Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Calculate the following ratios for all the periods and the year 1. NPM 2. Equity Capital Turnover 3. Return on equity Capital 4 DEPS

A. Calculate the following ratios for all the periods and the year

Calculate the following ratios for all the periods and the year

1. NPM 2. Equity Capital Turnover 3. Return on equity Capital 4 DEPS growth

B.Calculate the following ratios (Q Dec 18/Q Dec 17) and (9 months Dec 18/ 9 months Dec 17)

1 .Total income growth 2. PAT growth 3. DEPS growth

C. Analysis of performance

1. During the third quarter

2 Up to the 3rd quarter

D. Outlook for the full year 2018-19 beyond

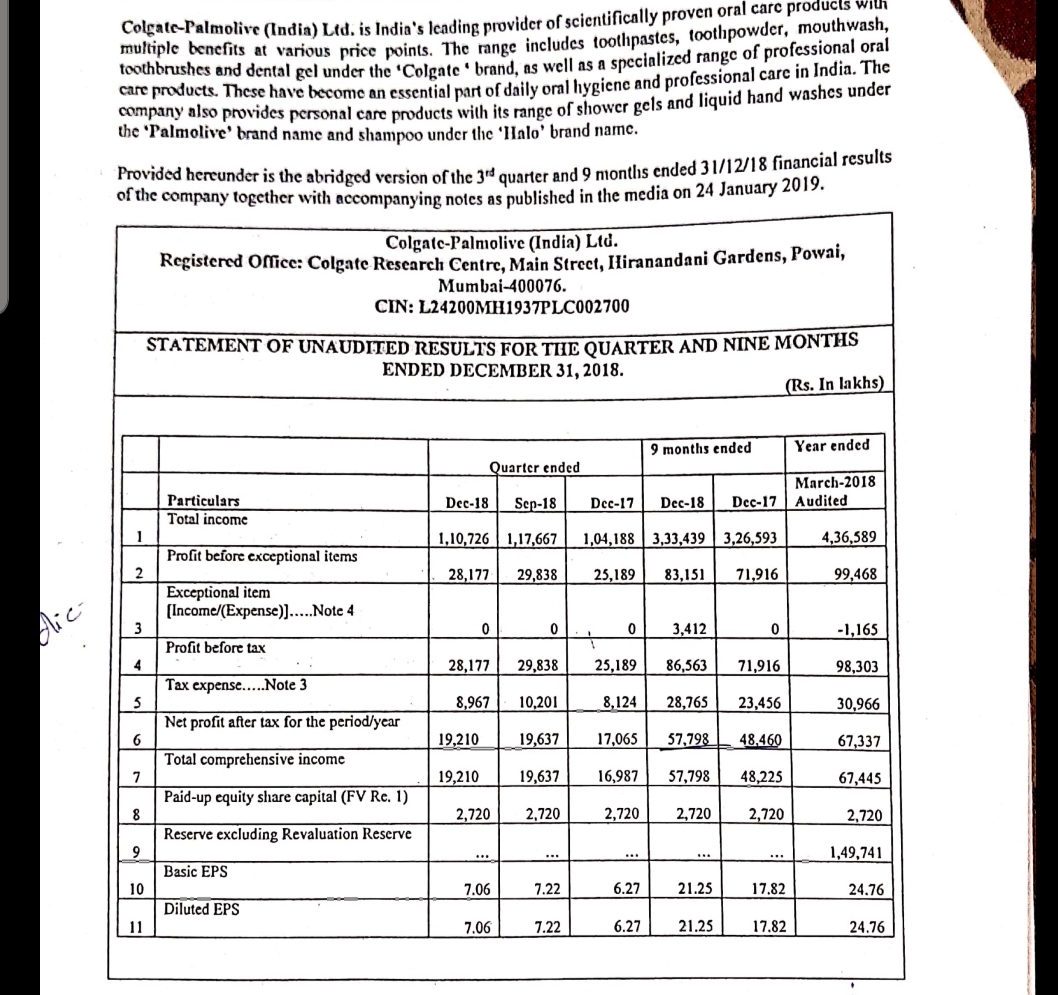

Colgate-Palmolive (India) Ltd. is India's leading provider of scientifica multiple benefits at various price points. The range dia) Ltd. is India's Icading provider of scientifically proven oral care producls with s at various price points. The range includes toothpastes, toothpowder, mouthwash, toothbnishes and dental gel under the 'Colgate brand, as well as a spee care products. These have become an essential part of daily oral the 'Colgate brand, as well as a specialized range of professional oral company also provides personal care products with its range of s come an essential part of daily oral hygiene and professional care in India. The the 'Palmolive' brand name and shampoo under the 'Ilalo' brand name. sonal care products with its range of shower gels and liquid hand washes under Provided hereunder is the abridged version of the 3 quarter and y of the company together with accompanying notes as published in the media on 4 abndged version of the 3rd quarter and 9 months ended 31/12/18 financial results oles as published in the media on 24 January 2019. Colgate-Palmolive (India) Ltd. vilice: Colgate Research Centre, Main Street, Iliranandani Gardens, Powaly Mumbai-400076. CIN: L24200MH1937PLC002700 STATEMENT OF UNAUDITED RESULTS FOR TID OUARTER AND NINE MONTHS ENDED DECEMBER 31, 2018. (Rs. In lakhs) 9 months ended Year ended Quarter ended Particulars Total income Dec-18 Sep-18 Dec-17 March-2018 Dec-17 Audited Dec-18 1,10,126. 1,17,667 1,04,188 | 3.33,439 | 3,26,593_4,36,589 Profit before exceptional items 28,177 29,838 25,189 83,151 71,916 99,468 Exceptional item [Income/Expense)).....Note 4 -1,165 Profit before tax 0 , 0 29,838 | 25,189 | 28,177 98,303 Tax expense.....Note 3 8,967 10,201 8,124 3,412 0 86,563 | 71,916 | 28,765 23,456 57,798 48,460 57,798 48,225 30,966 Net profit after tax for the period/year 19,210 19,637 17,065 67,337 Total comprehensive income 19,210 19,637 16,987 67,445 Paid-up equity share capital (FV Re. 1) 2,720 2,720 2,720 2,720 2,720 2,720 Reserve excluding Revaluation Reserve 1,49,741 Basic EPS 10 24.76 Diluted EPS 7.06 7.06 7.22 7.22 6.27 6.27 21.25 21.25 17.82 | 17.82 24.76Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started