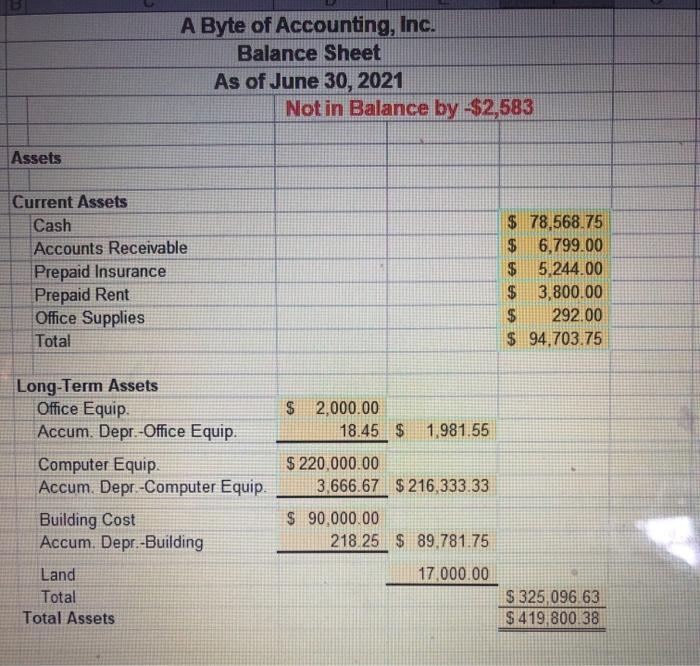

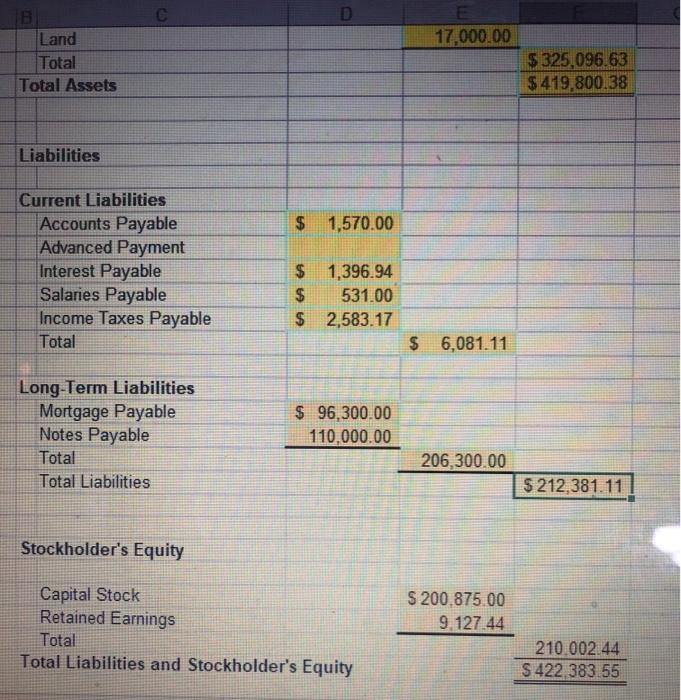

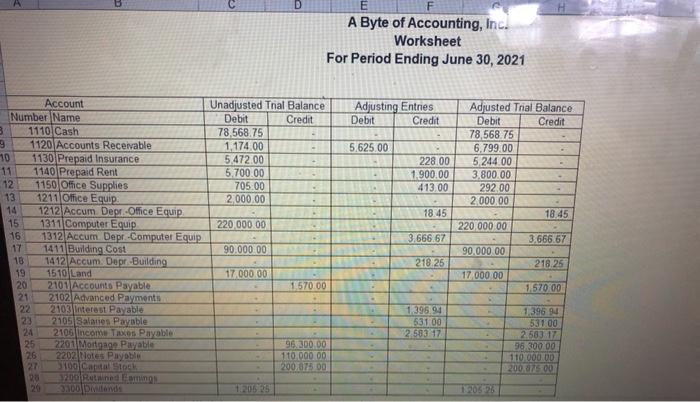

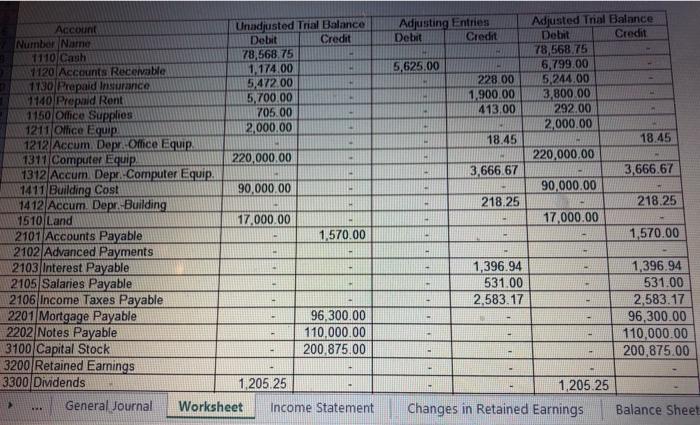

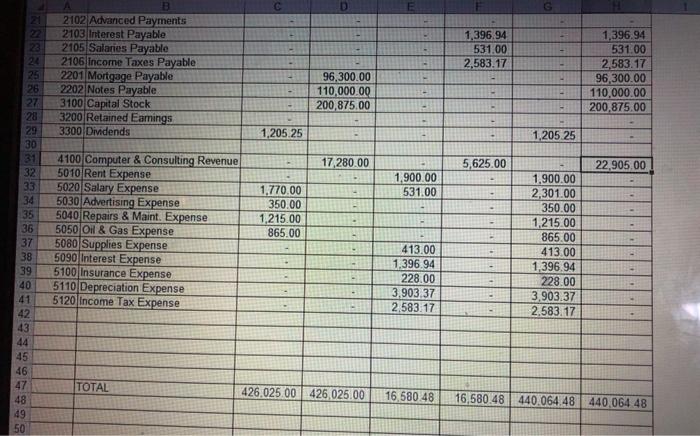

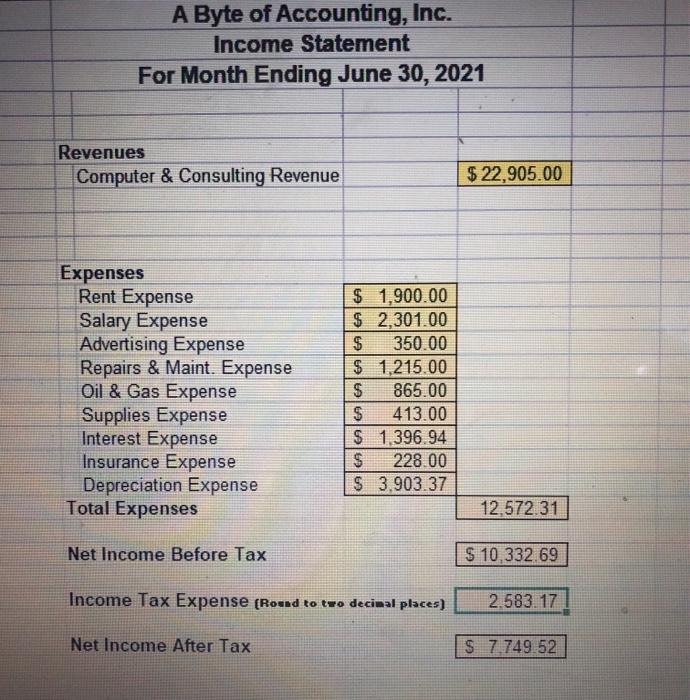

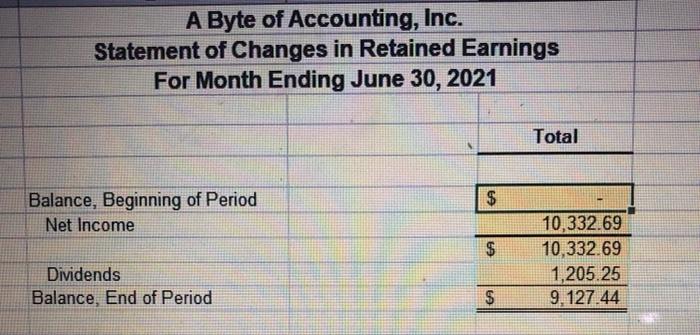

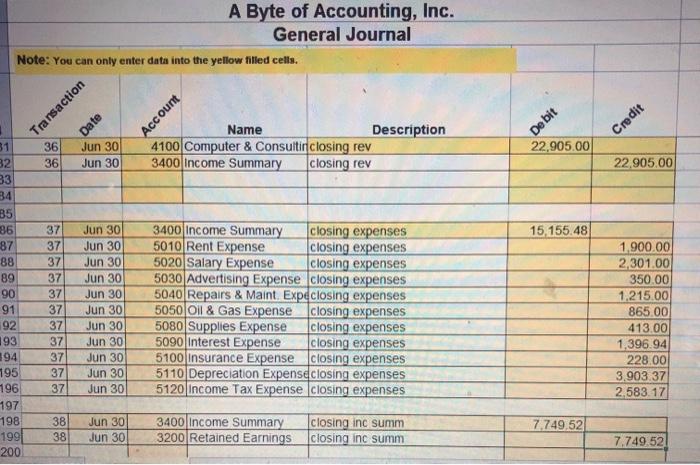

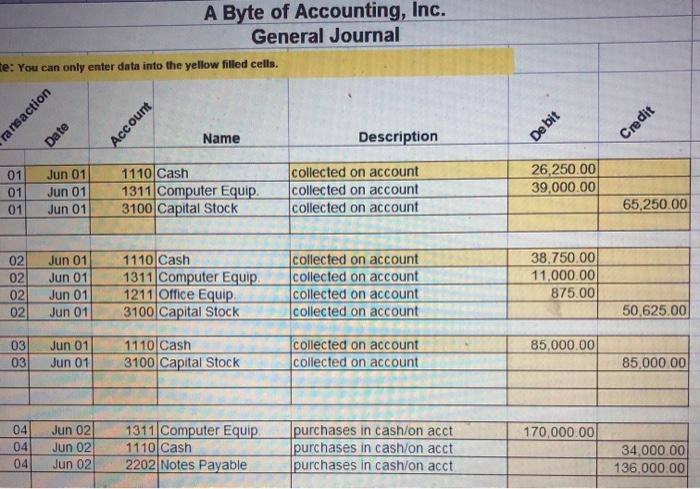

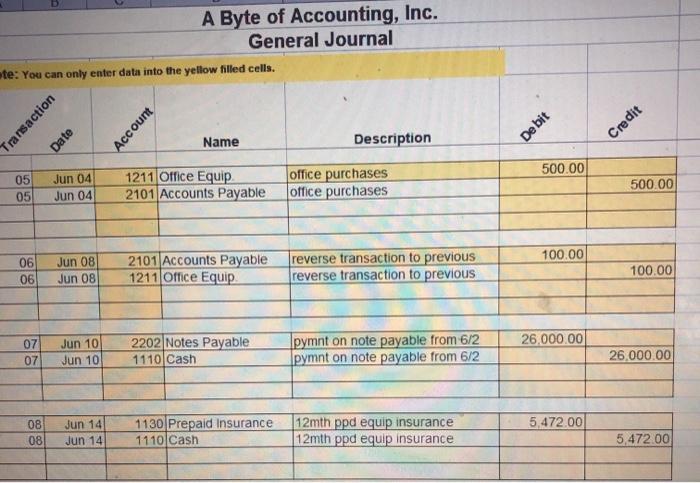

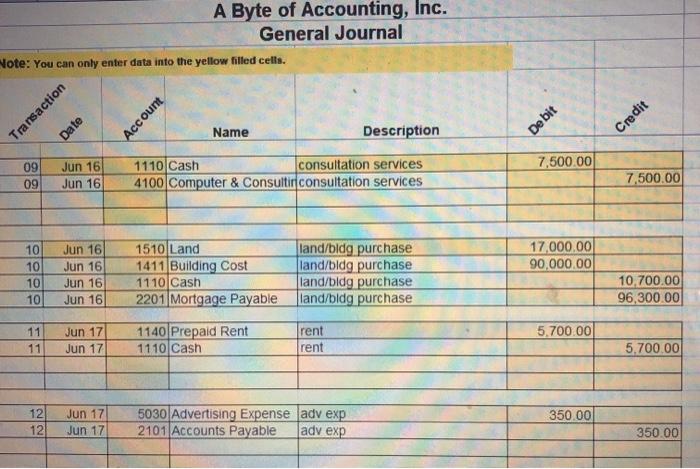

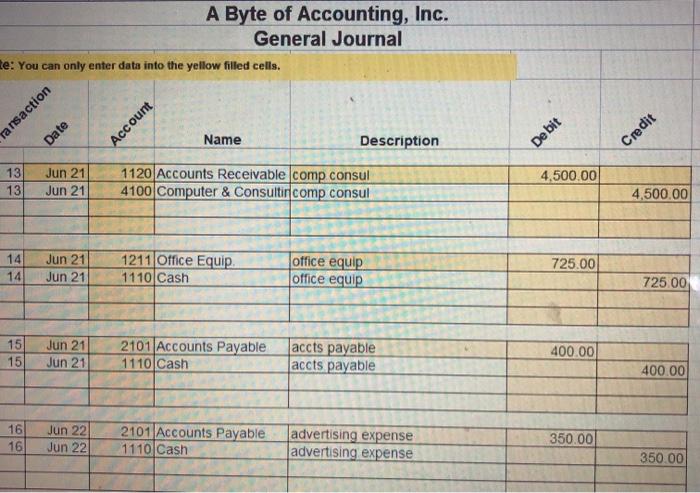

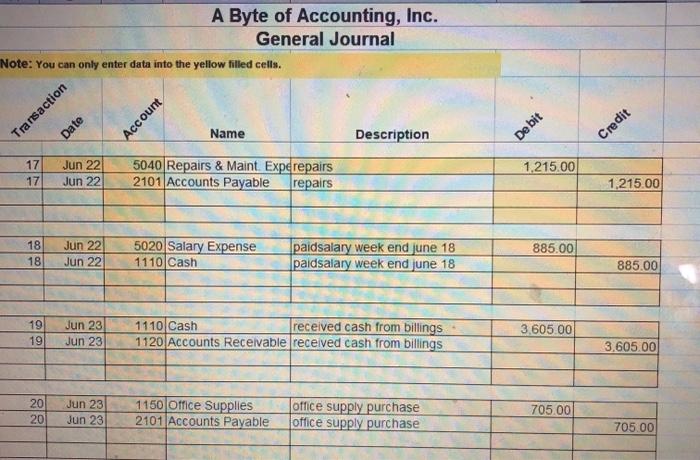

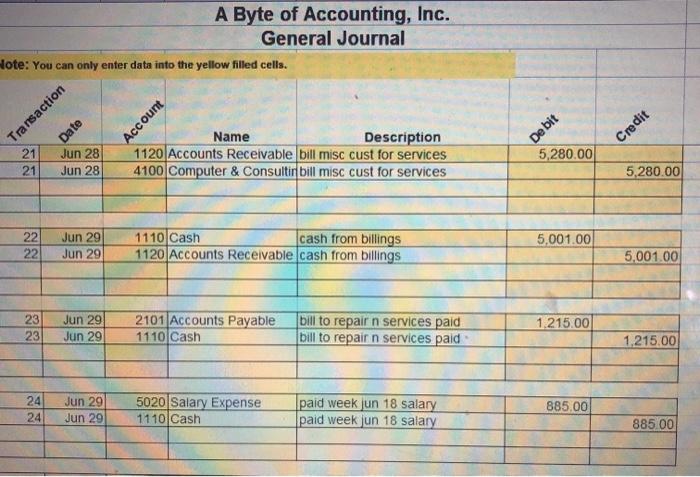

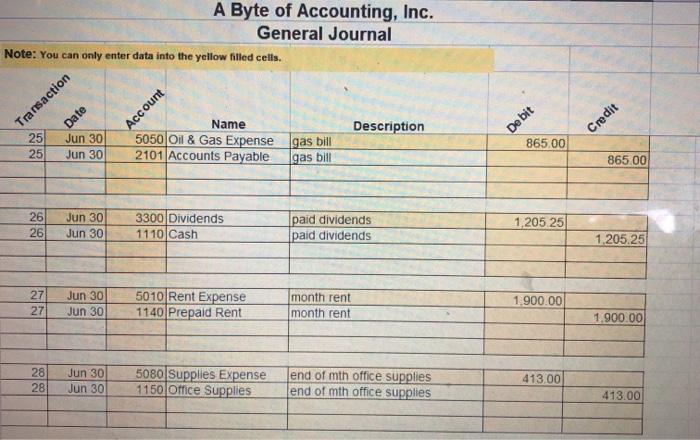

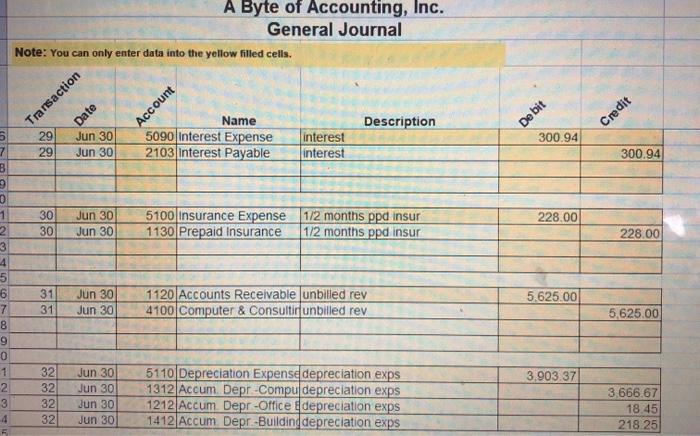

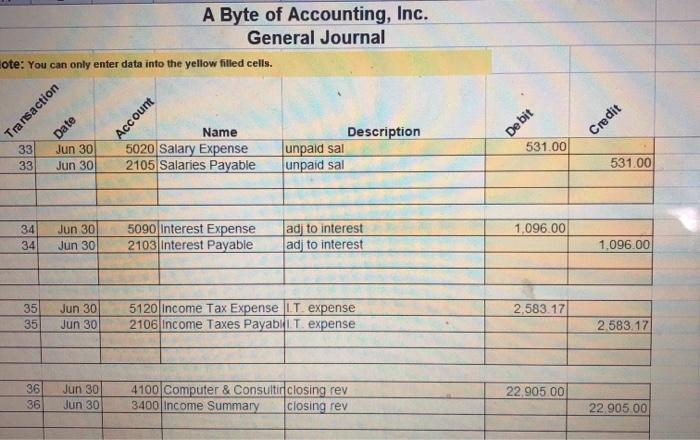

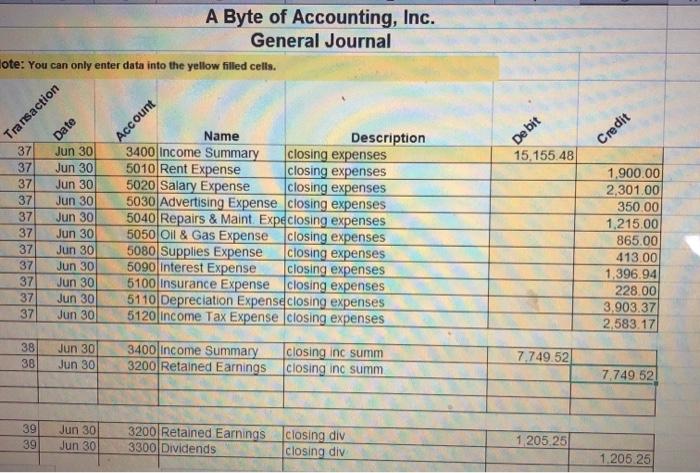

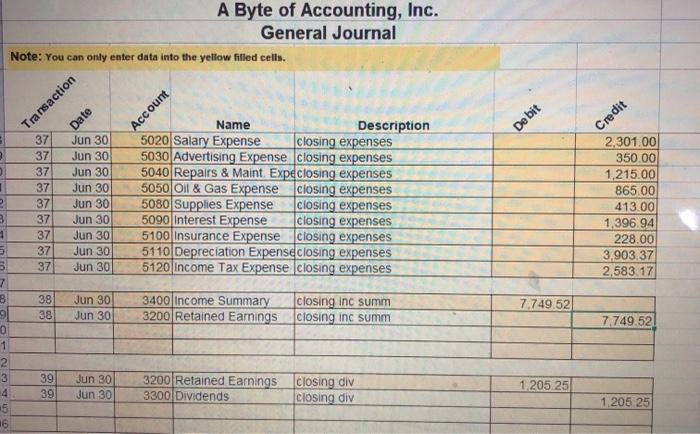

A Byte of Accounting, Inc. Balance Sheet As of June 30, 2021 Not in Balance by -$2,583 Assets Current Assets Cash Accounts Receivable Prepaid Insurance Prepaid Rent Office Supplies Total $78,568.75 $ 6,799.00 $ 5,244.00 $ 3,800.00 $ 292.00 $ 94,703.75 $ 2,000.00 18.45 $ 1,981.55 Long-Term Assets Office Equip Accum. Depr.-Office Equip. Computer Equip Accum. Depr.-Computer Equip. Building Cost Accum. Depr.-Building $ 220,000.00 3,666.67 $ 216,333.33 $ 90,000.00 218 25 $ 89.781.75 17 000.00 Land Total Total Assets $ 325,096 63 $ 419,800.38 D E 17,000.00 B Land Total Total Assets $325,096.63 $ 419,800.38 Liabilities $ 1,570.00 Current Liabilities Accounts Payable Advanced Payment Interest Payable Salaries Payable Income Taxes Payable Total $ 1,396.94 $ 531.00 $ 2,583.17 $ 6,081.11 Long-Term Liabilities Mortgage Payable Notes Payable Total Total Liabilities $ 96,300.00 110,000.00 206,300.00 $ 212 381.11 Stockholder's Equity Capital Stock Retained Earnings