Question

(a) Calculate the cost of equity of XYZ company using CAPM. (b) Calculate the weighted average cost of capital (WACC) of XYZ company. (c) Compute

(a) Calculate the cost of equity of XYZ company using CAPM.

(b) Calculate the weighted average cost of capital (WACC) of XYZ company.

(c) Compute the cash flow from assets for the project for each year.

(d) Assume that the average WACC for the telecommunications industry is 10%.

(i) Should XYZ Company use its WACC computed from (b) or the average WACC for the telecommunications industry to calculate the NPV of the project? Explain.

(ii) Using the appropriate WACC from part (i), calculate the NPV of the project and justify whether XYZ Company should undertake the project.

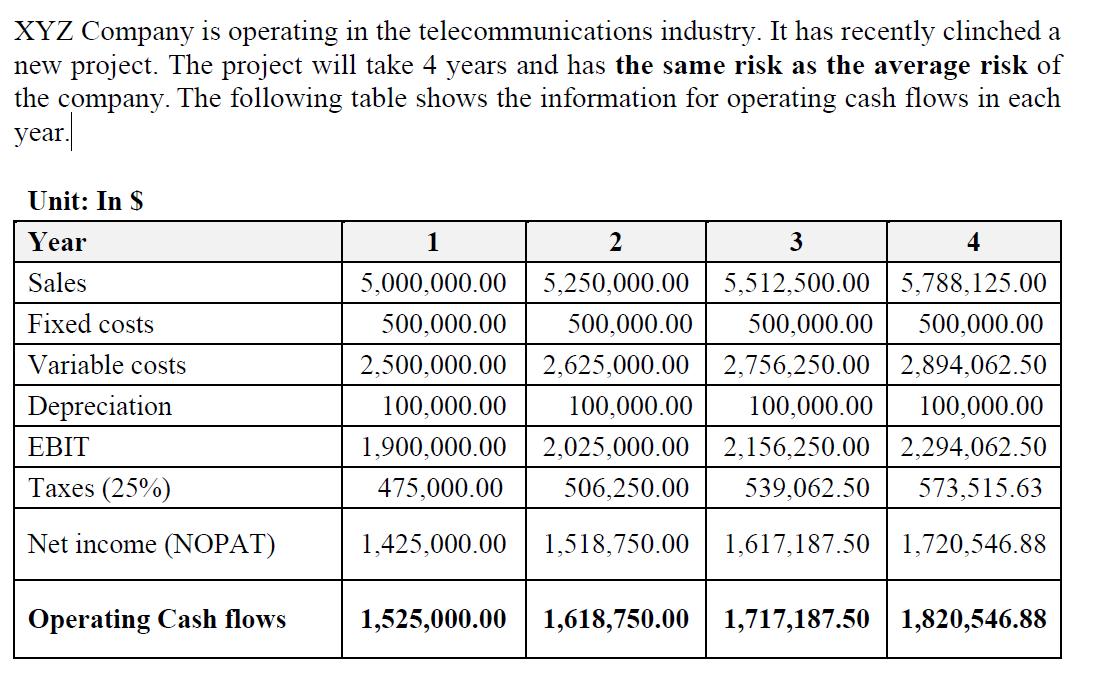

XYZ Company is operating in the telecommunications industry. It has recently clinched a new project. The project will take 4 years and has the same risk as the average risk of the company. The following table shows the information for operating cash flows in each year. Unit: In S Year Sales Fixed costs Variable costs Depreciation EBIT Taxes (25%) Net income (NOPAT) Operating Cash flows 1 2 3 4 5,000,000.00 5,250,000.00 5,512,500.00 5,788,125.00 500,000.00 500,000.00 500,000.00 500,000.00 2,625,000.00 2,756,250.00 2,894,062.50 2,500,000.00 100,000.00 1,900,000.00 100,000.00 100,000.00 100,000.00 2,025,000.00 2,156,250.00 2,294,062.50 506,250.00 539,062.50 573,515.63 475,000.00 1,425,000.00 1,518,750.00 1,617,187.50 1,720,546.88 1,525,000.00 1,618,750.00 1,717,187.50 1,820,546.88 XYZ Company is operating in the telecommunications industry. It has recently clinched a new project. The project will take 4 years and has the same risk as the average risk of the company. The following table shows the information for operating cash flows in each year. Unit: In S Year Sales Fixed costs Variable costs Depreciation EBIT Taxes (25%) Net income (NOPAT) Operating Cash flows 1 2 3 4 5,000,000.00 5,250,000.00 5,512,500.00 5,788,125.00 500,000.00 500,000.00 500,000.00 500,000.00 2,625,000.00 2,756,250.00 2,894,062.50 2,500,000.00 100,000.00 1,900,000.00 100,000.00 100,000.00 100,000.00 2,025,000.00 2,156,250.00 2,294,062.50 506,250.00 539,062.50 573,515.63 475,000.00 1,425,000.00 1,518,750.00 1,617,187.50 1,720,546.88 1,525,000.00 1,618,750.00 1,717,187.50 1,820,546.88

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Cost of Equity CoE The cost of equity CoE can be calculated using the Capital Asset Pricing Model CAPM The CAPM states that the expected return on a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started