Answered step by step

Verified Expert Solution

Question

1 Approved Answer

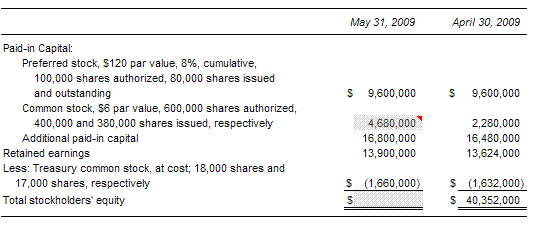

a. Calculate the amount that should be shown onthe balance sheet for common stock at May 31, 2009. b. The only transaction affecting additionalpaid-in capital

a. Calculate the amount that should be shown onthe balance sheet for common stock at May 31, 2009. b. The only transaction affecting additionalpaid-in capital during the month of May was the sale of additionalcommon stock. At what price per share were the additional sharessold? c. What was the average cost per share of commonstock purchased for the treasury during the month? d. During May, dividends on preferred stock equalto one-half of the 2009 dividend requirement were declared andpaid. There were no common dividends declared or paid in May.Calculate net income for May. e. Assume that on June 1, the board of directorsdeclares a cash dividend of $0.21 per share on the outstandingshares of common stock. The dividend will be payable on July 15 tostockholders of record on June 15. 1. Calculate the total amount of the dividend. 2. Explain the impact this action will have on the June 30 balancesheet, and on the income statement for June. f. Assuming that on June 1 the market valueof the common stock is $36 per share and that the board ofdirectors declares a 6% stock dividend on the issued shares ofcommon stock. Use the horizontal model (or write the journal entry)to show the issuance of the stock dividend. g. Assume that instead of the stock dividenddescribed in f above, the board of directors authorizes a 2-for-1stock split on June 1 when the market price of common stock is $36per share. 1. What will be the par value, and how many shares of common stockwill be authorized after the split? 2. What will be the marketprice per share of common stock after the split? 3. How many shares of common stock will be in the treasury afterthe split? h. By how much will total stockholders' equitychange as a result of: 1. The stock dividend described in part f? 2. The stock split described in part g

a. Calculate the amount that should be shown onthe balance sheet for common stock at May 31, 2009. b. The only transaction affecting additionalpaid-in capital during the month of May was the sale of additionalcommon stock. At what price per share were the additional sharessold? c. What was the average cost per share of commonstock purchased for the treasury during the month? d. During May, dividends on preferred stock equalto one-half of the 2009 dividend requirement were declared andpaid. There were no common dividends declared or paid in May.Calculate net income for May. e. Assume that on June 1, the board of directorsdeclares a cash dividend of $0.21 per share on the outstandingshares of common stock. The dividend will be payable on July 15 tostockholders of record on June 15. 1. Calculate the total amount of the dividend. 2. Explain the impact this action will have on the June 30 balancesheet, and on the income statement for June. f. Assuming that on June 1 the market valueof the common stock is $36 per share and that the board ofdirectors declares a 6% stock dividend on the issued shares ofcommon stock. Use the horizontal model (or write the journal entry)to show the issuance of the stock dividend. g. Assume that instead of the stock dividenddescribed in f above, the board of directors authorizes a 2-for-1stock split on June 1 when the market price of common stock is $36per share. 1. What will be the par value, and how many shares of common stockwill be authorized after the split? 2. What will be the marketprice per share of common stock after the split? 3. How many shares of common stock will be in the treasury afterthe split? h. By how much will total stockholders' equitychange as a result of: 1. The stock dividend described in part f? 2. The stock split described in part g Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started