Answered step by step

Verified Expert Solution

Question

1 Approved Answer

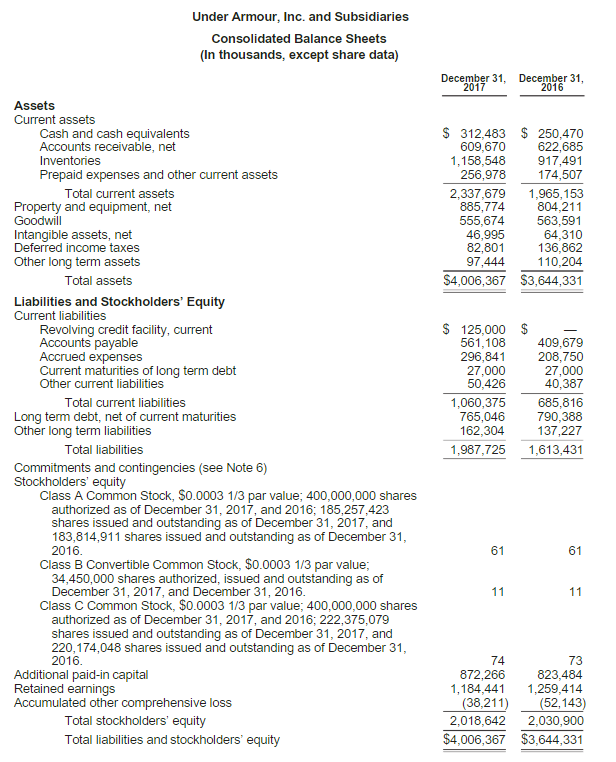

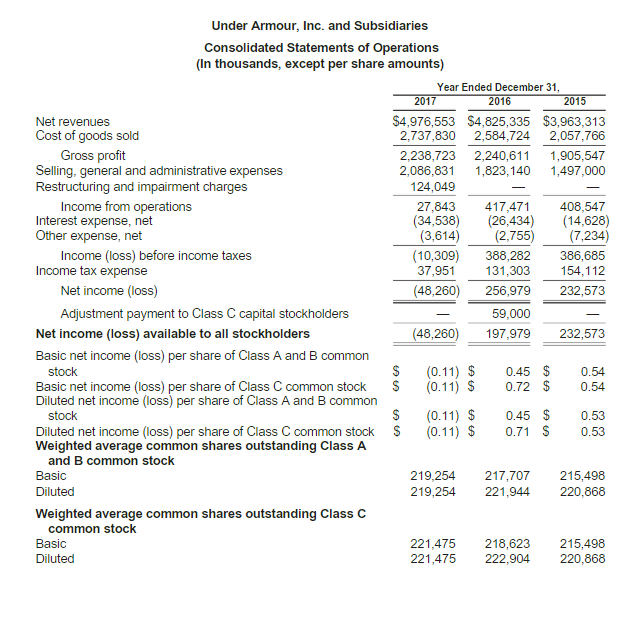

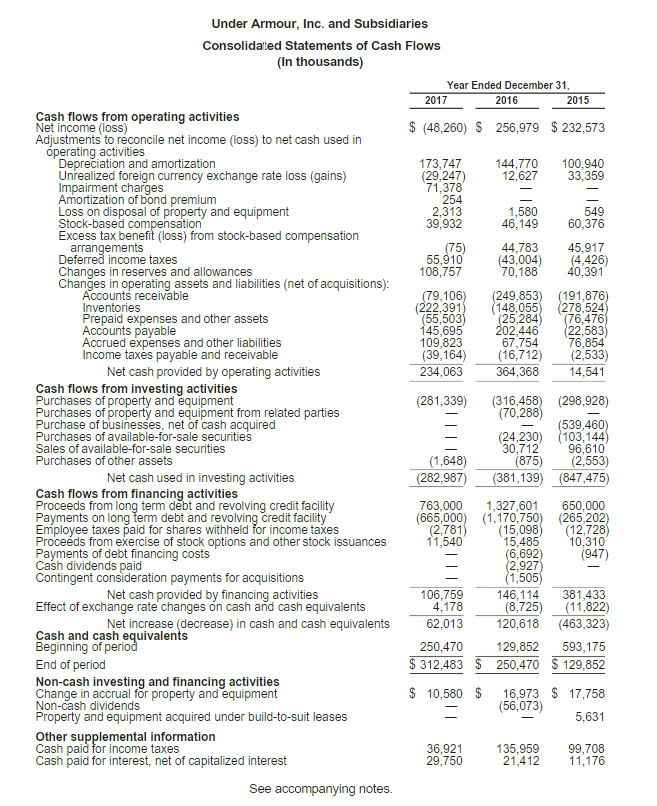

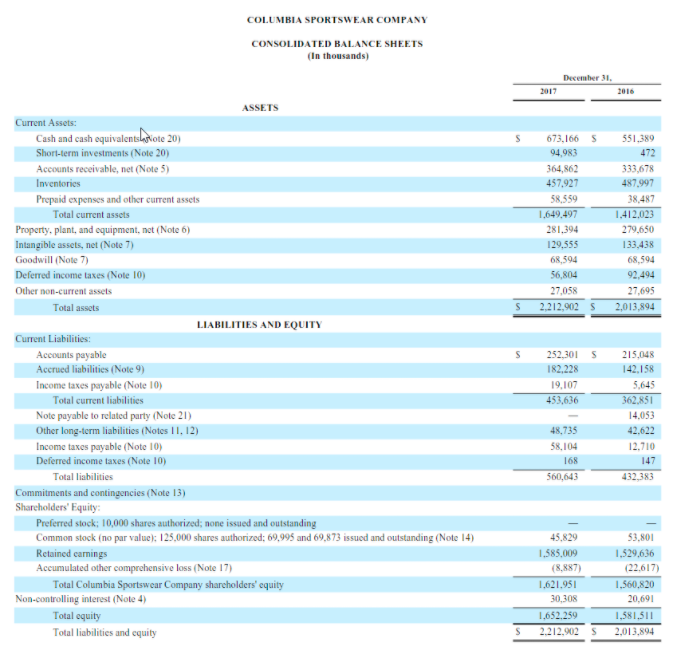

a. Calculate the return on common stockholders equity for each company for 2017. (round to 2 decimals) Columbia _______% Under Armour _______ % b. Calculate

a. Calculate the return on common stockholders equity for each company for 2017. (round to 2 decimals)

Columbia _______%

Under Armour _______ %

b. Calculate the dividend payout ratio for each company for 2017 (round to 1 decimal)