Total Total Liabilities and Stockholder's Equity $ 200.875 00 9.127.44 210.002.44 $ 422,383.55 D A Byte of Accounting, Inc. Worksheet For Period Ending June 30, 2021 Adjusting Entries Debit Credit Unadjusted Tral Balance Debit Credit 78,568.75 1,174,00 5.472.00 5.700.00 705:00 2,000.00 5.625.00 228.00 1.900.00 413.00 Adjusted Tral Balance Debit Credit 78,568.75 6.799.00 5,244.00 3,800.00 292,00 2 000.00 18.45 220,000.00 3,666 67 90.000.00 218.25 17 000.00 1.570.00 18.45 Account Number Name 3 1110 Cash 9 1120 Accounts Receivable 10 1130 Prepaid Insurance 11 1140 Prepaid Rent 12 1150 Office Supplies 13 1211 Office Equip 14 1212 Accum Dept.Office Equip 15 1311 Computer Equip 16 1312 Accum. Depr Computer Equip 17 1411 Building Cost 18 1412 Accum. Depr Building 19 1510 Land 20 2101 Accounts Payable 21 2102 Advanced Payments 22 2103 Interest Payable 23 2105 Salanes Payable 24 2106 income TXOS Payable 25 2200 Mortgage Payable 26 2202 Notes Payou 27 5100 Cat Stol 20 3200 Rudaming 220,000.00 3.666.67 90.00000 218 25 17 000.00 7.570.00 1.395.94 631 00 2.583717 96,300.00 110.000.00 200 07.00 1395 94 53100 2.583 17 96 300 00 110 000.00 200.875 00 Adjusting Entries Debit Credit 5,625.00 5.472.00 228.00 1,900.00 413,00 Adjusted Trial Balance Debit Credit 78,568.75 6,799.00 5,244.00 3,800.00 292.00 2.000.00 18.45 220,000.00 3,666.67 90,000.00 218.25 17,000.00 1,570.00 18.45 3,666 67 Account Unadjusted Trial Balance Number Name Debit Credit 1110 Cash 78,568.75 1120 Accounts Receivable 1.174.00 0730 Repaid Insurance 2140 Rrepad Rent 5,700.00 2150 Office Supplies 705.00 1211 Office Equip 2,000.00 1212 Accum Depre Office Equip 1310) Computer Equip 220,000.00 1312 Accum. Depr.-Computer Equip. 