Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Calculate the after tax cost of debt. b. Calculate the cost of preference shares c. Calculate the cost of internal equity d. Calculate the

a. Calculate the after tax cost of debt. b. Calculate the cost of preference shares c. Calculate the cost of internal equity d. Calculate the cost of external equity

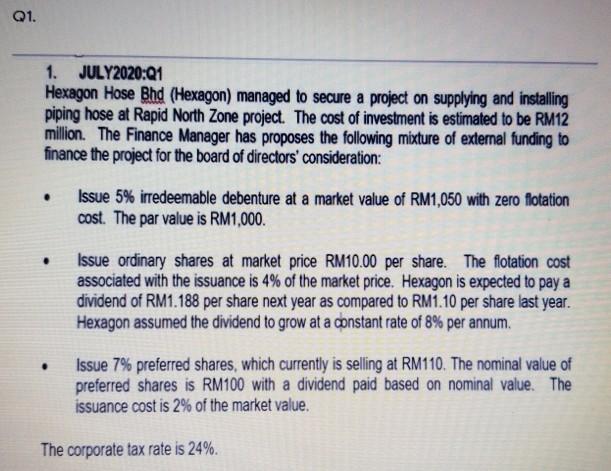

Q1. 1. JULY2020:01 Hexagon Hose Bhd (Hexagon) managed to secure a project on supplying and installing piping hose at Rapid North Zone project. The cost of investment is estimated to be RM12 million. The Finance Manager has proposes the following mixture of external funding to finance the project for the board of directors' consideration: . Issue 5% irredeemable debenture at a market value of RM1,050 with zero flotation cost. The par value is RM1,000. Issue ordinary shares at market price RM10.00 per share. The flotation cost associated with the issuance is 4% of the market price. Hexagon is expected to pay a dividend of RM1.188 per share next year as compared to RM1.10 per share last year. Hexagon assumed the dividend to grow at a constant rate of 8% per annum . Issue 7% preferred shares, which currently is selling at RM110. The nominal value of preferred shares is RM100 with a dividend paid based on nominal value. The issuance cost is 2% of the market value. The corporate tax rate is 24%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started