Columbia _______%

Under Armour _____%

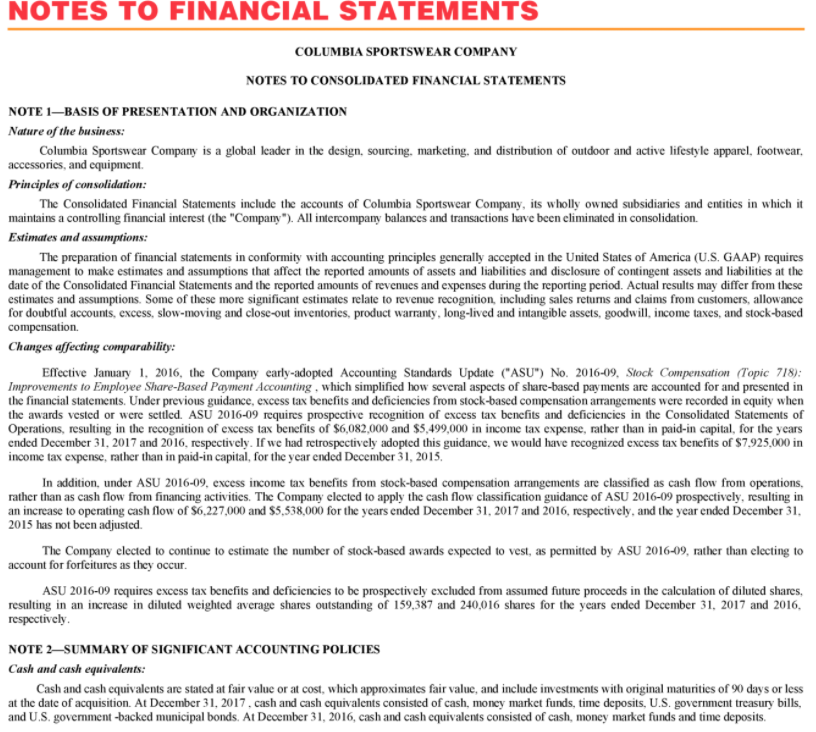

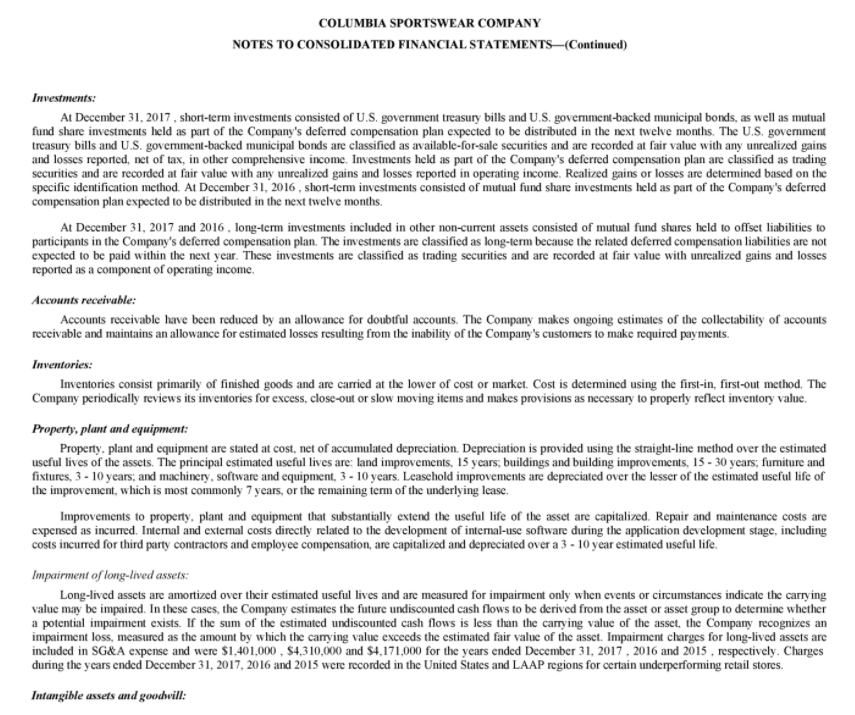

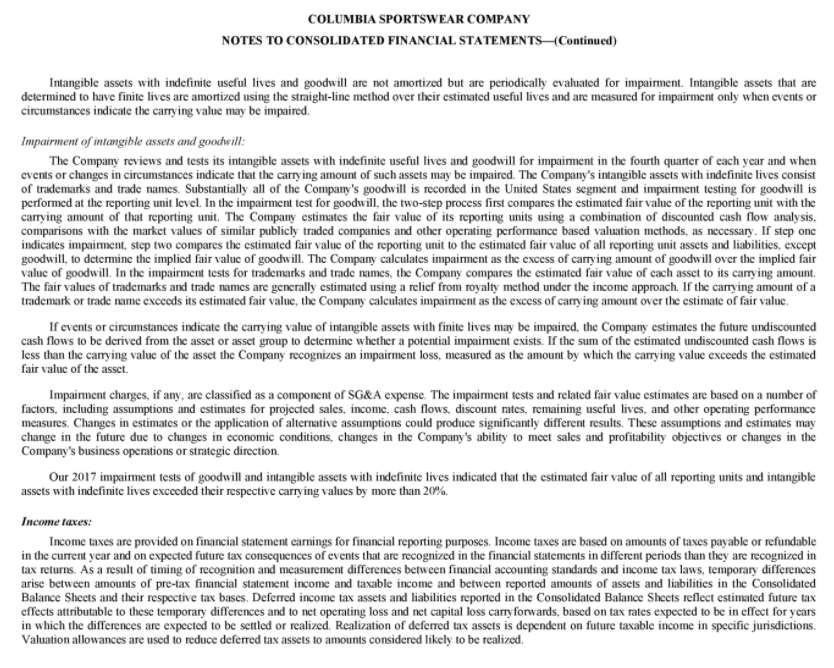

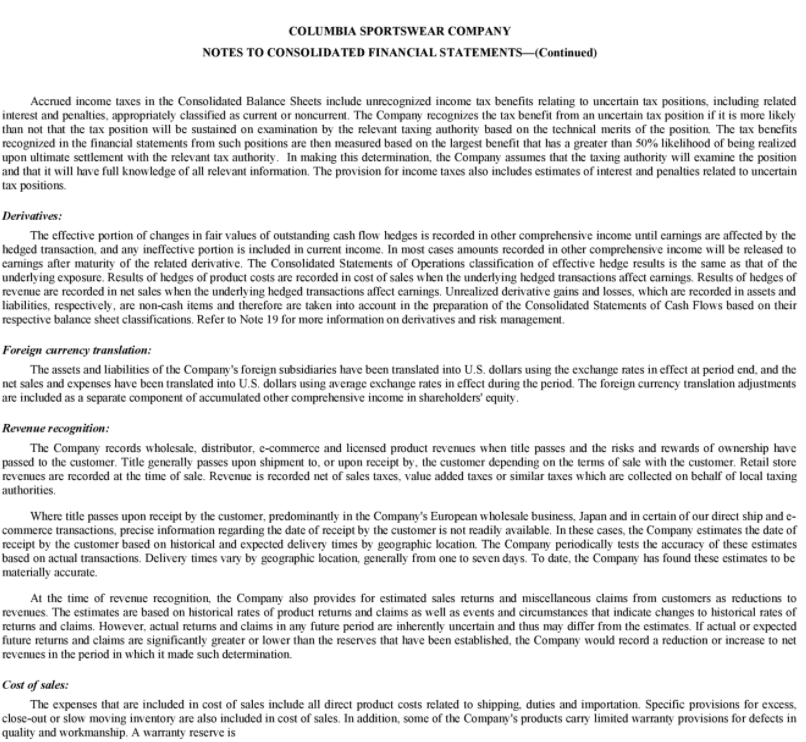

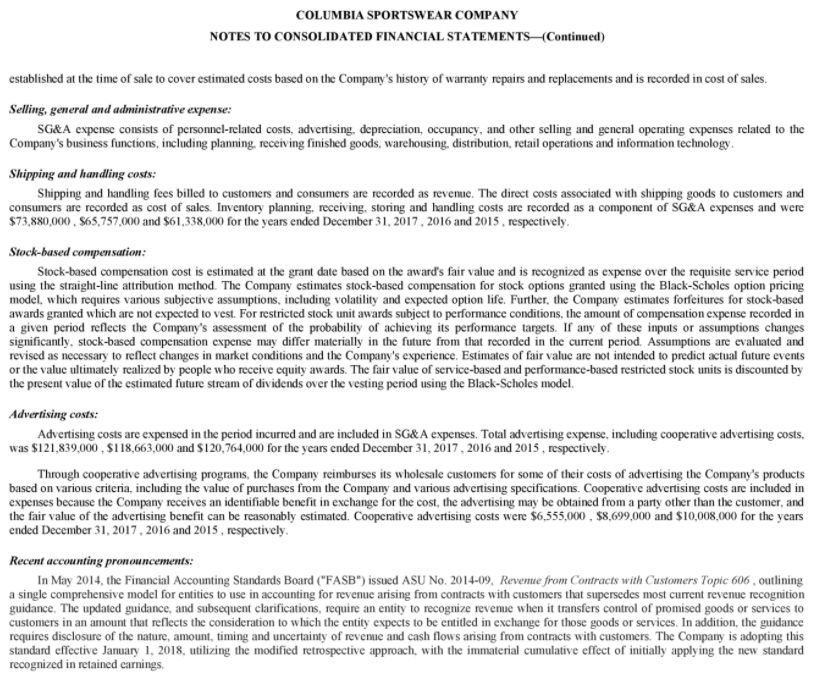

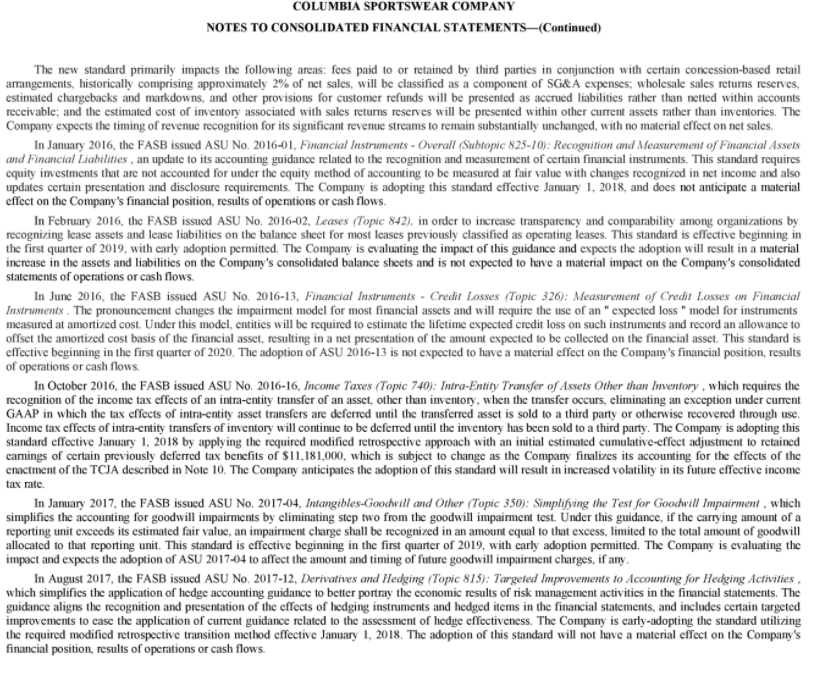

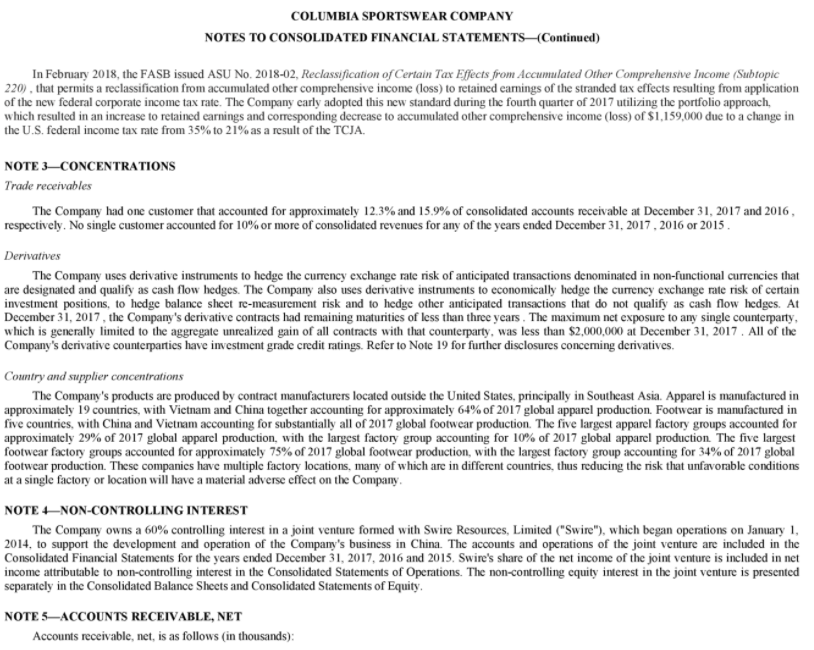

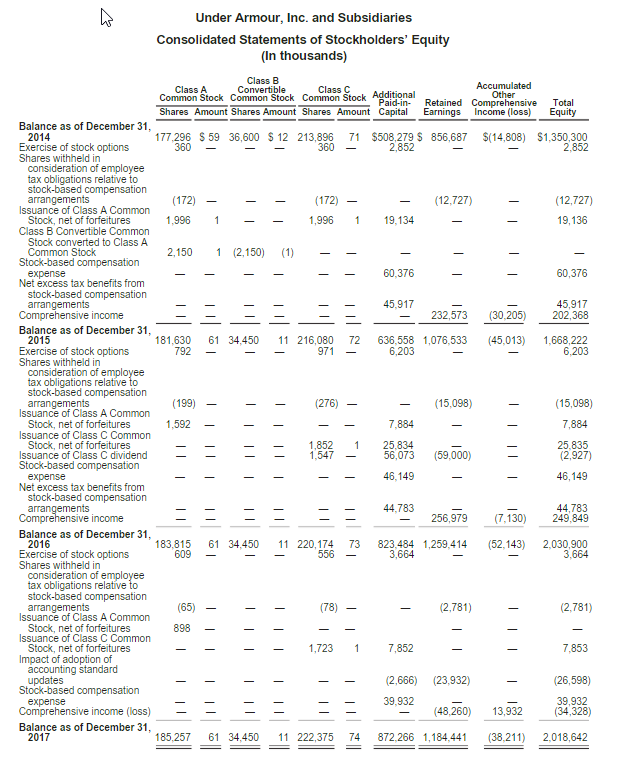

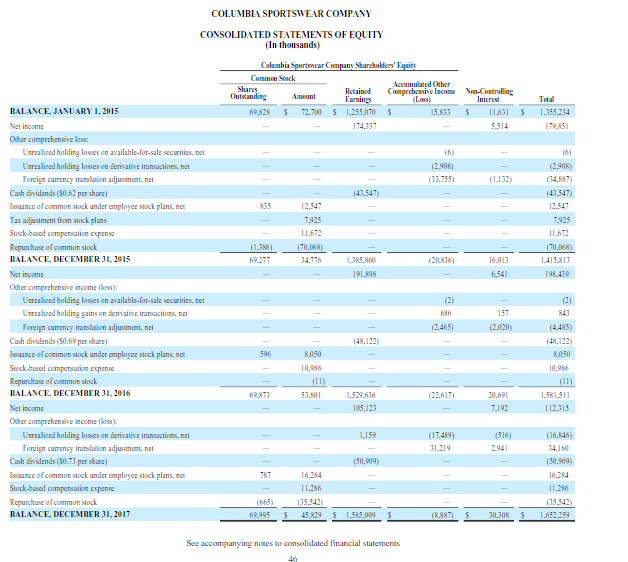

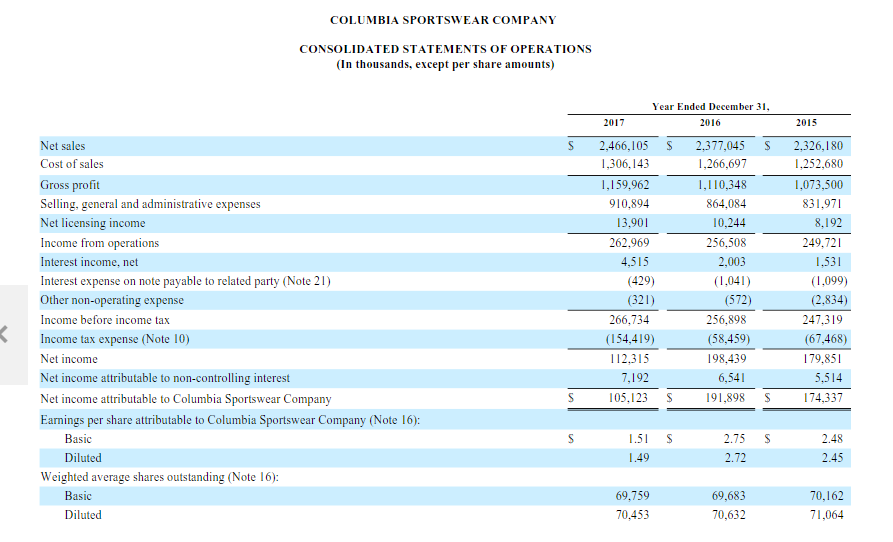

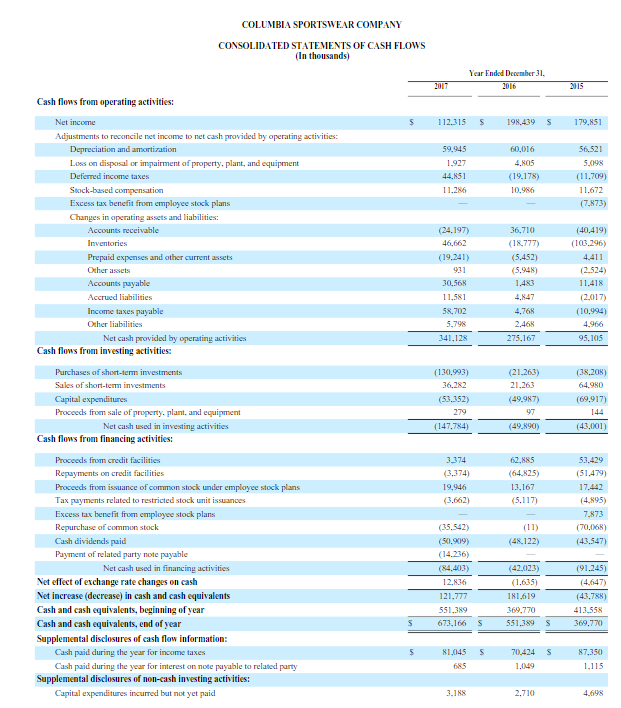

NOTES TO FINANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 1BASIS OF PRESENTATION AND ORGANIZATION Nature of the business: Columbia Sportswear Company is a global leader in the design, sourcing, marketing, and distribution of outdoor and active lifestyle apparel, footwear, accessories, and equipment Principles of consolidation: The Consolidated Financial Statements include the accounts of Columbia Sportswear Company, its wholly owned subsidiaries and entities in which it maintains a controlling financial interest (the "Company"). All intercompany balances and transactions have been eliminated in consolidation. Estimates and assumptions: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Consolidated Financial Statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from these estimates and assumptions. Some of these more significant estimates relate to revenue recognition, including sales returns and claims from customers, allowance for doubtful accounts, excess, slow-moving and close-out inventories, product warranty, long-lived and intangible assets, goodwill, income taxes, and stock-based compensation Changes affecting comparability: Effective January 1, 2016, the Company early-adopted Accounting Standards Update ("ASU") No. 2016-09, Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting, which simplified how several aspects of share-based payments are accounted for and presented in the financial statements. Under previous guidance, excess tax benefits and deficiencies from stock-based compensation arrangements were recorded in equity when the awards vested or were settled. ASU 2016-09 requires prospective recognition of excess tax benefits and deficiencies in the Consolidated Statements of Operations, resulting in the recognition of excess tax benefits of $6,082,000 and $5,499,000 in income tax expense, rather than in paid-in capital, for the years ended December 31, 2017 and 2016, respectively. If we had retrospectively adopted this guidance, we would have recognized excess tax benefits of $7.925,000 in income tax expense, rather than in paid-in capital, for the year ended December 31, 2015, In addition, under ASU 2016-09, excess income tax benefits from stock-based compensation arrangements are classified as cash flow from operations, rather than as cash flow from financing activities. The Company elected to apply the cash flow classification guidance of ASU 2016-09 prospectively, resulting in an increase to operating cash flow of $6,227,000 and $5,538,000 for the years ended December 31, 2017 and 2016, respectively, and the year ended December 31, 2015 has not been adjusted. The Company elected to continue to estimate the number of stock-based awards expected to vest, as permitted by ASU 2016-09, rather than electing to account for forfeitures as they occur. ASU 2016-09 requires excess tax benefits and deficiencies to be prospectively excluded from assumed future proceeds in the calculation of diluted shares, resulting in an increase in diluted weighted average shares outstanding of 159,387 and 240,016 shares for the years ended December 31, 2017 and 2016, respectively NOTE 2SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Cash and cash equivalents: Cash and cash equivalents are stated at fair value or at cost, which approximates fair value, and include investments with original maturities of 90 days or less at the date of acquisition. At December 31, 2017. cash and cash equivalents consisted of cash, money market funds, time deposits, U.S. government treasury bills, and U.S. government-backed municipal bonds. At December 31, 2016, cash and cash equivalents consisted of cash, money market funds and time deposits. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) Investments: At December 31, 2017, short-term investments consisted of U.S. government treasury bills and U.S. government-backed municipal bonds, as well as mutual fund share investments held as part of the Company's deferred compensation plan expected to be distributed in the next twelve months. The U.S. government treasury bills and U.S. govemment-backed municipal bonds are classified as available-for-sale securities and are recorded at fair value with any unrealized gains and losses reported, net of tax, in other comprehensive income. Investments held as part of the Company's deferred compensation plan are classified as trading securities and are recorded at fair value with any unrealized gains and losses reported in operating income. Realized gains or losses are determined based on the specific identification method. At December 31, 2016, short-term investments consisted of mutual fund share investments held as part of the Company's deferred compensation plan expected to be distributed in the next twelve months. At December 31, 2017 and 2016, long-term investments included in other non-current assets consisted of mutual fund shares held to offset liabilities to participants in the Company's deferred compensation plan. The investments are classified as long-term because the related deferred compensation liabilities are not expected to be paid within the next year. These investments are classified as trading securities and are recorded at fair value with unrealized gains and losses reported as a component of operating income. Accounts receivable: Accounts receivable have been reduced by an allowance for doubtful accounts. The Company makes ongoing estimates of the collectability of accounts receivable and maintains an allowance for estimated losses resulting from the inability of the Company's customers to make required payments. Inventories: Inventories consist primarily of finished goods and are carried at the lower of cost or market. Cost is determined using the first-in, first-out method. The Company periodically reviews its inventories for excess, close-out or slow moving items