Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Calculate Keenan's total dividends for 2021 assuming that it follows each of the following pollcles: 2. It cnntinies the 3n>n dividend payout ratio. Write

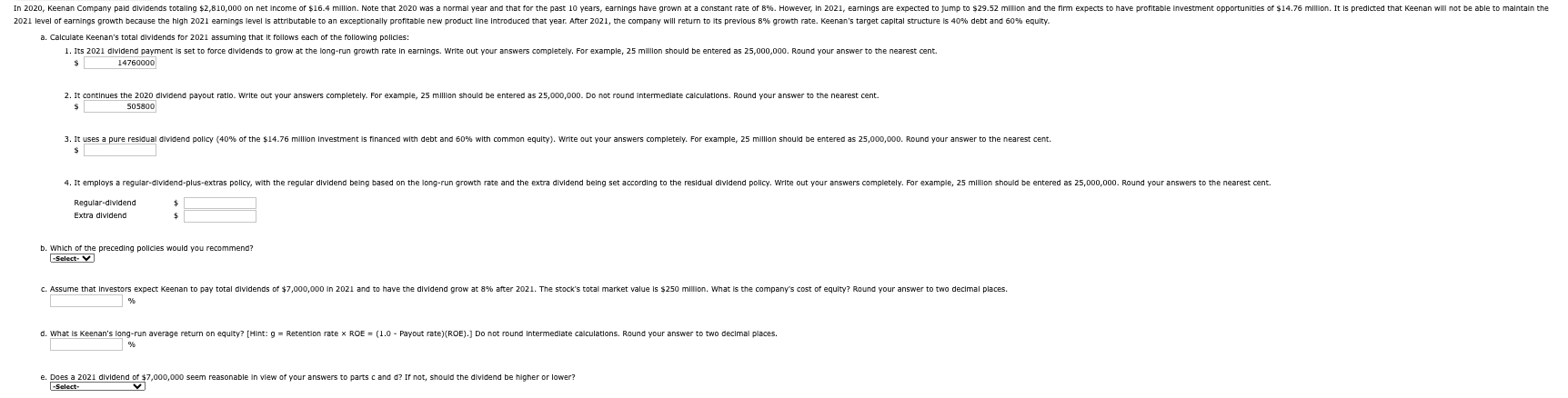

a. Calculate Keenan's total dividends for 2021 assuming that it follows each of the following pollcles: 2. It cnntinies the 3n>n dividend payout ratio. Write out your answers completely. For example, 25 million should be entered as 25,000,000. Do not round intermedlate calculations. Round your answer to the nearest cent. $ Regular-dividendExtradividend$ b. Which of the preceding pollcles would you recommend? [-5elect- V] c. Accuima that imuactrins expect Keenan to pay total dilidends of $7,000,000 in 2021 and to have the dividend grow at 8% after 2021 . The stock's total market value is $250 million. What is the company's cost of equity? Round your answer to two decimal places. d. What is Keenan's long--run average return on equity? [Hilnt: g= Retention rate ROE =(1.0 - Payout rate) ) ROE).] Do not round Intermedlate calculations. Round your answer to two decimal places. e. Does a 2021 dividend of $7,000,000 seem reasonable in view of your answers to parts c and d? If not, should the dividend be higher or lower? [-select- a. Calculate Keenan's total dividends for 2021 assuming that it follows each of the following pollcles: 2. It cnntinies the 3n>n dividend payout ratio. Write out your answers completely. For example, 25 million should be entered as 25,000,000. Do not round intermedlate calculations. Round your answer to the nearest cent. $ Regular-dividendExtradividend$ b. Which of the preceding pollcles would you recommend? [-5elect- V] c. Accuima that imuactrins expect Keenan to pay total dilidends of $7,000,000 in 2021 and to have the dividend grow at 8% after 2021 . The stock's total market value is $250 million. What is the company's cost of equity? Round your answer to two decimal places. d. What is Keenan's long--run average return on equity? [Hilnt: g= Retention rate ROE =(1.0 - Payout rate) ) ROE).] Do not round Intermedlate calculations. Round your answer to two decimal places. e. Does a 2021 dividend of $7,000,000 seem reasonable in view of your answers to parts c and d? If not, should the dividend be higher or lower? [-select

a. Calculate Keenan's total dividends for 2021 assuming that it follows each of the following pollcles: 2. It cnntinies the 3n>n dividend payout ratio. Write out your answers completely. For example, 25 million should be entered as 25,000,000. Do not round intermedlate calculations. Round your answer to the nearest cent. $ Regular-dividendExtradividend$ b. Which of the preceding pollcles would you recommend? [-5elect- V] c. Accuima that imuactrins expect Keenan to pay total dilidends of $7,000,000 in 2021 and to have the dividend grow at 8% after 2021 . The stock's total market value is $250 million. What is the company's cost of equity? Round your answer to two decimal places. d. What is Keenan's long--run average return on equity? [Hilnt: g= Retention rate ROE =(1.0 - Payout rate) ) ROE).] Do not round Intermedlate calculations. Round your answer to two decimal places. e. Does a 2021 dividend of $7,000,000 seem reasonable in view of your answers to parts c and d? If not, should the dividend be higher or lower? [-select- a. Calculate Keenan's total dividends for 2021 assuming that it follows each of the following pollcles: 2. It cnntinies the 3n>n dividend payout ratio. Write out your answers completely. For example, 25 million should be entered as 25,000,000. Do not round intermedlate calculations. Round your answer to the nearest cent. $ Regular-dividendExtradividend$ b. Which of the preceding pollcles would you recommend? [-5elect- V] c. Accuima that imuactrins expect Keenan to pay total dilidends of $7,000,000 in 2021 and to have the dividend grow at 8% after 2021 . The stock's total market value is $250 million. What is the company's cost of equity? Round your answer to two decimal places. d. What is Keenan's long--run average return on equity? [Hilnt: g= Retention rate ROE =(1.0 - Payout rate) ) ROE).] Do not round Intermedlate calculations. Round your answer to two decimal places. e. Does a 2021 dividend of $7,000,000 seem reasonable in view of your answers to parts c and d? If not, should the dividend be higher or lower? [-select Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started