1411 Building Cost 90,000.00 1412 Accum. Depr Building 1510 Land 17.000.00 2101 Accounts Payable 1,570.00 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 96,300.00 2202 Notes Payable 110,000.00 3100 Capital Stock 200.875.00 3200 Retained Earnings 3300 Dividends 1,205.25 General Journal Worksheet Income Statement 218.25 1,396.94 531.00 2,583.17 1,396.94 531.00 2,583.17 96,300.00 110,000.00 200.875.00 1 205.25 Changes in Retained Earnings Balance Sheet 21 1,396.94 531.00 2,583.17 B 2 102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3200 Retained Earings 3300 Dividends 96,300.00 110,000.00 200,875.00 1,396.94 531.00 2,583.17 96,300.00 110,000.00 200,875.00 1,205.25 1,205 25 17,280.00 5,625.00 22.905.00 1,900.00 531.00 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 Oil & Gas Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Income Tax Expense 1,770.00 350.00 1.215.00 865.00 413.00 1,396.94 228.00 3.903.37 2.583.17 1,900.00 2,301.00 350.00 1,215.00 865.00 413.00 1,396.94 228.00 3.903.37 2.583.17 TOTAL 426.025.00 426 025.00 16.580 48 16,580.48 440.064.48 440,064 48 A Byte of Accounting, Inc. Income Statement For Month Ending June 30, 2021 Revenues Computer & Consulting Revenue $ 22,905.00 Expenses Rent Expense Salary Expense Advertising Expense Repairs & Maint. Expense Oil & Gas Expense Supplies Expense Interest Expense Insurance Expense Depreciation Expense Total Expenses $ 1,900.00 $ 2,301.00 $ 350.00 $ 1,215.00 $ 865.00 $ 413.00 $ 1.39 .94 $ 228.00 $ 3.903.37 12.572.31 Net Income Before Tax S 10.332.69 Income Tax Expense (Roud to two decimal places) 2.583.17 Net Income After Tax $ 7.749.52 A Byte of Accounting, Inc. Statement of Changes in Retained Earnings For Month Ending June 30, 2021 Total $ Balance, Beginning of Period Net Income $ 10,332.69 10,332.69 1,205.25 9.127 44 