and makes provisions as necessary to properly reflect inventory value. Property, plant and equipment: Property, plant and equipment are stated at cost, net of accumulated depreciation. Depreciation is provided using the straight-line method over the estimated useful lives of the assets. The principal estimated useful lives are: land improvements, 15 years, buildings and building improvements, 15 - 30 years, furniture and fixtures, 3 - 10 years, and machinery, software and equipment, 3 - 10 years. Leasehold improvements are depreciated over the lesser of the estimated useful life of the improvement, which is most commonly 7 years, or the remaining term of the underlying lease. Improvements to property, plant and equipment that substantially extend the useful life of the asset are capitalized. Repair and maintenance costs are expensed as incurred. Internal and external costs directly related to the development of internal-use software during the application development stage, including costs incurred for third party contractors and employee compensation, are capitalized and depreciated over a 3 - 10 year estimated useful life. Impairment of long-lived assets: Long-lived assets are amortized over their estimated useful lives and are measured for impairment only when events or circumstances indicate the carrying value may be impaired. In these cases, the Company estimates the future undiscounted cash flows to be derived from the asset or asset group to determine whether a potential impairment exists. If the sum of the estimated undiscounted cash flows is less than the carrying value of the asset, the Company recognizes an impairment loss, measured as the amount by which the carrying value exceeds the estimated fair value of the asset. Impairment charges for long-lived assets are included in SG&A expense and were $1,401,000 $4,310,000 and $4,171,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Charges during the ycars ended December 31, 2017, 2016 and 2015 were recorded in the United States and LAAP regions for certain underperforming retail stores. Intangible assets and goodwill: COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTSContinued) Intangible assets with indefinite useful lives and goodwill are not amortized but are periodically evaluated for impairment. Intangible assets that are determined to have finite lives are amortized using the straight-line method over their estimated useful lives and are measured for impairment only when events or circumstances indicate the carrying value may be impaired. Impairment of intangible assets and goodwill: The Company reviews and tests its intangible assets with indefinite useful lives and goodwill for impairment in the fourth quarter of each year and when events or changes in circumstances indicate that the carrying amount of such assets may be impaired. The Company's intangible assets with indefinite lives consist of trademarks and trade names. Substantially all of the Company's goodwill is recorded in the United States segment and impairment testing for goodwill is performed at the reporting unit level. In the impairment test for goodwill , the two-step process first compares the estimated fair value of the reporting unit with the carrying amount of that reporting unit. The Company estimates the fair value of its reporting units using a combination of discounted cash flow analysis, comparisons with the market values of similar publicly traded companies and other operating performance based valuation methods, as necessary. If step one indicates impaiment, step two compares the estimated fair value of the reporting unit to the estimated fair value of all reporting unit assets and liabilities, except goodwill, to determine the implied fair value of goodwill. The Company calculates impairment as the excess of carrying amount of goodwill over the implied fair value of goodwill. In the impairment tests for trademarks and trade names, the Company compares the estimated fair value of each asset to its carrying amount The fair values of trademarks and trade names are generally estimated using a relief from royalty method under the income approach. If the carrying amount of a trademark or trade name exceeds its estimated fair value, the Company calculates impairment as the excess of carrying amount over the estimate of fair value. If events or circumstances indicate the carrying value of intangible assets with finite lives may be impaired, the Company estimates the future undiscounted cash flows to be derived from the asset or asset group to determine whether a potential impairment exists. If the sum of the estimated undiscounted cash flows is less than the carrying value of the asset the Company recognizes an impairment loss, measured as the amount by which the carrying value exceeds the estimated fair value of the asset Impairment charges, if any, are classified as a component of SG&A expense. The impairment tests and related fair value estimates are based on a number of factors, including assumptions and estimates for projected sales, income, cash flows, discount rates, remaining useful lives, and other operating performance measures. Changes in estimates or the application of alternative assumptions could produce significantly different results. These assumptions and estimates may change in the future due to changes in economic conditions, changes in the Company's ability to meet sales and profitability objectives or changes in the Company's business operations or strategic direction Our 2017 impairment tests of goodwill and intangible assets with indefinite lives indicated that the estimated fair value of all reporting units and intangible assets with indefinite lives exceeded their respective carrying values by more than 20%. Income taxes: Income taxes are provided on financial statement earnings for financial reporting purposes. Income taxes are based on amounts of taxes payable or refundable in the current year and on expected future tax consequences of events that are recognized in the financial statements in different periods than they are recognized in tax returns. As a result of timing of recognition and measurement differences between financial accounting standards and income tax laws, temporary differences arise between amounts of pre-tax financial statement income and taxable income and between reported amounts of assets and liabilities in the Consolidated Balance Sheets and their respective tax bases. Deferred income tax assets and liabilities reported in the Consolidated Balance Sheets reflect estimated future tax effects attributable to these temporary differences and to net operating loss and net capital loss carryforwards, based on tax rates expected to be in effect for years in which the differences are expected to be settled or realized. Realization of deferred tax assets is dependent on future taxable income in specific jurisdictions Valuation allowances are used to reduce deferred tax assets to amounts considered likely to be realized. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) Accrued income taxes in the Consolidated Balance Sheets include unrecognized income tax benefits relating to uncertain tax positions, including related interest and penalties, appropriately classified as current or noncurrent. The Company recognizes the tax benefit from an uncertain tax position if it is more likely than not that the tax position will be sustained on examination by the relevant taxing authority based on the technical merits of the position. The tax benefits recognized in the financial statements from such positions are then measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the relevant tax authority. In making this determination, the Company assumes that the taxing authority will examine the position and that it will have full knowledge of all relevant information. The provision for income taxes also includes estimates of interest and penalties related to uncertain tax positions. Derivatives: The effective portion of changes in fair values of outstanding cash flow hedges is recorded in other comprehensive income until earnings are affected by the hedged transaction, and any ineffective portion is included in current income. In most cases amounts recorded in other comprehensive income will be released to earnings after maturity of the related derivative. The Consolidated Statements of Operations classification of effective hedge results is the same as that of the underlying exposure. Results of hedges of product costs are recorded in cost of sales when the underlying hedged transactions affect earnings. Results of hedges of revenue are recorded in net sales when the underlying hedged transactions affect earnings. Unrealized derivative gains and losses, which are recorded in assets and liabilities, respectively, are non-cash items and therefore are taken into account in the preparation of the Consolidated Statements of Cash Flows based on their respective balance sheet classifications. Refer to Note 19 for more information on derivatives and risk management. Foreign currency translation: The assets and liabilities of the Company's foreign subsidiaries have been translated into U.S. dollars using the exchange rates in effect at period end, and the net sales and expenses have been translated into US dollars using average exchange rates in effect during the period. The foreign currency translation adjustments are included as a separate component of accumulated other comprehensive income in shareholders' equity Revenue recognition: The Company records wholesale, distributor, c-commerce and licensed product revenues when title passes and the risks and rewards of ownership have passed to the customer. Title generally passes upon shipment to, or upon receipt by the customer depending on the terms of sale with the customer. Retail store revenues are recorded at the time of sale. Revenue is recorded net of sales taxes, value added taxes or similar taxes which are collected on behalf of local taxing authorities Where title passes upon receipt by the customer, predominantly in the Company's European wholesale business, Japan and in certain of our direct ship and e- commerce transactions, precise information regarding the date of receipt by the customer is not readily available. In these cases, the Company estimates the date of receipt by the customer based on historical and expected delivery times by geographic location. The Company periodically tests the accuracy of these estimates based on actual transactions. Delivery times vary by geographic location, generally from one to seven days. To date, the Company has found these estimates to be materially accurate. At the time of revenue recognition, the Company also provides for estimated sales returns and miscellaneous claims from customers as reductions to revenues. The estimates are based on historical rates of product returns and claims as well as events and circumstances that indicate changes to historical rates of returns and claims. However, actual returns and claims in any future period are inherently uncertain and thus may differ from the estimates. If actual or expected future returns and claims are significantly greater or lower than the reserves that have been established, the Company would record a reduction or increase to net revenues in the period in which it made such determination. Cost of sales: The expenses that are included in cost of sales include all direct product costs related to shipping, duties and importation. Specific provisions for excess, close-out or slow moving inventory are also included in cost of sales. In addition, some of the Company's products carry limited warranty provisions for defects in quality and workmanship. A warranty reserve is COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Continued) established at the time of sale to cover estimated costs based on the Company's history of warranty repairs and replacements and is recorded in cost of sales. Selling, general and administrative expense: SG&A expense consists of personnel-related costs, advertising, depreciation, occupancy, and other selling and general operating expenses related to the Company's business functions, including planning, receiving finished goods, warehousing, distribution, retail operations and information technology Shipping and handling costs: Shipping and handling fees billed to customers and consumers are recorded as revenue. The direct costs associated with shipping goods to customers and consumers are recorded as cost of sales. Inventory planning, receiving, storing and handling costs are recorded as a component of SG&A expenses and were $73,880,000 $65,757,000 and $61,338,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Stock-based compensation: Stock-based compensation cost is estimated at the grant date based on the award's fair value and is recognized as expense over the requisite service period using the straight-line attribution method. The Company estimates stock-based compensation for stock options granted using the Black-Scholes option pricing model, which requires various subjective assumptions, including volatility and expected option life. Further, the Company estimates forfeitures for stock-based awards granted which are not expected to vest. For restricted stock unit awards subject to performance conditions, the amount of compensation expense recorded in a given period reflects the Company's assessment of the probability of achieving its performance targets. If any of these inputs or assumptions changes significantly, stock-based compensation expense may differ materially in the future from that recorded in the current period. Assumptions are evaluated and revised as necessary to reflect changes in market conditions and the Company's experience. Estimates of fair value are not intended to predict actual future events or the value ultimately realized by people who receive equity awards. The fair value of service-based and performance-based restricted stock units is discounted by the present value of the estimated future stream of dividends over the vesting period using the Black-Scholes model. Advertising costs: Advertising costs are expensed in the period incurred and are included in SG&A expenses. Total advertising expense, including cooperative advertising costs, was $121,839,000, $118,663,000 and $120,764,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Through cooperative advertising programs, the Company reimburses its wholesale customers for some of their costs of advertising the Company's products based on various criteria, including the value of purchases from the Company and various advertising specifications. Cooperative advertising costs are included in expenses because the Company receives an identifiable benefit in exchange for the cost, the advertising may be obtained from a party other than the customer, and the fair value of the advertising benefit can be reasonably estimated. Cooperative advertising costs were $6,555,000, $8,699,000 and $10,008,000 for the years ended December 31, 2017, 2016 and 2015, respectively. Recent accounting pronouncements: In May 2014, the Financial Accounting Standards Board ("FASB") issued ASU No. 2014-09, Revenue from Contracts with Customers Topic 606, outlining a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers that supersedes most current revenue recognition guidance. The updated guidance, and subsequent clarifications, require an entity to recognize revenue when it transfers control of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In addition, the guidance requires disclosure of the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. The Company is adopting this standard effective January 1, 2018, utilizing the modified retrospective approach, with the immaterial cumulative effect of initially applying the new standard recognized in retained carnings. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) The new standard primarily impacts the following areas: fees paid to or retained by third parties in conjunction with certain concession-based retail arrangements, historically comprising approximately 2% of net sales, will be classified as a component of SG&A expenses, wholesale sales retums reserves, estimated chargebacks and markdowns, and other provisions for customer refunds will be presented as accrued liabilities rather than netted within accounts receivable; and the estimated cost of inventory associated with sales returns reserves will be presented within other current assets rather than inventories. The Company expects the timing of revenue recognition for its significant revenue streams to remain substantially unchanged, with no material effect on net sales, In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, an update to its accounting guidance related to the recognition and measurement of certain financial instruments. This standard requires equity investments that are not accounted for under the equity method of accounting to be measured at fair value with changes recognized in net income and also updates certain presentation and disclosure requirements. The Company is adopting this standard effective January 1, 2018, and does not anticipate a material effect on the Company's financial position, results of operations or cash flows. In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842), in order to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet for most leases previously classified as operating leases. This standard is effective beginning in the first quarter of 2019, with carly adoption permitted. The Company is evaluating the impact of this guidance and expects the adoption will result in a material increase in the assets and liabilities on the Company's consolidated balance sheets and is not expected to have a material impact on the Company's consolidated statements of operations or cash flows. In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The pronouncement changes the impairment model for most financial assets and will require the use of an "expected loss" model for instruments measured at amortized cost. Under this model, entities will be required to estimate the lifetime expected credit loss on such instruments and record an allowance to offset the amortized cost basis of the financial asset, resulting in a net presentation of the amount expected to be collected on the financial asset. This standard is effective beginning in the first quarter of 2020, The adoption of ASU 2016-13 is not expected to have a material effect on the Company's financial position, results of operations or cash flows. In October 2016, the FASB issued ASU No. 2016-16, Income Taxes (Topic 740): Intra-Entity Transfer of Assets Other than Inventory, which requires the recognition of the income tax effects of an intra-entity transfer of an asset, other than inventory, when the transfer occurs, eliminating an exception under current GAAP in which the tax effects of intra-entity asset transfers are deferred until the transferred asset is