Question

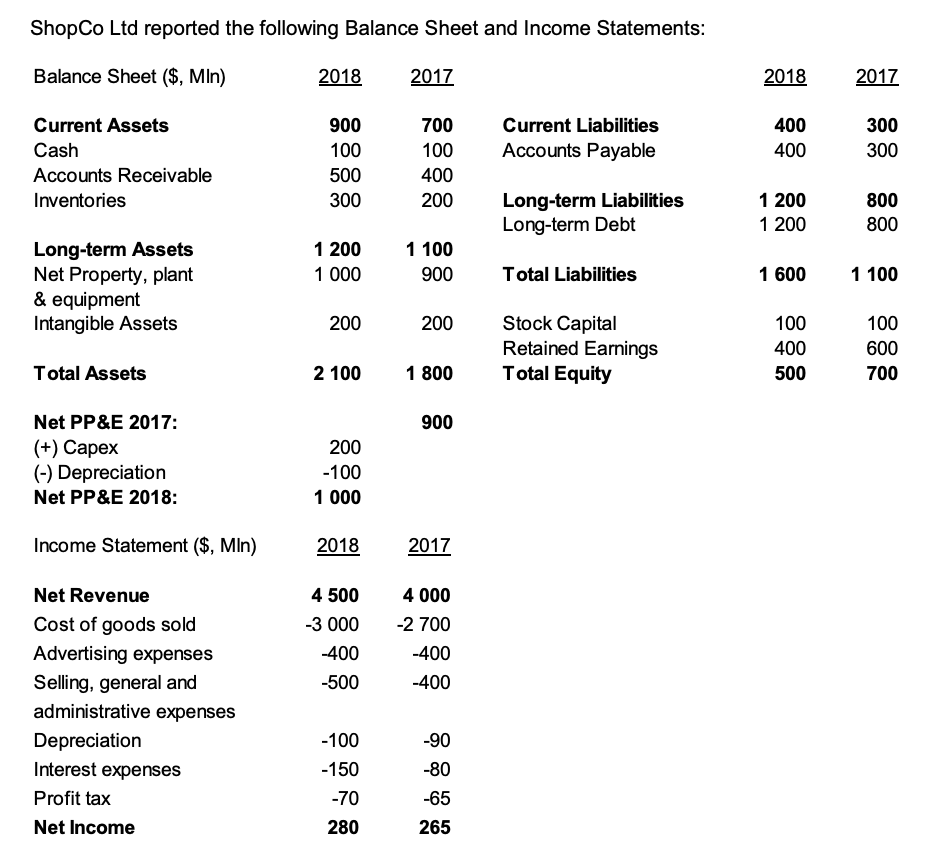

a) Calculate Gross profit, Operating profit and EBITDA for 2018 and 2017. Calculate respective profit margins (Gross profit, Operating profit, EBITDA and Net Profit margins)

a) Calculate Gross profit, Operating profit and EBITDA for 2018 and 2017. Calculate respective profit margins (Gross profit, Operating profit, EBITDA and Net Profit margins) and provide a short analysis of profitability in 2018 vs 2017. b) Calculate ROE and ROA for ShopCo in 2018 and 2017, provide a short analysis of any changes in the respective ratios.

a) Calculate Gross profit, Operating profit and EBITDA for 2018 and 2017. Calculate respective profit margins (Gross profit, Operating profit, EBITDA and Net Profit margins) and provide a short analysis of profitability in 2018 vs 2017. b) Calculate ROE and ROA for ShopCo in 2018 and 2017, provide a short analysis of any changes in the respective ratios.

c) How the companys debt/equity ratio changed in 2018 vs 2017? What was the change in the company current ratio? Provide comments.

d) Calculate Free Cash Flow of Shop Co in 2018. Calculate and provide comments about Cash Conversion Cycle.

ShopCo Ltd reported the following Balance Sheet and Income Statements: Balance Sheet($, MIn) 2018 2017 2018 2017 Current Liabilities Accounts Payable 400 400 300 300 Current Assets Cash Accounts Receivable Inventories 900 100 500 300 700 100 400 200 Long-term Liabilities Long-term Debt 1 200 1 200 800 800 1 200 1 000 1 100 900 Total Liabilities 1 600 1 100 Long-term Assets Net Property, plant & equipment Intangible Assets 200 200 Stock Capital Retained Earnings Total Equity 100 400 500 100 600 700 Total Assets 2 100 1 800 900 Net PP&E 2017: (+) Capex (-) Depreciation Net PP&E 2018: 200 -100 1 000 Income Statement ($, MIn) 2018 2017 4 500 -3000 -400 -500 4 000 -2 700 -400 -400 Net Revenue Cost of goods sold Advertising expenses Selling, general and administrative expenses Depreciation Interest expenses Profit tax Net Income -90 -80 -100 -150 -70 280 -65 265Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started