Dividends Balance, End of Period $ A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Transaction Date Account De bit Credit Name Description 4100 Computer & Consultin closing rev 3400 Income Summary closing rev 36 36 22.905.00 22.905.00 37 37 15.155.48 37 31 32 33 34 B5 36 87 88 89 90 91 92 193 394 195 196 197 198 1991 200 37 37 37 37 37 37 37 37 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 3400 Income Summary closing expenses 5010 Rent Expense closing expenses 5020 Salary Expense closing expenses 5030 Advertising Expense closing expenses 5040 Repairs & Maint Expeclosing expenses 5050 Oil & Gas Expense closing expenses 5080 Supplies Expense closing expenses 5090 Interest Expense closing expenses 5100 Insurance Expense closing expenses 5110 Depreciation Expense closing expenses 5120 Income Tax Expense closing expenses 1.900.00 2,301.00 350.00 1.215.00 865.00 413.00 1,396.94 228.00 3.903.37 2.583.17 38 38 Jun 30 Jun 30 3400 Income Summary closing inc summ 3200 Retained Earnings closing inc summ 7,749.52 7.749.52 A Byte of Accounting, Inc. General Journal te: You can only enter data into the yellow filled cells. ransaction Date Account De bit Credit Name Description 01 Jun 01 Jun 01 Jun 01 01 1110 Cash 1311 Computer Equip. 3100 Capital Stock collected on account collected on account collected on account 26,250.00 39,000.00 01 65,250.00 02 02 02 02 Jun 01 Jun 01 Jun 01 Jun 01 1110 Cash 1311 Computer Equip 1211 Office Equip 3100 Capital Stock collected on account collected on account collected on account collected on account 38,750.00 11,000.00 875.00 50.625.00 85,000.00 03 03 Jun 01 Jun 01 1110 cash 3100 Capital Stock collected on account collected on account 85,000.00 170,000.00 04 04 04 Jun 02 Jun 02 Jun 02 1311 Computer Equip 