sold to a third party or otherwise recovered through use. Income tax effects of intra-cntity transfers of inventory will continue to be deferred until the inventory has been sold to a third party. The Company is adopting this standard effective January 1, 2018 by applying the required modified retrospective approach with an initial estimated cumulative effect adjustment to retained carings of certain previously deferred tax benefits of $11,181,000, which is subject to change as the Company finalizes its accounting for the effects of the enactment of the TCJA described in Note 10. The Company anticipates the adoption of this standard will result in increased volatility in its future effective income tax rate In January 2017, the FASB issued ASU No. 2017-04, Intangibles-Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment, which simplifies the accounting for goodwill impairments by eliminating step two from the goodwill impairment test. Under this guidance, if the carrying amount of a reporting unit exceeds its estimated fair value, an impairment charge shall be recognized in an amount equal to that excess, limited to the total amount of goodwill allocated to that reporting unit. This standard is effective beginning in the first quarter of 2019, with early adoption permitted. The Company is evaluating the impact and expects the adoption of ASU 2017-04 to affect the amount and timing of future goodwill impairment charges, if any. In August 2017, the FASB issued ASU No. 2017-12. Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, which simplifies the application of hedge accounting guidance to better portray the economic results of risk management activities in the financial statements. The guidance aligns the recognition and presentation of the effects of hedging instruments and hedged items in the financial statements, and includes certain targeted improvements to case the application of current guidance related to the assessment of hedge effectiveness. The Company is carly-adopting the standard utilizing the required modified retrospective transition method effective January 1, 2018. The adoption of this standard will not have a material effect on the Company's financial position, results of operations or cash flows. COLUMBIA SPORTSWEAR COMPANY NOTES TO CONSOLIDATED FINANCIAL STATEMENTSContinued) In February 2018, the FASB issued ASU No. 2018-02, Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income (Subtopic 220), that permits a reclassification from accumulated other comprehensive income (loss) to retained earnings of the stranded tax effects resulting from application of the new federal corporate income tax rate. The Company early adopted this new standard during the fourth quarter of 2017 utilizing the portfolio approach, which resulted in an increase to retained earnings and corresponding decrease to accumulated other comprehensive income (loss) of $1,159,000 due to a change in the U.S. federal income tax rate from 35% to 21% as a result of the TCJA. NOTE 3CONCENTRATIONS Trade receivables The Company had one customer that accounted for approximately 12.3% and 15.9% of consolidated accounts receivable at December 31, 2017 and 2016, respectively. No single customer accounted for 10% or more of consolidated revenues for any of the years ended December 31, 2017, 2016 or 2015. Derivatives The Company uses derivative instruments to hedge the currency exchange rate risk of anticipated transactions denominated in non-functional currencies that are designated and qualify as cash flow hedges. The Company also uses derivative instruments to economically hedge the currency exchange rate risk of certain investment positions, to hedge balance sheet re-measurement risk and to hedge other anticipated transactions that do not qualify as cash flow hedges. At December 31, 2017, the Company's derivative contracts had remaining maturities of less than three years. The maximum net exposure to any single counterparty, which is generally limited to the aggregate unrealized gain of all contracts with that counterparty, was less than $2,000,000 at December 31, 2017. All of the Company's derivative counterparties have investment grade credit ratings. Refer to Note 19 for further disclosures conceming derivatives. Country and supplier concentrations The Company's products are produced by contract manufacturers located outside the United States, principally in Southeast Asia. Apparel is manufactured in approximately 19 countries, with Vietnam and China together accounting for approximately 64% of 2017 global apparel production. Footwear is manufactured in five countries, with China and Vietnam accounting for substantially all of 2017 global footwear production. The five largest apparel factory groups accounted for approximately 29% of 2017 global apparel production, with the largest factory group accounting for 10% of 2017 global apparel production. The five largest footwear factory groups accounted for approximately 75% of 2017 global footwear production, with the largest factory group accounting for 34% of 2017 global footwear production. These companies have multiple factory locations, many of which are in different countries, thus reducing the risk that unfavorable conditions at a single factory or location will have a material adverse effect on the Company NOTE NON-CONTROLLING INTEREST The Company owns a 60% controlling interest in a joint venture formed with Swire Resources, Limited ("Swire"), which began operations on January 1, 2014, to support the development and operation of the Company's business in China. The accounts and operations of the joint venture are included in the Consolidated Financial Statements for the years ended December 31, 2017, 2016 and 2015. Swire's share of the net income of the joint venture is included in net income attributable to non-controlling interest in the Consolidated Statements of Operations. The non-controlling equity interest in the joint venture is presented separately in the Consolidated Balance Sheets and Consolidated Statements of Equity NOTE 5ACCOUNTS RECEIVABLE, NET Accounts receivable, net, is as follows (in thousands): Under Armour, Inc. and Subsidiaries Consolidated Statements of Stockholders' Equity (In thousands) - - - - - - Class B Class A Convertible Class C Accumulated Common Stock Common Stock Common Stock Additional