Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a- Calculate the Break-even of the Profit Before Taxes, and interpret the result b-Calculate the Return on Equity (ROE), the Return on Assets (ROA, and

a- Calculate the Break-even of the Profit Before Taxes, and interpret the result

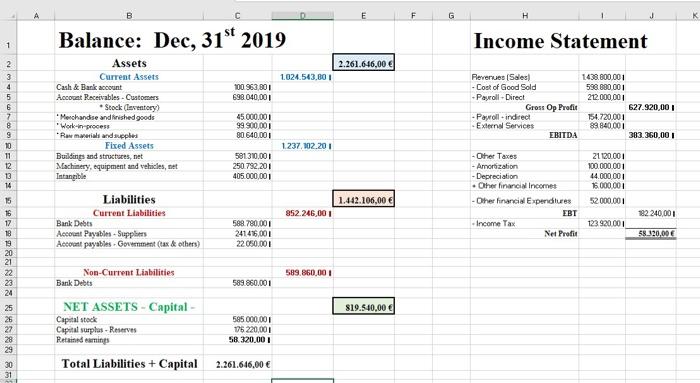

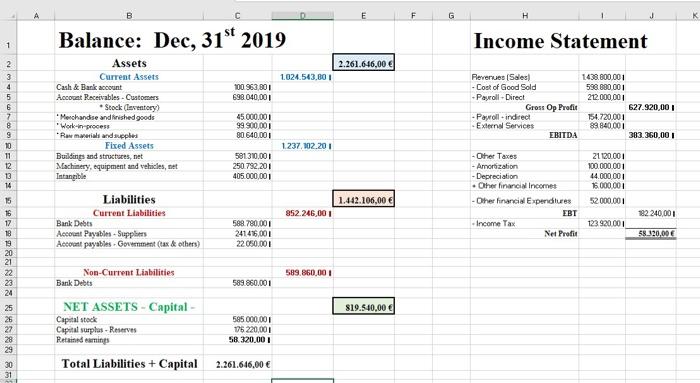

A B E F G H Balance: Dec, 31" 2019 Income Statement 1 2.261.616.00 1.024.543,801 2 3 4 5 6 7 8 100 963,801 698,040,001 Assets Current Assets Cash & Bank account Account Receivables - Customers *Stock (eventory) "Merchandise and finished goods "Work in process *Ramil and suples Fixed Assets Buildings and structures, net Machinery, equipment and vehicles, met Intangible Pievenues (Sales! - Cost of Good Sold - Payroll - Direct Gross Op Profit - Payroll - indirect - External Services EBITDA 1438.800,001 536.890.001 212.000.001 627.920,00 154.720,001 89.840.001 383.360,00 45000.001 99.900,001 80 640,001 1.237.102.201 10 11 12 13 14 581310,001 250 792,201 405.000,001 21 120,001 100.000,001 44.000,00 16.000.000 52.000,001 1.442.106,00 -Other Taxes - Amortization - Depreciation Other financial Income - Other financial Expenditures EBT -Income Tax Net Profit 852.246,00 182 240,001 Liabilities Current Liabilities Bank Debts Account Payables - Supplies Account payables. Government tax & others) 123 920.001 15 16 17 18 19 20 21 22 23 24 588 780.00 241 416,001 22050,001 58_120,00 589.860,000 Non-Current Liabilities Bank Debts 589.860.001 $19.510,00 25 26 27 28 29 NET ASSETS - Capital Capital stock Capital surplus - Reserves Resideri Total Liabilities + Capital 585 000,001 16220,001 58.320,00 2.261.616.00 31 b-Calculate the Return on Equity (ROE), the Return on Assets (ROA, and interpret the results obtained

c-Calculate the Leverage (Debt_to_Equity) Ratio, and the solvency (Total Debt) ratio, and interpret the results obtained

d-Calculate Profit margin (Net Income-to-Sales) ratio and interpret the results obtained

e-Calculate Inventory Turnover (Days sales in inventory) and interpret the results obtained

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started