1110 Cash 2202 Notes Payable purchases in cash/on acct purchases in cash/on acct purchases in cash/on acct 34,000.00 136,000.00 A Byte of Accounting, Inc. General Journal ote: You can only enter data into the yellow filled cells. Transaction Date Account De bit Name Description Credit 500.00 05 05 Jun 04 Jun 04 1211 Office Equip 2101 Accounts Payable office purchases office purchases 500.00 100.00 06 06 Jun 08 Jun 08 2101 Accounts Payable 1211 Office Equip reverse transaction to previous reverse transaction to previous 100.00 26,000.00 07 07 Jun 10 Jun 10 2202 Notes Payable 1110 Cash pymnt on note payable from 6/2 pymnt on note payable from 6/2 26,000.00 5.472.00 08 08 Jun 14 Jun 14 1130 Prepaid Insurance 1110 Cash 12mth ppd equip insurance 12mth ppd equip insurance 5.472.00 A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Transaction Date Account De bit Name Description Credit 7,500.00 09 09 Jun 16 Jun 16 1110 Cash consultation services 4100 Computer & Consultir consultation services 7,500.00 17,000.00 90,000.00 10 10 10 10 Jun 16 Jun 16 Jun 16 Jun 16 1510 Land 1411 Building Cost 1110 cash 2201 Mortgage Payable land/bldg purchase land/bldg purchase land/bldg purchase land/bldg purchase 10.700.00 96,300.00 5,700.00 11 11 Jun 17 Jun 17 1140 Prepaid Rent 1110 cash rent rent 5.700.00 12 12 Jun 17 Jun 17 5030 Advertising Expense adv exp 2101 Accounts Payable adv exp 350.00 350.00 A Byte of Accounting, Inc. General Journal te: You can only enter data into the yellow filled cells. ransaction Date Account Name De bit Description Credit 13 13 Jun 21 Jun 21 1120 Accounts Receivable comp consul 4100 Computer & Consultir comp consul 4,500.00 4,500.00 14 14 Jun 21 Jun 21 1211 Office Equip 1110 Cash office equip Office equip 725.00 725.00 15 