Other Paid-in- Retained Comprehensive Total Shares Amount Shares Amount Shares Amount Capital Earnings Income (loss) Equity Balance as of December 31, 2014 177,296 S 59 36,600 $ 12 213,896 71 $508,279 $ 856,687 $(14,808) $1,350,300 Exercise of stock options 360 360 2.852 2.852 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (172) (172) (12,727) (12,727) Issuance of Class A Common Stock, net of forfeitures 1.996 1 1,996 1 19,134 19,136 Class B Convertible Common Stock converted to Class A Common Stock 2,150 1 (2,150) (1) Stock-based compensation expense 60.376 60,376 Net excess tax benefits from stock-based compensation arrangements 45.917 45,917 Comprehensive income 232,573 (30,205) 202,368 Balance as of December 31, 2015 181,630 61 34.450 11 216,080 72 636,558 1,076,533 (45,013) 1,668,222 Exercise of stock options 792 971 6,203 6.203 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (199) (276) (15,098) (15,098) Issuance of Class A Common Stock, net of forfeitures 1,592 7,884 7,884 Issuance of Class C Common Stock, net of forfeitures 1,852 1 25,834 25.835 Issuance of Class C dividend 1.547 56,073 (59,000) (2.927) Stock-based compensation expense 46,149 46,149 Net excess tax benefits from stock-based compensation arrangements 44.783 44,783 Comprehensive income 256,979 (7.130) 249.849 Balance as of December 31, 2016 183.815 61 34.450 11 220,174 73 823,484 1,259,414 (52,143) 2,030,900 Exercise of stock options 609 556 3,664 3,664 Shares withheld in consideration of employee tax obligations relative to stock-based compensation arrangements (65) (78) (2.781) (2.781) Issuance of Class A Common Stock, net of forfeitures 898 Issuance of Class C Common Stock, net of forfeitures 1,723 1 7,852 7,853 Impact of adoption of accounting Standard updates (2,666) (23,932) (26,598) Stock-based compensation expense 39,932 39.932 Comprehensive income (loss) (48,260) 13,932 (34,328) Balance as of December 31, 2017 185.257 61 34.450 11 222,375 74 872, 266 1,184,441 (38,211) 2,018,642 - | 11 I II - - - - - - - - - - - Under Armour, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) December 31, 2017 December 31, 2016 $ 312,483 $ 250,470 609,670 622,685 1,158,548 917,491 256,978 174,507 2,337,679 1,965,153 885,774 804,211 555,674 563,591 46,995 64,310 82,801 136,862 97,444 110,204 $4,006,367 $3,644,331 Assets Current assets Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property and equipment, net Goodwill Intangible assets, net Deferred income taxes Other long term assets Total assets Liabilities and Stockholders' Equity Current liabilities Revolving credit facility, current Accounts payable Accrued expenses Current maturities of long term debt Other current liabilities Total current liabilities Long term debt, net of current maturities Other long term liabilities Total liabilities Commitments and contingencies (see Note 6) Stockholders' equity Class A Common Stock, $0.0003 1/3 par value; 400,000,000 shares authorized as of December 31, 2017, and 2016; 185,257,423 shares issued and outstanding as of December 31, 2017, and 183,814,911 shares issued and outstanding as of December 31, 2016 Class B Convertible Common Stock, $0.0003 1/3 par value; 34,450,000 shares authorized, issued and outstanding as of December 31, 2017, and December 31, 2016. Class C Common Stock, $0.0003 1/3 par value; 400,000,000 shares authorized as of December 31, 2017, and 2016; 222,375,079 shares issued and outstanding as of December 31, 2017, and 220,174,048 shares issued and outstanding as of December 31, 2016. Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity $ 125,000 $ 561,108 409,679 296,841 208,750 27,000 27,000 50,426 40,387 1,060,375 685,816 765,046 790,388 162,304 137,227 1,987,725 1,613,431 61 61 11 11 74 73 872,266 823,484 1,184,441 1,259,414 (38,211) (52,143) 2,018,642 2,030,900 $4,006,367 $3,644,331 Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts) Year Ended December 31, 2017 2016 2015 Net revenues $4,976,553 $4,825,335 $3,963,313 Cost of goods sold 2,737,830 2,584,724 2,057,766 Gross profit 2,238,723 2,240,611 1,905,547 Selling, general and administrative expenses 2,086,831 1,823,140 1,497,000 Restructuring and impairment charges 124,049 Income from operations 27,843 417,471 408,547 Interest expense, net (34,538) (26,434) (14,628) Other expense, net (3,614) (2,755) (7,234) Income (loss) before income taxes (10,309) 388,282 386,685 Income tax expense 37,951 131,303 154,112 Net income (loss) (48,260) 256,979 232,573 Adjustment payment to Class C capital stockholders 59,000 Net income (loss) available to all stockholders (48,260) 197,979 232,573 Basic net income (loss) per share of Class A and B common stock $ (0.11) $ 0.45 $ 0.54 Basic net income (loss) per share of Class C common stock $ (0.11) $ 0.72 $ 0.54 Diluted net income (Loss) per share of Class A and B common stock $ (0.11) $ 0.45 $ 0.53 Diluted net income (loss) per share of Class C common stock $ (0.11) $ 0.71 $ 0.53 Weighted average common shares outstanding Class A and B common stock Basic 219,254 217,707 215,498 Diluted 219,254 221,944 220,868 Weighted average common shares outstanding Class C common stock Basic 221,475 218,623 215,498 Diluted 221,475 222,904 220,868 Under Armour, Inc. and Subsidiaries Consolidated Statements of Cash Flows (In thousands) Year Ended December 31, 2017 2016 2015 Cash flows from operating activities Net income (Loss) $ (48,260) S 256,979 $ 232,573 Adjustments to reconcile net income (loss) to net cash used in operating activities Depreciation and amortization 173,747 144,770 100,940 Unrealized foreign currency exchange rate loss (gains) (29,247) 12,627 33,359 Impairment charges 71,378 Amortization of bond premium 254 Loss on disposal of property and equipment 2,313 1,580 549 Stock-based compensation 39,932 46,149 60,376 Excess tax benefit (loss) from stock-based compensation arrangements (75) 44,783 45,917 Deferred income taxes 55,910 (43,004) (4,426) Changes in reserves and allowances 108,757 70,188 40,391 Changes in operating assets and liabilities (net of acquisitions): Accounts receivable (79,106) (249,853) (191,876) Inventories (222,391) (148,055) 278,524) Prepaid expenses and other assets (55,503) (25,284) (76,476) Accounts payable 145,695 202,446 22,583) Accrued expenses and other liabilities 109,823 67,754 76,854 Income taxes payable and receivable (39,164) (16,712) (2,533) Net