all the transactions and have completed the worksheet however I get following message on the financial statements: "You must finish the worksheet before you can complete the ...." Answer: The worksheet demonstrates that the accounting system is working. If all of your journal entries are in balance then the Unadjusted Trial Balance and the Adjusting Entry columns will balance. The Adjusted Trial Balance columns net the Unadjusted Trial Balance and the Adjusting Entry columns. There are four steps to completing the worksheet: 1. Copy the account balances from the Adjusted Trial Balance into the either the Income Statement or the Balance Sheet columns, (debits remain debits and credits remain credits). 2. Calculate the Net Income or Net Loss by finding the difference between the revenues and expenses. 3. Calculate the Net Income or Net Loss by finding the difference between the total of the debit balances and the total of the credit balances of the accounts in the Balance Sheet columns of the worksheet. 4. Compare the two Net Incomes. If they are the same the financial statements will be displayed, otherwise there is an error in the completion of the worksheet. nen Poeta F How_to_complete workshest Compatibility Model - Microface be . Genel Camina 2 Merge Center Cone Normal Yanga . A Curney 2 Normal 27 Det A2 D H Income Statement Debit Credit B 4 5 6 Account 7 Number Name 8 1110 Cash 9 1120 Accounts Receivable 10 1140 Prepaid Rent 11 1211 Office Equip. 12 1212 Accum. Depr.-Office Equip. 13 2101 Accounts Payable 14 3100 Hudson Bloom, Capital 15 3300 Hudson Bloom. Withdrawals 16 17 4100 Computer & Consulting Revenue 18 5010 Rent Expense 19 5020 Salary Expense 20 21 Total 22 NET INCOME 23 Balance 24 25 Adjusted Trial Balance Debit Credit 1,000.00 2.000.00 3,000.00 4,000.00 400.00 5.000.00 400.00 500.00 Balance Sheet Debit Credit 1,000.00 2,000.00 3.000.00 4,000.00 400.00 5,000.00 400.00 500.00 6.000.00 6.000.00 600.00 700.00 600.00 700.00 11,800.00 11.800.00 6.000.00 10,500.00 1.300.00 4.700.00 6,000.00 5,800.00 4,700.00 10,500.00 6,000.00 10,500.00 Introduction FAQ Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement - - B B D E F G H 1 J K L 7 Number Name Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit 8 1110 Cash 37,304.17 37,304.17 37,304.17 9 1120 Accounts Receivable 19.115.00 9,250.00 28,365.00 28,365.00 10 1130 Prepaid Insurance 5,808.00 242.00 5,566.00 5,566.00 11 1140 Prepaid Rent 7,500.00 7.500.00 12 1150 Office Supplies 247.00 247.00 247.00 13 1211 Office Equip. 2.246.00 2,246.00 2,246.00 14 1212 Accum. Depr.-Office Equip 24.75 24.75 24.75 15 1311 Computer Equip. 185,110.00 185.110.00 185, 110.00 16 1312 Accum. Depr.-Computer Equip. 3,239.33 3,239.33 3,239.33 17 1411 Building Cost 23,000.00 23,000.00 23,000.00 18 1412 Accum. Depr.-Building 358.46 358.46 358.46 19 1510 Land 143,000.00 143.000.00 143,000.00 20 2101 Accounts Payable 2,085.00 2,085.00 2,085.00 21 2102 Advanced Payments 22 2103 Interest Payable 1,584.40 1,584.40 1.584 40 23 2105 Salaries Payable 810.00 486.00 324.00 324.00 24 2106 Income Taxes Payable 3,452.07 3,452.07 3,452.07 25 2201 Mortgage Payable 151.700.00 151,700.00 151.700.00 26 2202 Notes Payable 103.420.00 103,420.00 103.420.00 27 3100 Capital Stock 154,251.00 154,251.00 154,251.00 28 3200 Retained Earnings 29 3300 Dividends 1,432.83 1,432.83 1,432.83) 30 31 4100 Computer & Consulting Revenue 16,960.00 9,250.00 26,210.00 26,210.00 32 5010 Rent Expense 7,500.00 7,500.00 7,500.00 33 5020 Salary Expense 810.00 486.00 1,296.00 1.296.00 34 5030 Advertising Expense 275.00 275.00 275.00 35 5040 Repairs & Maint. Expense 1.190.00 1,190.00 1.190.000 36 5050 Oil & Gas Expense 815.00 815.00 815.00 37 5080 Supplies Expense 247.00 247.00 247.00 38 5090 Interest Expense 1.584.40 1.584.40 1,584.40 39 5100 Insurance Expense 242.00 242.00 242.00 40 5110 Depreciation Expense 3,622.54 3,622.54 3,622.54 41 5120 Income Tax Expense 3.452.07 3.452.07 4.192.99 42 43 44 45 46 47 TOTAL 428,416.00 428,416.00 26,384.01 26,384.01 446,572.01 446,572.01 16,771.94 26,210.00 428,537.71 416,739.47 48 NET INCOME 9,438.06 11,798.24 49 26.210.00 26,210.00 428,537.71 428,537.71 50 51 Introduction FAQ Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement Changes in Retained Earni ... FAQ 05 I