Answered step by step

Verified Expert Solution

Question

1 Approved Answer

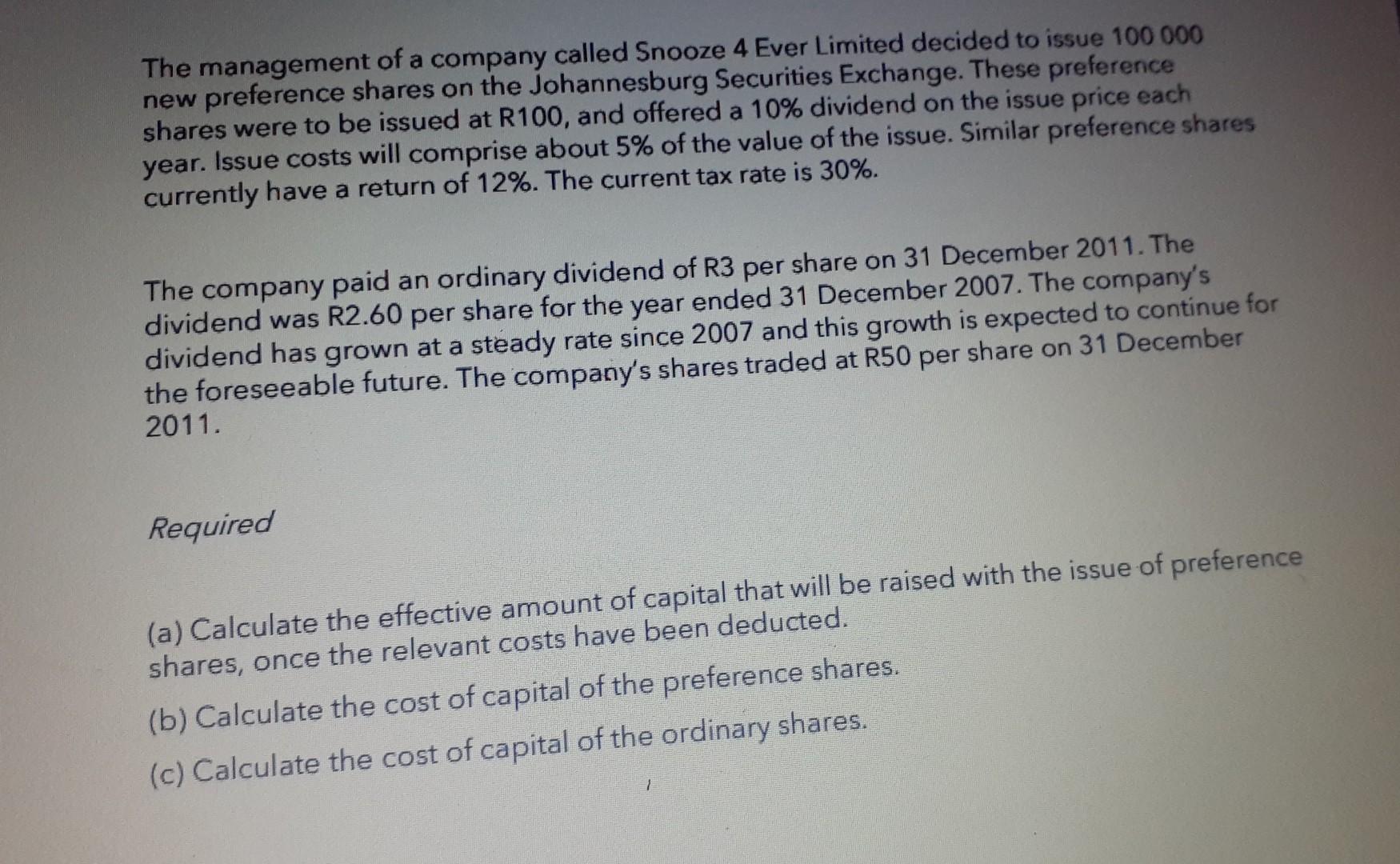

a) calculate the effective amount of capital that will be raised with the issue of preference shares, once the relevant costs have been deducted. b)

a) calculate the effective amount of capital that will be raised with the issue of preference shares, once the relevant costs have been deducted.

b) calculate the cost of capital pf the preference shares

c) calculate the cost of capital of the ordinary shares

The management of a company called Snooze 4 Ever Limited decided to issue 100000 new preference shares on the Johannesburg Securities Exchange. These preference shares were to be issued at R100, and offered a 10% dividend on the issue price each year. Issue costs will comprise about 5% of the value of the issue. Similar preference shares currently have a return of 12%. The current tax rate is 30%. The company paid an ordinary dividend of R3 per share on 31 December 2011. The dividend was R2.60 per share for the year ended 31 December 2007. The company's dividend has grown at a steady rate since 2007 and this growth is expected to continue for the foreseeable future. The company's shares traded at R50 per share on 31 December 2011. Required (a) Calculate the effective amount of capital that will be raised with the issue of preference shares, once the relevant costs have been deducted. (b) Calculate the cost of capital of the preference shares. (c) Calculate the cost of capital of the ordinary sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started