Question

A: Cabell Products is a division of a major corporation. Last year the division had total sales of $27,320,000, net operating income of $2,924,320, and

A: Cabell Products is a division of a major corporation. Last year the division had total sales of $27,320,000, net operating income of $2,924,320, and average operating assets of $8,000,000. The company's minimum required rate of return is 15%. The division's turnover is closest to? 9.34 / 3.42 / 0.37 / 2.44

B: Cabell Products is a division of a major corporation. Last year the division had total sales of $23,170,000, net operating income of $1,668,240, and average operating assets of $5,097,400. The company's minimum required rate of return is 19%. The division's return on investment (ROI) is closest to? 7.2% / 32.7% / 37.9% / 22.0%

C: The Consumer Products Division of Cabell Products had average operating assets of $1,300,000 and net operating income of $119,300 in May. The minimum required rate of return for performance evaluation purposes is 9%. What was the Consumer Products Division's residual income in May? $(2,300) / $10,737 / $2,300 / $(10,737)

D: Cabell Products is considering eliminating a department that has an annual contribution margin of $80,000 and $160,000 in annual fixed costs. Of the fixed costs, $90,000 cannot be avoided. The annual financial advantage (disadvantage) for the company of eliminating this department would be? $10,000 / ($10,000) / $80,000 / ($80,000)

E: The following information relates to next year's projected operating results of the Childrens Division of Cabell Products :

| Contribution margin | $ | 200,000 | |

| Fixed expenses | 500,000 | ||

| Net operating loss | $ | (300,000? |

If the Children's Division is eliminated, $170,000 of the above fixed expenses could be avoided. The annual financial advantage (disadvantage) for the company of eliminating this division should be? ($300,000) / $30,000 / ($30,000) / $300,000

F: Cabell Products just inherited a 1958 Chevy Impala from her late Aunt Joop. Aunt Joop purchased the car 40 years ago for $8,000. They are either going to sell the car for $10,000 or have it restored and then sell it for $22,000. The restoration will cost $9,000. They would be financially better off by? $3,000 to have the vehicle restored / $6,000 to have the vehicle restored / $9,000 to have the vehicle restored / $11,000 to have the vehicle restored

G: Cabell Products is considering Alternative A and Alternative B. Costs associated with the alternatives are listed below:

| Alternative A | Alternative B | ||||

| Materials costs | $ | 51,000 | $ | 68,900 | |

| Processing costs | $ | 46,900 | $ | 46,900 | |

| Equipment rental | $ | 16,300 | $ | 16,300 | |

| Occupancy costs | $ | 18,500 | $ | 27,500 | |

What is the financial advantage (disadvantage) of Alternative B over Alternative A? $132,700 / $26,900 / $159,600 / $146,150

H: Cabell Products has provided the following data concerning an investment project that it is considering:

| Initial investment | $ | 210,000 | |

| Annual cash flow | $ | 126,000 | per year |

| Expected life of the project | 4 | years | |

| Discount rate | 9 | % |

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the project is closest to? $198,114 / $210,000 / $(84,000) / $(198,114)

I: Cabell Products is investigating automating a process. Old equipment, with a current salvage value of $30,000, would be replaced by a new machine. The new machine would be purchased for $396,000 and would have a 6 year useful life and no salvage value. By automating the process, the company would save $137,000 per year in cash operating costs. The simple rate of return on the investment is closest to (Ignore income taxes.)? 19.4% / 17.9% / 34.6% / 16.7%

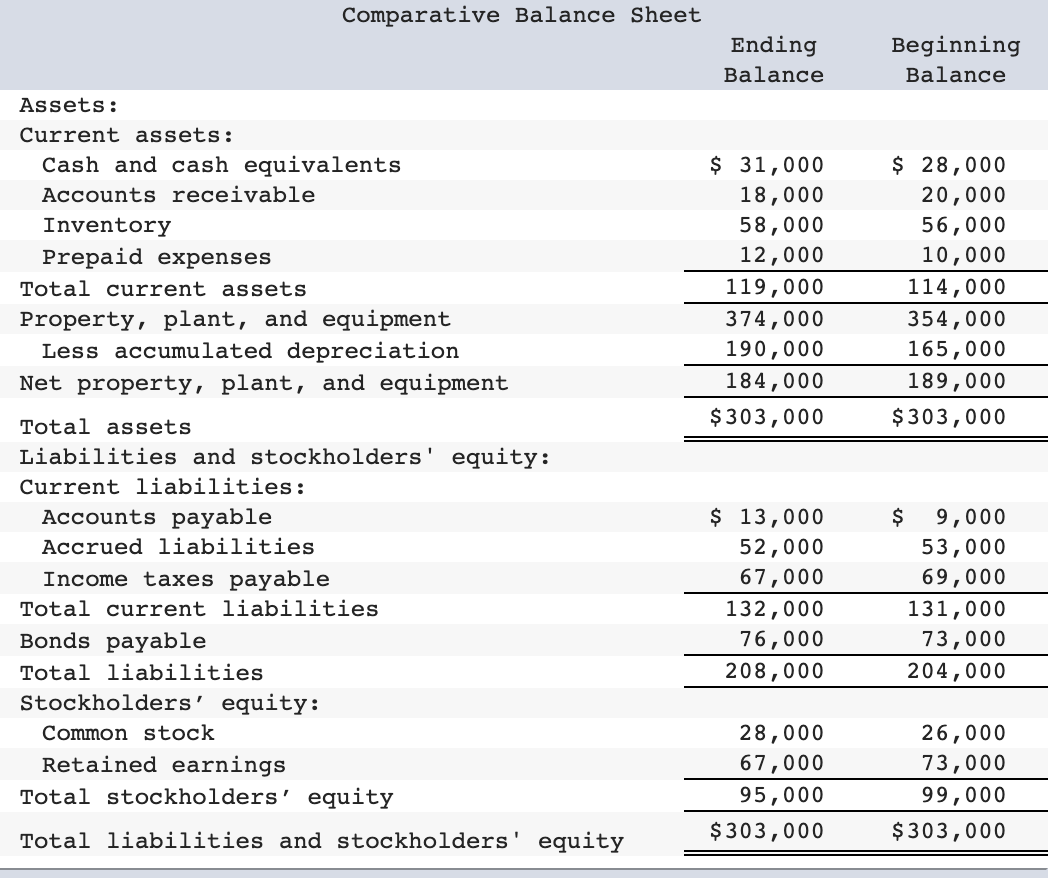

J: Cabell Products comparative balance sheet appears below:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities. Which of the following is correct regarding the operating activities section of the statement of cash flows?

-

The change in Accounts Receivable will be subtracted from net income; The change in Inventory will be added to net income

-

The change in Accounts Receivable will be added to net income; The change in Inventory will be subtracted from net income

-

The change in Accounts Receivable will be added to net income; The change in Inventory will be added to net income

-

The change in Accounts Receivable will be subtracted from net income; The change in Inventory will be subtracted from net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started