Question

a. Calculate the degree of operating leverage, the degree of financial leverage, and the degree of combined leverage before expansion. (For the degree of operating

a. Calculate the degree of operating leverage, the degree of financial leverage, and the degree of combined leverage before expansion. (For the degree of operating leverage, use the formula: DOL = (S ? TVC) / (S ? TVC ? FC). For the degree of combined leverage, use the formula: DCL = (S ? TVC) / (S ? TVC ? FC ? I). These instructions apply throughout this problem.) (Round your answers to 2 decimal places.)

b. Construct the income statement for the two alternative financing plans. (Round EPS to 2 decimal places.)

c. Calculate the degree of operating leverage, the degree of financial leverage, and the degree of combined leverage, after expansion. (Round your answers to 2 decimal places.)

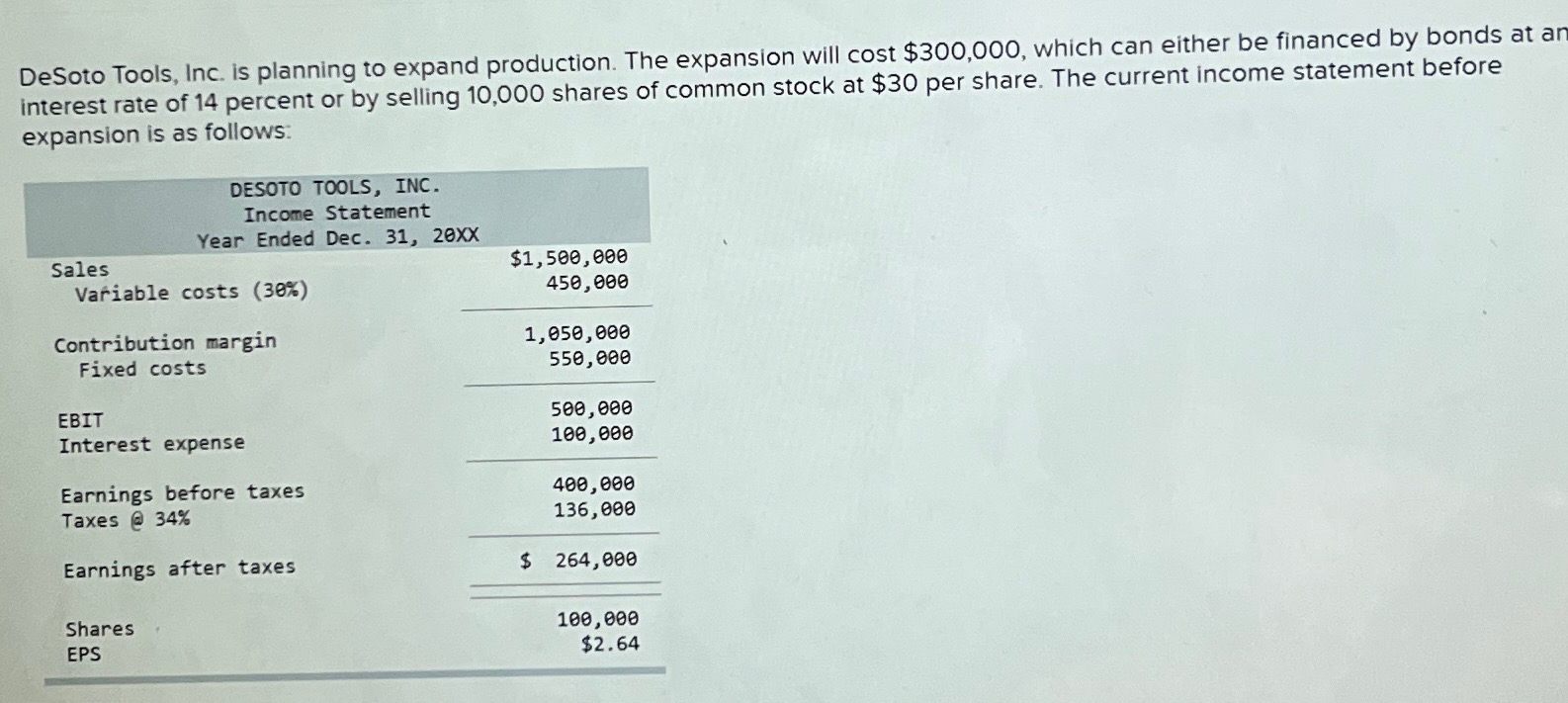

DeSoto Tools, Inc. is planning to expand production. The expansion will cost $300,000, which can either be financed by bonds at an interest rate of 14 percent or by selling 10,000 shares of common stock at $30 per share. The current income statement before expansion is as follows: DESOTO TOOLS, INC. Income Statement Year Ended Dec. 31, 20XX Sales $1,500,000 Variable costs (30%) 450,000 Contribution margin 1,050,000 Fixed costs 550,000 EBIT Interest expense Earnings before taxes Taxes @ 34% Earnings after taxes Shares EPS $ 264,000 100,000 $2.64 500,000 100,000 400,000 136,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started