Question

a. Calculate the following ratios: i. Profitability ratios - Return on Capital Employed, Return on Equity, Gross profit margin and Net profit margin ii. Long-term

a. Calculate the following ratios:

i. Profitability ratios - Return on Capital Employed, Return on Equity, Gross profit margin and Net profit margin

ii. Long-term solvency and stability - Debt/Asset ratio, Gearing ratio, and Interest cover

iii. Short-term solvency and liquidity – Current ratio and Acid test ratio

iv. Efficiency (turnover ratios) – Account receivable collection period, Account payable payment period, Inventory turnover (times)

b. Prepare a report addressed to the Chief Executive Officer, assessing the relative performance and financial position of Glory Ltd for the year ended 31st December 2018

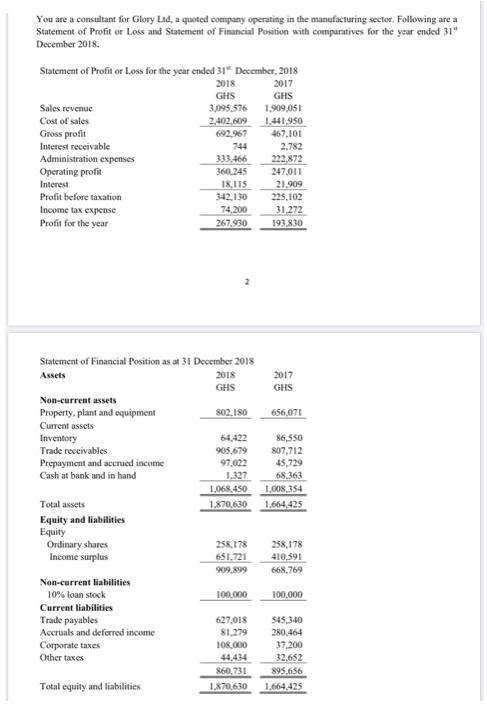

You are a consultant for Glory Ltd, a quoted company operating in the manufacturing sector. Following are a Statement of Profit or Loss and Statement of Financial Position with comparatives for the year ended 31" December 2018. Statement of Profit or Loss for the year ended 31 December, 2018 2018 2017 GHS GHS 3,095,576 1,909,051 1,441,950 467,101 2,782 222,872 247,011 21,909 Sales revenue Cost of sales Gross profit Interest receivable Administration expenses Operating profit Interest Profit before taxation Income tax expense Profit for the year Non-current assets Property, plant and equipment Current assets Statement of Financial Position as at 31 December 2018 Assets Inventory Trade receivables Prepayment and accrued income Cash at bank and in hand Total assets Equity and liabilities Equity Ordinary shares Income surplus Non-current liabilities 10% loan stock Current liabilities Trade payables Accruals and deferred income Corporate taxes Other taxes 2,402,609 692,967 744 333,466 360,245 Total equity and liabilities 18,115 342,130 74,200 267,930 2018 GHS 802,180 64,422 905,679 97,022 1.327 1,068,450 1,870,630 258,178 651.721 909,899 100,000 225,102 31,272 193,830 2017 GHS 656,071 86,550 807,712 45,729 68,363 1,008,354 1,664,425 258,178 410.591 668,769 100,000 627,018 545,340 81,279 280,464 108,000 37,200 44,434 32,652 860,731 895.656 1,870,630 1,664,425

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION The above questions can be solved sequentially ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started