Question

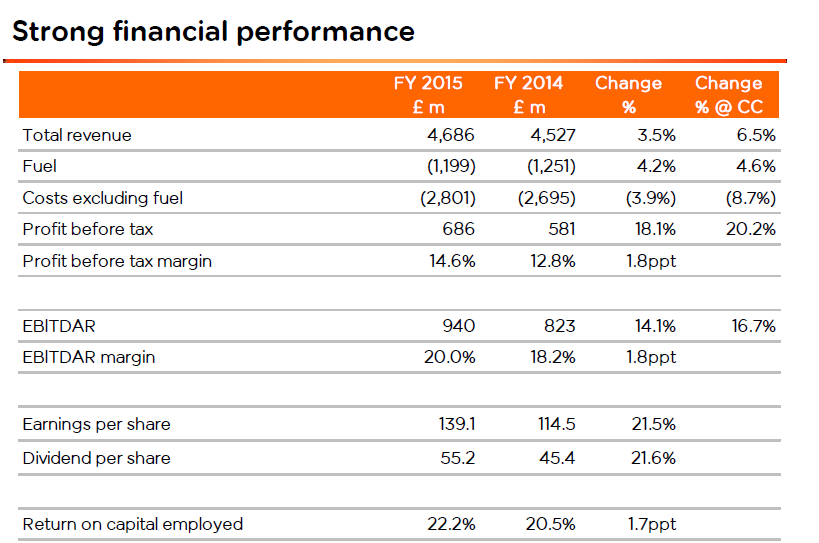

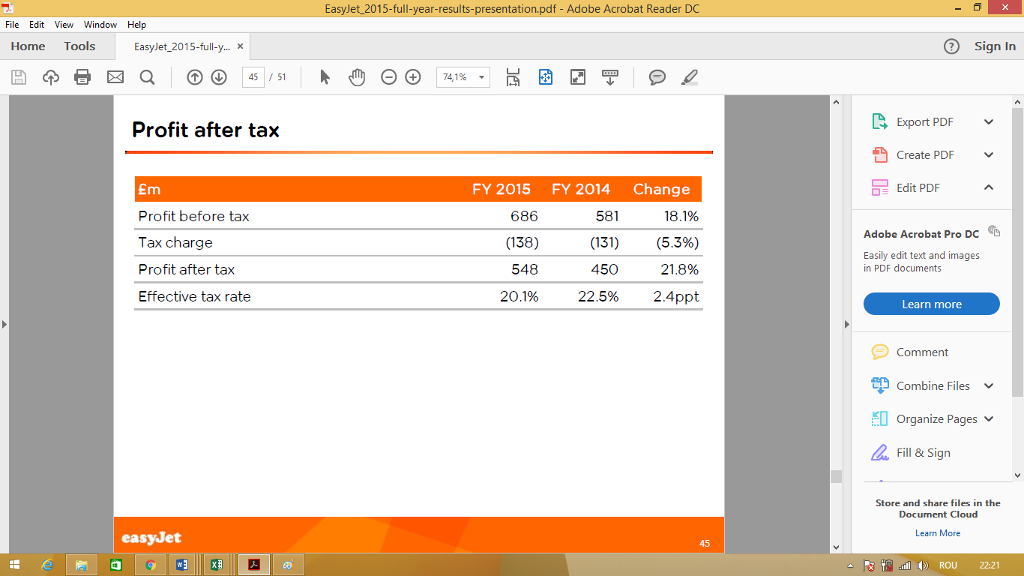

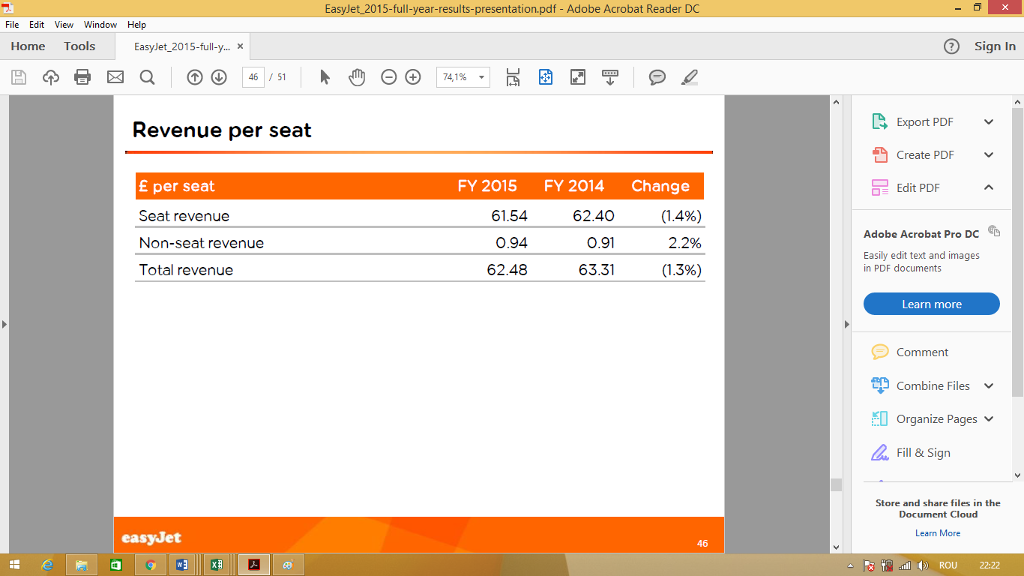

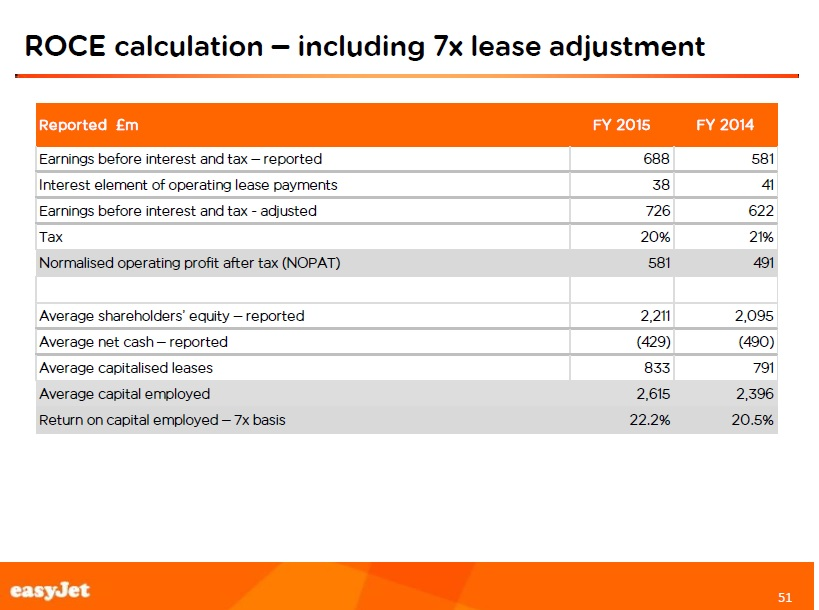

a) Calculate EasyJets dividend payout ratios: one payout ratio based on its net income and one based on its free cash flow available for shareholders

a) Calculate EasyJets dividend payout ratios: one payout ratio based on its net income and one based on its free cash flow available for shareholders (i.e. its free cash flow to equity, FCFE) for the financial year ended 2015.

b) Comment on EasyJets dividend policy and explain why it may have chosen its dividend history based on the theories identified in part (a) and your results from part (b). Based on your analysis, would you recommend that EasyJet returned more cash or less cash to its shareholders for its fiscal years ended 2016 and 2017?

EasyJet plc dividend history

| Financial year end | Type | Amount | Ex-dividend date | Payment date |

| 30/09/2015 | Total | 55.20p | ||

| Final | 55.20p | 25/02/2016 | 18/03/2016 | |

| Special | n/a | n/a | n/a | |

| 30/09/2014 | Total | 45.40p | ||

| Final | 45.40p | 26/02/2015 | 20/03/2015 | |

| Special | n/a | n/a | n/a | |

| 30/09/2013 | Total | 77.60p | ||

| Final | 33.50p | 26/02/2014 | 21/03/2014 | |

| Special | 44.10p | 26/02/2014 | 21/03/2014 | |

| 30/09/2012 | Total | 21.50p | ||

| Final | 21.50p | 27/02/2013 | 22/03/2013 | |

| Special | n/a | n/a | n/a | |

| 30/09/2011 | Total | 45.40p | ||

| Final | 10.50p | 29/02/2012 | 23/03/2012 | |

| Special | 34.90p | 05/03/2012 | 23/03/2012 | |

Historical dividends may be adjusted to reflect any subsequent rights issues and corporate actions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started