15 Jun 21 Jun 21 2101 Accounts Payable 1110 cash accts payable accts payable 400.00 400.00 16 16 Jun 22 Jun 22 2101 Accounts Payable 1110 Cash advertising expense advertising expense 350.00 350.00 A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Date Account Name Transaction Description De bit Credit 17 17 Jun 22 Jun 22 1.215.00 5040 Repairs & Maint. Experepairs 2101 Accounts Payable repairs 1,215.00 18 18 Jun 22 Jun 22 5020 Salary Expense 1110 Cash 885.00 paidsalary week end june 18 paidsalary week end june 18 885.00 19 19 Jun 23 Jun 23 1110 Cash received cash from billings 1120 Accounts Receivable received cash from billings 3.605.00 3,605.00 20 20 Jun 23 Jun 23 1150 Office Supplies 2101 Accounts Payable office supply purchase office supply purchase 705.00 705.00 A Byte of Accounting, Inc. General Journal dote: You can only enter data into the yellow filled cells. Date Account De bit Transaction Credit 21 21 Jun 28 Jun 28 Name Description 1120 Accounts Receivable bill misc cust for services 4100 Computer & Consultir bill misc cust for services 5,280.00 5,280.00 22 22 Jun 29 Jun 29 1110 Cash cash from billings 1120 Accounts Receivable cash from billings 5.001.00 5,001.00 23 23 Jun 29 Jun 29 2101 Accounts Payable 1110 Cash bill to repair n services paid bill to repair n services paid 1.215.00 1.215.00 24 24 Jun 29 Jun 29 5020 Salary Expense 1110 cash paid week jun 18 salary paid week jun 18 salary 885.00 885.00 A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Account Transaction De bit Date Description 25 25 Credit Name 5050 Oil & Gas Expense 2101 Accounts Payable Jun 30 Jun 30 865.00 gas bill gas bill 865.00 26 26 Jun 30 Jun 30 3300 Dividends 1110 Cash paid dividends paid dividends 1,205 25 1.205.25 27 27 Jun 30 Jun 30 5010 