have entered all the transactions and have completed the worksheet however I get following message on the financial statements: "You must finish the worksheet before you can complete the ...." Answer: The worksheet demonstrates that the accounting system is working. If all of your journal entries are in balance then the Unadjusted Trial Balance and the Adjusting Entry columns will balance. The Adjusted Trial Balance columns net the Unadjusted Trial Balance and the Adjusting Entry columns. There are four steps to completing the worksheet: 1. Copy the account balances from the Adjusted Trial Balance into the either the Income Statement or the Balance Sheet columns, (debits remain debits and credits remain credits). 2. Calculate the Net Income or Net Loss by finding the difference between the revenues and expenses. 3. Calculate the Net Income or Net Loss by finding the difference between the total of the debit balances and the total of the credit balances of the accounts in the Balance Sheet columns of the worksheet. 4. Compare the two Net Incomes. If they are the same the financial statements will be displayed, otherwise there is an error in the completion of the worksheet. nen Poeta F How_to_complete workshest Compatibility Model - Microface be . Genel Camina 2 Merge Center Cone Normal Yanga . A Curney 2 Normal 27 Det A2 D H Income Statement Debit Credit B 4 5 6 Account 7 Number Name 8 1110 Cash 9 1120 Accounts Receivable 10 1140 Prepaid Rent 11 1211 Office Equip. 12 1212 Accum. Depr.-Office Equip. 13 2101 Accounts Payable 14 3100 Hudson Bloom, Capital 15 3300 Hudson Bloom. Withdrawals 16 17 4100 Computer & Consulting Revenue 18 5010 Rent Expense 19 5020 Salary Expense 20 21 Total 22 NET INCOME 23 Balance 24 25 Adjusted Trial Balance Debit Credit 1,000.00 2.000.00 3,000.00 4,000.00 400.00 5.000.00 400.00 500.00 Balance Sheet Debit Credit 1,000.00 2,000.00 3.000.00 4,000.00 400.00 5,000.00 400.00 500.00 6.000.00 6.000.00 600.00 700.00 600.00 700.00 11,800.00 11.800.00 6.000.00 10,500.00 1.300.00 4.700.00 6,000.00 5,800.00 4,700.00 10,500.00 6,000.00 10,500.00 Introduction FAQ Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement - - B B D E F G H 1 J K L 7 Number Name Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit 8 1110 Cash 37,304.17 37,304.17 37,304.17 9 1120 Accounts Receivable 19.115.00 9,250.00 28,365.00 28,365.00 10 1130 Prepaid Insurance 5,808.00 242.00 5,566.00 5,566.00 11 1140 Prepaid Rent 7,500.00 7.500.00 12 1150 Office Supplies 247.00 247.00 247.00 13 1211 Office Equip. 2.246.00 2,246.00 2,246.00 14 1212 Accum. Depr.-Office Equip 24.75 24.75 24.75 15 1311 Computer Equip. 185,110.00 185.110.00 185, 110.00 16 1312 Accum. Depr.-Computer Equip. 3,239.33 3,239.33 3,239.33 17 1411 Building Cost 23,000.00 23,000.00 23,000.00 18 1412 Accum. Depr.-Building 358.46 358.46 358.46 19 1510 Land 143,000.00 143.000.00 143,000.00 20 2101 Accounts Payable 2,085.00 2,085.00 2,085.00 21 2102 Advanced Payments 22 2103 Interest Payable 1,584.40 1,584.40 1.584 40 23 2105 Salaries Payable 810.00 486.00 324.00 324.00 24 2106 Income Taxes Payable 3,452.07 3,452.07 3,452.07 25 2201 Mortgage Payable 151.700.00 151,700.00 151.700.00 26 2202 Notes Payable 103.420.00 103,420.00 103.420.00 27 3100 Capital Stock 154,251.00 154,251.00 154,251.00 28 3200 Retained Earnings 29 3300 Dividends 1,432.83 1,432.83 1,432.83) 30 31 4100 Computer & Consulting Revenue 16,960.00 9,250.00 26,210.00 26,210.00 32 5010 Rent Expense 7,500.00 7,500.00 7,500.00 33 5020 Salary Expense 810.00 486.00 1,296.00 1.296.00 34 5030 Advertising Expense 275.00 275.00 275.00 35 5040 Repairs & Maint. Expense 1.190.00 1,190.00 1.190.000 36 5050 Oil & Gas Expense 815.00 815.00 815.00 37 5080 Supplies Expense 247.00 247.00 247.00 38 5090 Interest Expense 1.584.40 1.584.40 1,584.40 39 5100 Insurance Expense 242.00 242.00 242.00 40 5110 Depreciation Expense 3,622.54 3,622.54 3,622.54 41 5120 Income Tax Expense 3.452.07 3.452.07 4.192.99 42 43 44 45 46 47 TOTAL 428,416.00 428,416.00 26,384.01 26,384.01 446,572.01 446,572.01 16,771.94 26,210.00 428,537.71 416,739.47 48 NET INCOME 9,438.06 11,798.24 49 26.210.00 26,210.00 428,537.71 428,537.71 50 51 Introduction FAQ Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement Changes in Retained Earni