Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a). calculate the market risk premium. b). what does a beta of 1.40 inform shareholder about the risk of Sam Enterprises? c). Explain the ways

a). calculate the market risk premium.

b). what does a beta of 1.40 inform shareholder about the risk of Sam Enterprises?

c). Explain the ways to find risk free rate of return, market risk premium and security risk premium when you are given any security market line diagram.

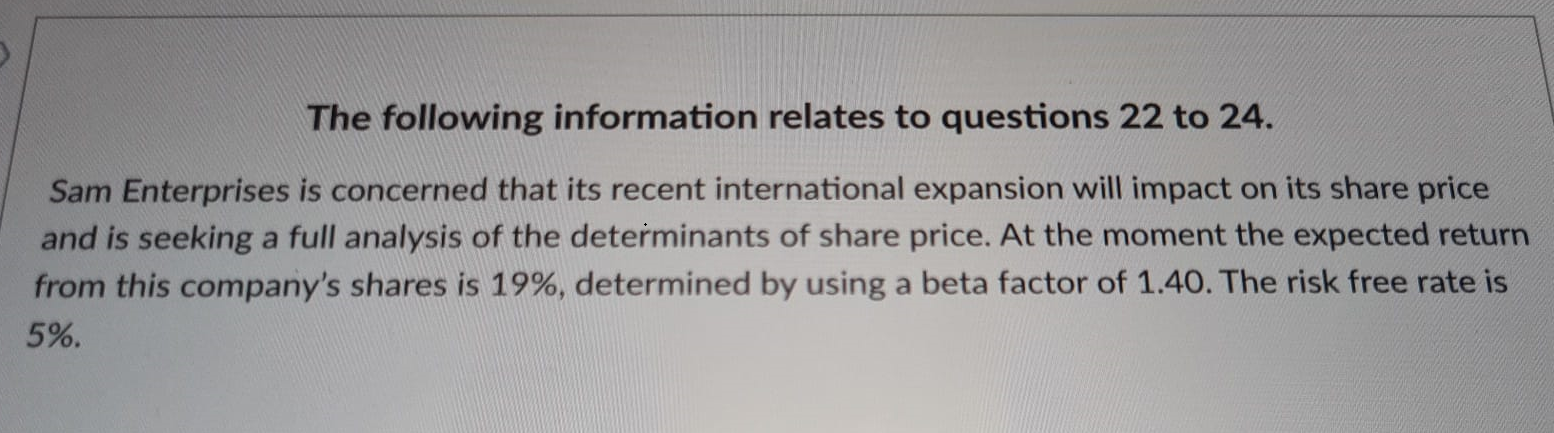

The following information relates to questions 22 to 24 . Sam Enterprises is concerned that its recent international expansion will impact on its share price and is seeking a full analysis of the determinants of share price. At the moment the expected return from this company's shares is 19%, determined by using a beta factor of 1.40. The risk free rate is 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started