Answered step by step

Verified Expert Solution

Question

1 Approved Answer

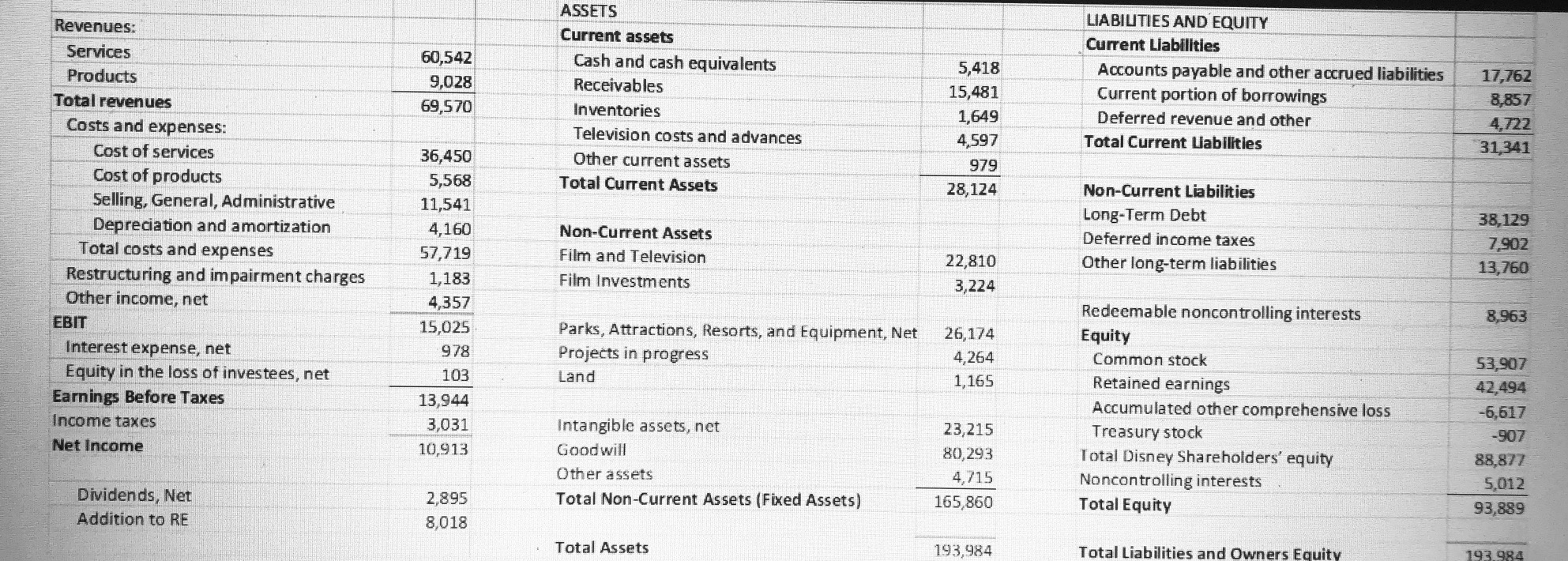

A) Calculate projected DFN if sales increase by eight percent. Assume that costs change with sales and that current liabilities grow at four percent while

A) Calculate projected DFN if sales increase by eight percent. Assume that costs change with sales and that current liabilities grow at four percent while non current liab. do not change. D/E, prof. margin, and div. payout remain the same.

B) In continuation of the last scenario, this corporation has thirty-two million shares and wants to issue 4 mill. more at $85.98. As a result, the div. payout ratio will grow by the % change in shares outstanding, but the curr. assets will stay constant. How will this change the DFN from part A?

60,542 9,028 69,570 ASSETS Current assets Cash and cash equivalents Receivables Inventories Television costs and advances Other current assets Total Current Assets 5,418 15,481 1,649 4,597 979 28,124 LIABILITIES AND EQUITY Current Liabilities Accounts payable and other accrued liabilities Current portion of borrowings Deferred revenue and other Total Current Liabilities 17,762 8,857 4,722 31,341 Revenues: Services Products Total revenues Costs and expenses: Cost of services Cost of products Selling, General, Administrative Depreciation and amortization Total costs and expenses Restructuring and impairment charges Other income, net EBIT Interest expense, net Equity in the loss of investees, net Earnings Before Taxes Income taxes Net Income Non-Current Liabilities Long-Term Debt Deferred income taxes Other long-term liabilities Non-Current Assets Film and Television Film Investments 38,129 7,902 13,760 22,810 3,224 36,450 5,568 11,541 4,160 57,719 1,183 4,357 15,025 978 103 13,944 3,031 10,913 8,963 Parks, Attractions, Resorts, and Equipment, Net Projects in progress Land 26,174 4,264 1,165 Redeemable noncontrolling interests Equity Common stock Retained earnings Accumulated other comprehensive loss Treasury stock Total Disney Shareholders' equity Noncontrolling interests Total Equity Intangible assets, net Goodwill Other assets Total Non-Current Assets (Fixed Assets) 23,215 80,293 4,715 165,860 53,907 42,494 -6,617 -907 88,877 5,012 93,889 Dividends, Net Addition to RE 2,895 8,018 Total Assets 193,984 Total Liabilities and Owners Equity 193 984 60,542 9,028 69,570 ASSETS Current assets Cash and cash equivalents Receivables Inventories Television costs and advances Other current assets Total Current Assets 5,418 15,481 1,649 4,597 979 28,124 LIABILITIES AND EQUITY Current Liabilities Accounts payable and other accrued liabilities Current portion of borrowings Deferred revenue and other Total Current Liabilities 17,762 8,857 4,722 31,341 Revenues: Services Products Total revenues Costs and expenses: Cost of services Cost of products Selling, General, Administrative Depreciation and amortization Total costs and expenses Restructuring and impairment charges Other income, net EBIT Interest expense, net Equity in the loss of investees, net Earnings Before Taxes Income taxes Net Income Non-Current Liabilities Long-Term Debt Deferred income taxes Other long-term liabilities Non-Current Assets Film and Television Film Investments 38,129 7,902 13,760 22,810 3,224 36,450 5,568 11,541 4,160 57,719 1,183 4,357 15,025 978 103 13,944 3,031 10,913 8,963 Parks, Attractions, Resorts, and Equipment, Net Projects in progress Land 26,174 4,264 1,165 Redeemable noncontrolling interests Equity Common stock Retained earnings Accumulated other comprehensive loss Treasury stock Total Disney Shareholders' equity Noncontrolling interests Total Equity Intangible assets, net Goodwill Other assets Total Non-Current Assets (Fixed Assets) 23,215 80,293 4,715 165,860 53,907 42,494 -6,617 -907 88,877 5,012 93,889 Dividends, Net Addition to RE 2,895 8,018 Total Assets 193,984 Total Liabilities and Owners Equity 193 984Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started