Rent Expense 1140 Prepaid Rent month rent month rent 1.900.00 1.900.00 28 28 Jun 30 Jun 30 5080 Supplies Expense 1150 Office Supplies end of mth office supplies end of mth office supplies 41300 413.00 A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Date Account Transaction Description De bit Credit 5 7 B 300.94 Name 5090 Interest Expense 2103 Interest Payable 29 29 interest interest 300.94 0 1 30 30 228.00 Jun 30 Jun 30 5100 insurance Expense 1130 Prepaid Insurance 1/2 months ppd insur 1/2 months ppd insur 228.00 31 31 Jun 30 Jun 30 5.625.00 1120 Accounts Receivable unbilled rev 4100 Computer & Consultirunbilled rev 5.625.00 3 4 5 6 7 8 9 0 1 2 3 4 3.903.37 32 32 32 32 Jun 30 Jun 30 Jun 30 Jun 30 5110 Depreciation Expense depreciation exps 1312 Accum Depr Compu depreciation exps 1212 Accum Depr-Office depreciation exps 1412 Accum Depr.-Building depreciation exps 3.666.67 18.45 218 25 A Byte of Accounting, Inc. General Journal ote: You can only enter data into the yellow filled cells. Transaction Date Account De bit Credit 33 33 Name 5020 Salary Expense 2105 Salaries Payable Jun 30 Jun 30 531.00 Description unpaid sal unpaid sal 531.00 34 34 Jun 30 Jun 30 5090 Interest Expense 2103 Interest Payable 1,096.00 adj to interest adj to interest 1.096.00 35 35 Jun 30 Jun 30 5120 Income Tax Expense T. expense 2106 Income Taxes Payabl. expense 2,583.17 2.583.17 36 36 Jun 30 Jun 30 4100 Computer & Consultir closing rev 3400 Income Summary Closing rev 22.905.00 22.905.00 A Byte of Accounting, Inc. General Journal lote: You can only enter data into the yellow filled cells. Date Account De bit Transaction Credit 15.155.48 37 37 37 37 37 37 37 37 37 37 37 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Name Description 3400 Income Summary