Question

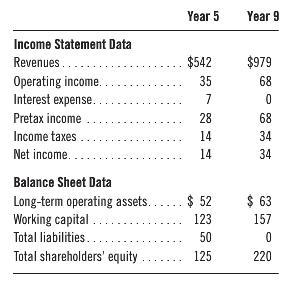

Selected financial statement data from Texas Telecom, Inc., for Years 5 and 9 are reproduced below ($ millions): Required: a. Calculate return on common equity

Selected financial statement data from Texas Telecom, Inc., for Years 5 and 9 are reproduced below ($ millions):

Required:

a. Calculate return on common equity and disaggregate ROCE for Years 5 and 9 using end-of-year values for computations requiring an average (assume fixed assets and working capital are operating and a 50% tax rate).

b. Comment on Texas Telecom’s use of financial leverage.

Year 5 Year 9 Income Statement Data Revenues.. $542 $979 Operating income. Interest expense. 35 68 7 Pretax income 28 68 Income taxes 14 34 Net income.. 14 34 Balance Sheet Data Long-term operating assets... $ 52 Working capital . $ 63 ..... 123 157 Total liabilities.. 50 Total shareholders' equity 125 220

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Statement Analysis and Security Valuation

Authors: Stephen Penman

5th edition

78025311, 978-0078025310

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App