cash provided by operating activities 234,063 364,368 14,541 Cash flows from investing activities Purchases of property and equipment (281,339) (316,458) (298,928) Purchases of property and equipment from related parties (70,288) Purchase of businesses, net of cash acquired (539,460) Purchases of available-for-sale securities (24,230) (103,144) Sales of available-for-sale securities 30,712 96,610 Purchases of other assets (1,648) (875) (2,553) Net cash used in investing activities (282,987) (381,139) (847,475) Cash flows from financing activities Proceeds from long term debt and revolving credit facility 763,000 1,327,601 650,000 Payments on long term debt and revolving credit facility (665,000) (1,170,750) (265,202) Employee taxes paid for shares withheld for income taxes (2,781) (15,098) (12,728) Proceeds from exercise of stock options and other stock issuances 11,540 15,485 10,310 Payments of debt financing costs (6,692) (947) Cash dividends paid (2.927) Contingent consideration payments for acquisitions (1,505) Net cash provided by financing activities 106,759 146,114 381,433 Effect of exchange rate changes on cash and cash equivalents 4,178 (8,725) (11,822) Net increase (decrease) in cash and cash equivalents 62,013 120,618 (463,323) Cash and cash equivalents Beginning of period 250,470 129,852 593,175 End of period $ 312,483 $ 250,470 $ 129,852 Non-cash investing and financing activities Change in accrual for property and equipment $ 10,580 $ 16,973 $ 17,758 Non-cash dividends (56,073) Property and equipment acquired under build-to-suit leases 5,631 Other supplemental information Cash paid for income taxes 36,921 135,959 99,708 Cash paid for interest, net of capitalized interest 29,750 21,412 11,176 See accompanying notes. 11 COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) December 31. S 673.166 S 551.389 94.983 472 364,862 333,678 457.927 487,997 58,559 38,487 1.649,497 1.412.023 281.394 279,650 129.555 133,438 68,594 68,594 56,804 92,494 27.058 27,695 2,212,902 5 2,013,894 s ASSETS Current Assets: Cash and cash equivalentshote 20) Short-term investments (Note 20) Accounts receivable, net (Note 5) Inventories Prepaid expenses and other current assets Total current assets Property, plant, and equipment, net (Note 6) Intangible assets, net (Note 7) Goodwill (Note 7) Deferred income taxes (Note 10) Other non-current assets Total assets LIABILITIES AND EQUITY Current Liabilities: Accounts payable Accrued liabilities (Note 9) Income taxes payable (Note 10) Total current liabilities Note payable to related party (Note 21) Other long-term liabilities (Notes 11, 12) Income taxes payable (Note 10) Deferred income taxes (Note 10) Total liabilities Commitments and contingencies (Note 13) Shareholders' Equity Preferred stock; 10,000 shares authorized: none issued and outstanding Common stock (no par value): 125,000 shares authorized: 69,995 and 69,873 issued and outstanding (Note 14) Retained carings Accumulated other comprehensive loss (Note 17) Total Columbia Sportswear Company shareholders' equity Non-controlling interest (Note 4) Total equity Total liabilities and equity 252,301 S 182.228 19.107 453.636 215,048 142.158 5,645 362.851 14.053 42.622 12.710 147 432,383 48,735 58,104 168 560,643 45.829 1.585,009 (8,887) 1.621.951 30,308 1.652.259 2.212.902 53.801 1.529,636 (22.617) 1,560.820 20,691 1.581.511 2.013.894 S COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF EQUITY (In thousands) Columbia Sportswear Company Shareholders' Equity Comme Sack Shares Accumulated Other Outstanding Amunt Retained Comprehensive lacus Nr.Controlling Earnings (L) Interest 69.28 s 72.700 5.255.070 $ 15.33 5 11.631 5.514 $ Total 1.355.234 179.851 (6) (2.908) (31.755 16) (2.908) (34,7) (1.132 (43.547) 835 12.547 7.925 11.672 (70,068) (1.366) 69.277 7.925 11.672 170.068) 1.415.813 198.439 (20.836) 1.325.860 191.898 16.013 6541 BALANCE JANUARY 1, 2015 Net income Other comprehensive loss: Unrealized holding losses on available-for-sale securities, nel Unrealized holding losses on derivative transactions, nel Foreign currency translation adjustment, net Cash dividends (50.62 per share Issuance of common stock under employee stock plans, net Tax adjustment from stock plans Suck-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2015 Net income Other comprehensive income loss Unrealized holding losses on available for sale securities, nel Unrealized holding gains on derivative transactions, nel Foreign currency translation adjustment.net Cash dividends (50.69 per share Issuance of common stock under employee stock plans, net Suck-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2016 Nel income Other comprehensive income (loss Unrealized holding losses on derivative actions, nel Foreign cumency translation adjusimeni. Det Cash dividends (50.73 per share) Issuance of common stock under employee stock plans, net Suck-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2017 686 843 157 (2.020) (2.465) (48,122) 596 (4.485) (48,122) 8,050 10.986 2,050 10,986 69.873 1.59.636 105,123 20.601 7,192 1.581.511 112.315 1.159 (17.459) (516) 2.941 (50,909) 16.284 11,286 35.542) 45.829 $ 1.585.009 (16,846) 14.160 (50,909) 16.284 11.286 (35.542) 1.652259 69.995 S (8.887) 5 30,30 See accompanying notes to consolidated financial statements 46 COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Year Ended December 31, 2016 2017 2015 S Net sales Cost of sales Gross profit Selling, general and administrative expenses Net licensing income Income from operations Interest income, net Interest expense on note payable to related party (Note 21) Other non-operating expense Income before income tax Income tax expense (Note 10) Net income Net income attributable to non-controlling interest Net income attributable to Columbia Sportswear Company Earnings per share attributable to Columbia Sportswear Company (Note 16): Basic Diluted Weighted average shares outstanding (Note 16): Basic Diluted 2,466,105 S 1,306,143 1,159.962 910,894 13.901 262,969 4,515 (429) (321) 266,734 (154,419) 112.315 7,192 105,123 S 2.377,045 $ 1,266,697 1,110,348 864.084 10.244 256,508 2,003 (1,041) (572) 256,898 (58,459) 198,439 6,541 191,898 S 2.326,180 1.252,680 1,073,500 831,971 8,192 249,721 1.531 (1,099) (2.834) 247,319 (67,468) 179,851 5.514 174,337Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started