Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Calculate the payoff at expiration of calls and puts on the stock index in which the underlying price is 6,601.19 when the options expire.

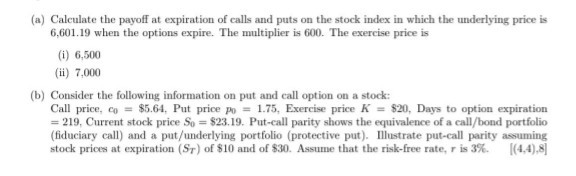

(a) Calculate the payoff at expiration of calls and puts on the stock index in which the underlying price is 6,601.19 when the options expire. The multiplier is 600. The exercise price is (i) 6,500 (ii) 7.000 (b) Consider the following information on put and call option on a stock: Call price, co = $5.64. Put price po = 1.75. Exercise price K = $20 Days to option expiration = 219. Current stock price So = $23.19. Put-call parity shows the equivalence of a call/bond portfolio (fiduciary call) and a put/underlying portfolio (protective put). Illustrate put-call parity assuming stock prices at expiration (Sr) of $10 and of $30. Assume that the risk-free rate, r is 3%. |(4.4),81

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started