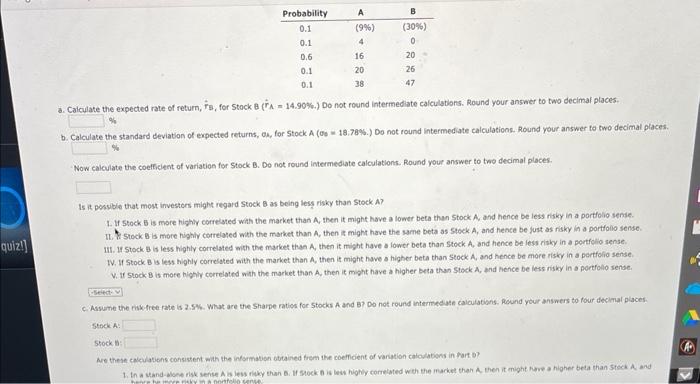

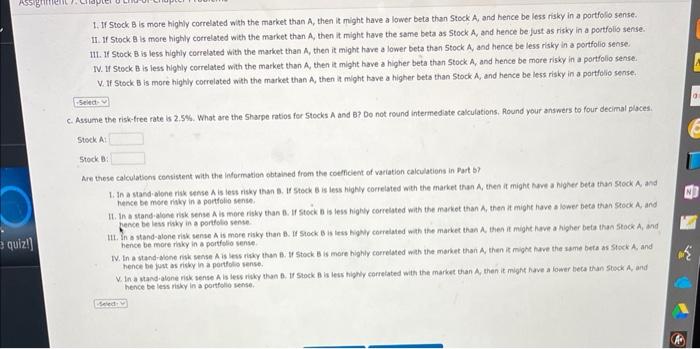

a. Calculate the expected rate of return, B, for 5 tock 8 ( A=14.90%.) Do not round intermediate calculations. Round your answer to two decimal places. of b. Calculate the standard deviation of expected returns, of, for 5 tock A (os =18;78%.) Do not round intermediate calculations. Round your answer to two decimal places. Now calculate the coeffelent of yariation for Stock B. Do not round intermediate calculations. Round yout answer to two decimal places. Is it posvible that most investors might regard Stock B as being less risky than Stock A? II. F Stock 8 is miore highty cotrelated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfoilo sense. 111. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfclio sense. IV. If stock B is less highly correlsted with the market than A, then it might have a higher beta than Stock A, and hence be more risty in a portfolio sense. V. if Slock B is mote highly coerelated with the market than A, then it might have a higher beta than Stock A, and hence be less nisky in a portfolio sense. ci. Assume the riskefree rate is 2.5%. What are the sharpe ratios for 5 tocks A and B? Do not round intermedate calculations. Rownd your answers to four decimal places. stock A: Are these calculations consisent with the information obtained frem the coeffient of variation caloylabises in fart b? 1. If Stock, B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. If If 5 tock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolis sense: 111. If Stock B is less highly coerelated with the market than A, thea it might have a lower beta than 5 tock A and hence be less risky in a portfolio sense. W. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. V. If Stock B is more highly correlated with the market than A, then it might have a higher bets than stock A; and hence be less risky in a partfolio sense. c. Assume the risk-free rate is 2.5%. What are the Sharpe ratios fer 5 tocks A and B? Do not round intermediate calculations. Round your answers to four decimal places. Steck A: stock B2 Are those calculaticos consistent with the information obtained from the cotflicient of variation calculations in Part b? 1. In a sand alone risk sense A is less risky than B. If Steck 6 is less highly correlated aith the market than A, then it might heve a higher beta than Sock A, and hence be more risky in a portiolio sense. gence be less risky in a portfolia sense III. In s stand-alone risk tense A is more risky than 8 . If Stock B is litis higkiy correlated wath the market than A, then it might hive a higher beta than 5 tock A, and hence be more rinky in a portfolio sense. W. In a stand-alone mik sense A is less rikky than B. If Stock. B is more highly correlated wath the merket than A, then it might hime the same bete as Stock A. and hence be just as risky in a portolis sense. V. In a sandialone rick sense A is lews rikky than B. if 5 tock B is less highy corretated with the market than A, then it might have a lower beca than 5 tock A, and hence be less risky in a portfolio sense