closing expenses 5010 Rent Expense closing expenses 5020 Salary Expense closing expenses 5030 Advertising Expense closing expenses 5040 Repairs & Maint. Expeclosing expenses 5050 Oil & Gas Expense closing expenses 5080 Supplies Expense closing expenses 5090 interest Expense closing expenses 5100 Insurance Expense closing expenses 5110 Depreciation Expense closing expenses 5120 income Tax Expense closing expenses 1.900.00 2.301.00 350.00 1.215.00 865.00 413.00 1.396.94 228.00 3.903.37 2,583.17 38 38 Jun 30 Jun 30 3400 Income Summary 3200 Retained Earnings closing inc summ closing inc summ 7.749.52 7.749 52 39 Jun 30 Jun 30 39 3200 Retained Earnings closing div 3300 Dividends closing div 1 205,25 1.205.25 A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Date Account Transaction De bit Credit 1 37 37 37 37 37 37 37 37 37 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Name Description 5020 Salary Expense closing expenses 5030 Advertising Expense closing expenses 5040 Repairs & Maint. Expeclosing expenses 5050 Oil & Gas Expense closing expenses 5080 Supplies Expense closing expenses 5090 Interest Expense closing expenses 5100 Insurance Expense closing expenses 5110 Depreciation Expense closing expenses 5120 Income Tax Expense closing expenses 2.301.00 350.00 1,215.00 865.00 413.00 1,396.94 228.00 3.903.37 2,583 17 3 1 5 7 8 9 0 1 2 38 38 Jun 30 Jun 30 3400 Income Summary 3200 Retained Eamings closing Inc summ closing inc summ 7.749.52 7.749.52 39 39 Jun 30 Jun 30 3200 Retained Earnings closing div 3300 Dividends closing div 1,205.25 4 5 6 1,205 25 Please help me see why my balance sheet 1S Unbalanced at over 2,000 dollars? I provided the work- Sheet, Joumal, Income Statement Retamed earnings so you can see the information. Thx