Question

A. Calculate the Internal rate of return and net present value for the above project. Critically evaluate the results and decide whether you should invest

A. Calculate the Internal rate of return and net present value for the above project. Critically evaluate the results and decide whether you should invest based on the two methods used for evaluating. Threshold limit for IRR is 15%.

B. Critically compare the principles of the IRR and net present value methods including their advantages and disadvantages. Relate the answer to the above case (250 words )

C. The projects in the above case is independent. Which technique would you prefer out of NPV and IRR if the projects were independent projects and why?( 300 words)

D. Using the above example, explain why payback period is not a preferred method

2. Explain Nominal and real interest rates in 200 words.and Extract the rate of inflation for Ethiopia, Iran, Zambia, Uzbekistan and Haiti. Calculate the real interest rate by Fisher method in the above 5 countries if the nominal interest rate in all the above countries is 30%. Please mention the source of information.

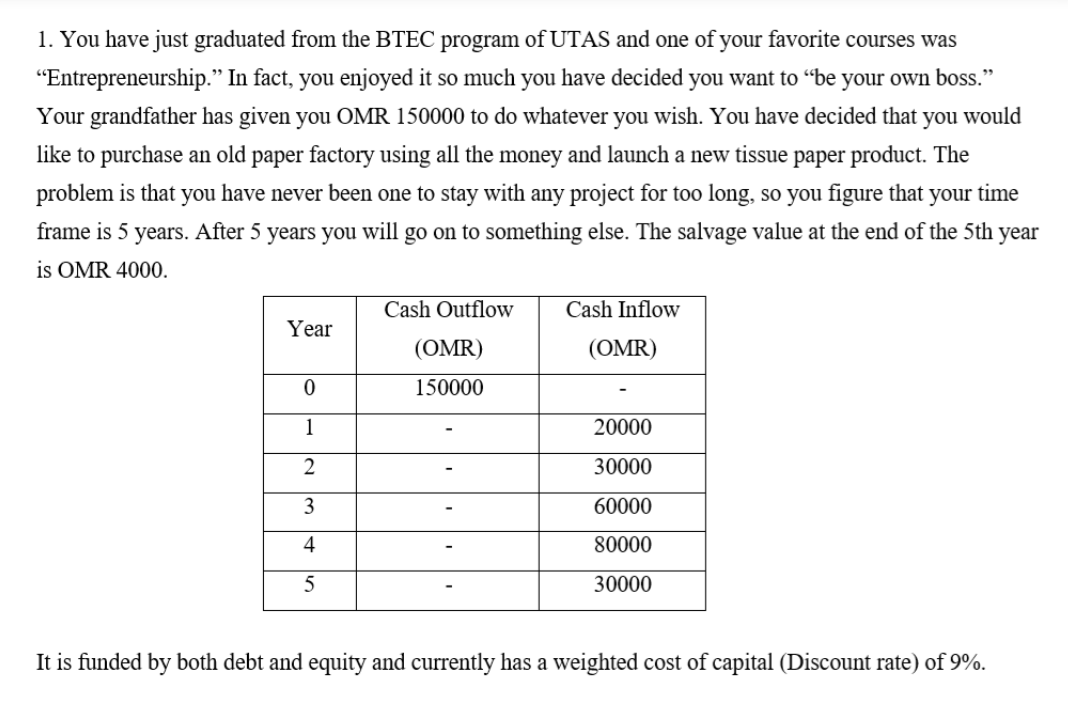

1. You have just graduated from the BTEC program of UTAS and one of your favorite courses was Entrepreneurship. In fact, you enjoyed it so much you have decided you want to be your own boss. Your grandfather has given you OMR 150000 to do whatever you wish. You have decided that you would like to purchase an old paper factory using all the money and launch a new tissue paper product. The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 5 years. After 5 years you will go on to something else. The salvage value at the end of the 5th year is OMR 4000. Cash Outflow Cash Inflow Year (OMR) (OMR) 0 150000 1 20000 2 30000 3 60000 4 80000 5 30000 It is funded by both debt and equity and currently has a weighted cost of capital (Discount rate) of 9%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started