Answered step by step

Verified Expert Solution

Question

1 Approved Answer

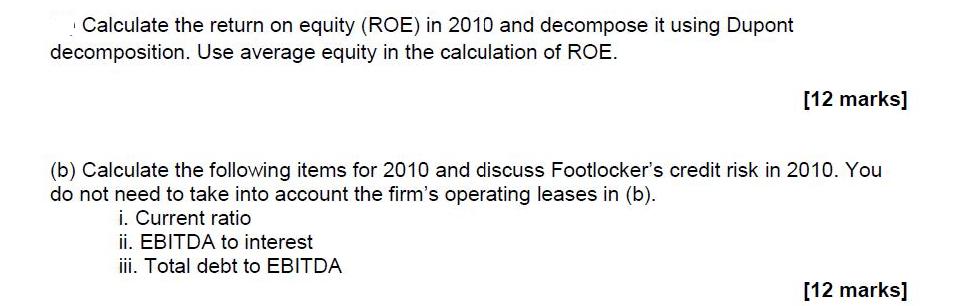

Calculate the return on equity (ROE) in 2010 and decompose it using Dupont decomposition. Use average equity in the calculation of ROE. [12 marks]

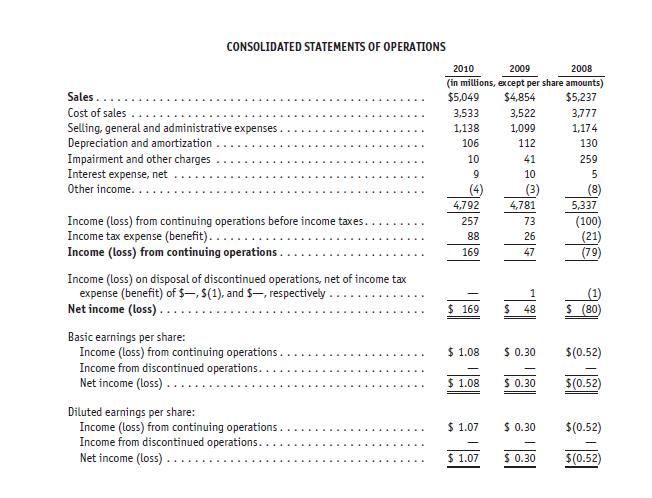

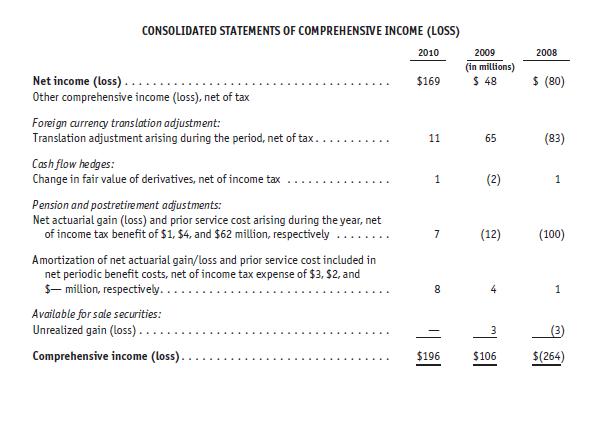

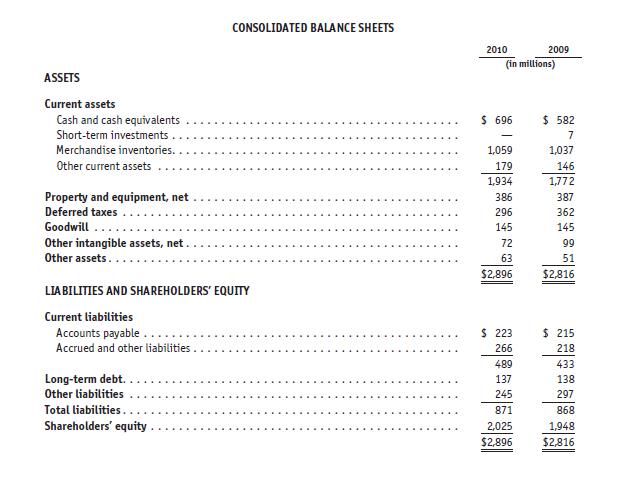

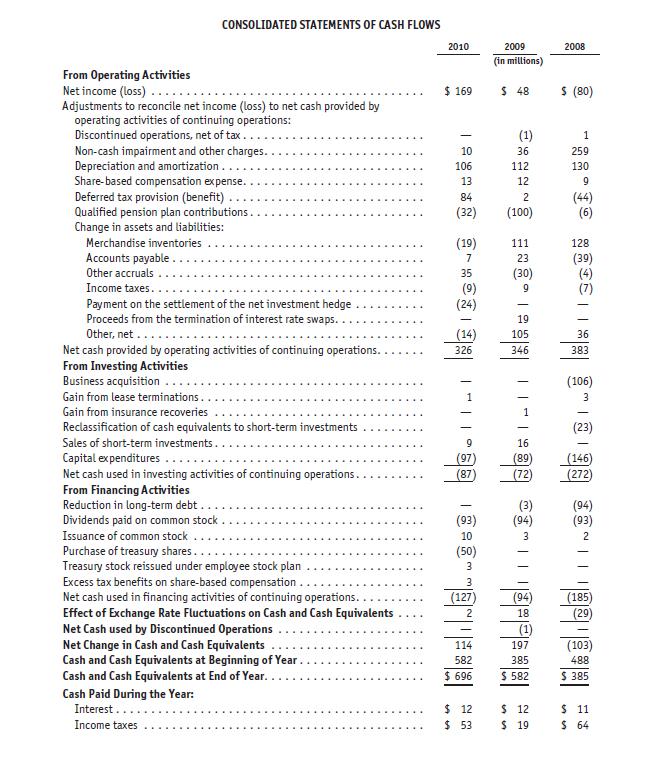

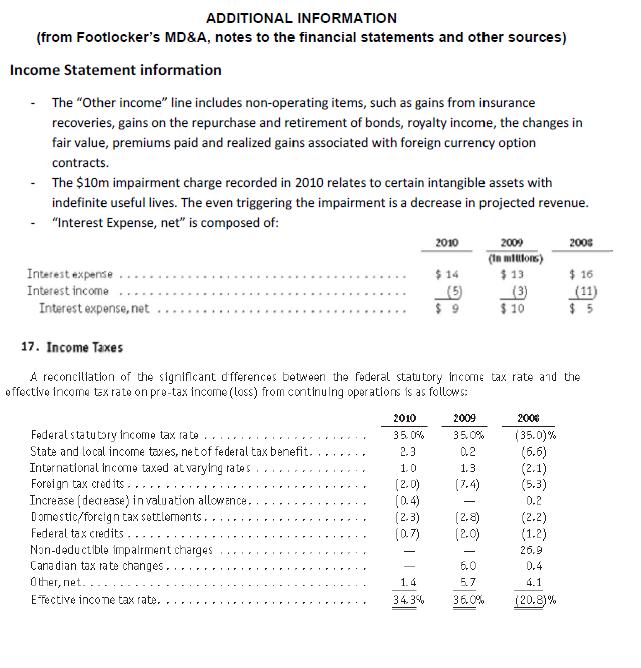

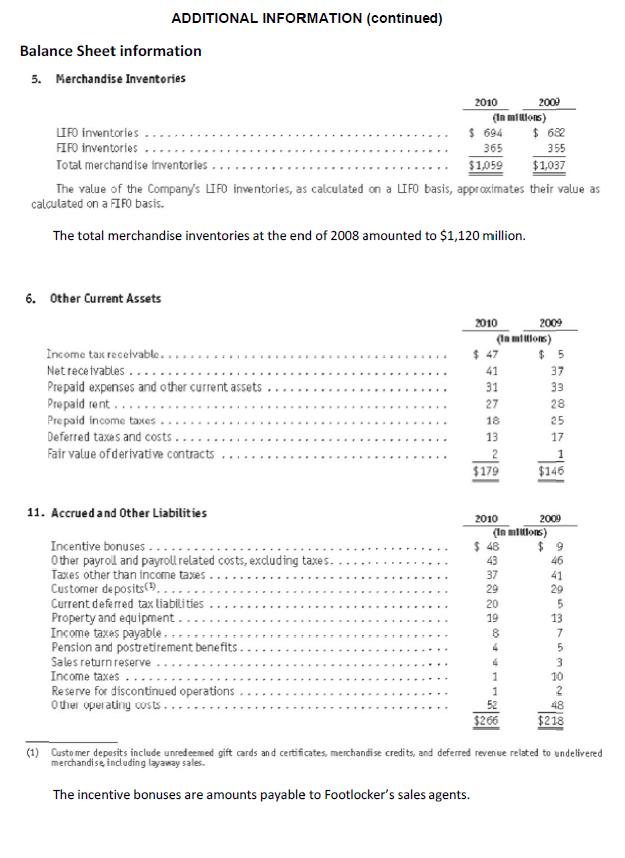

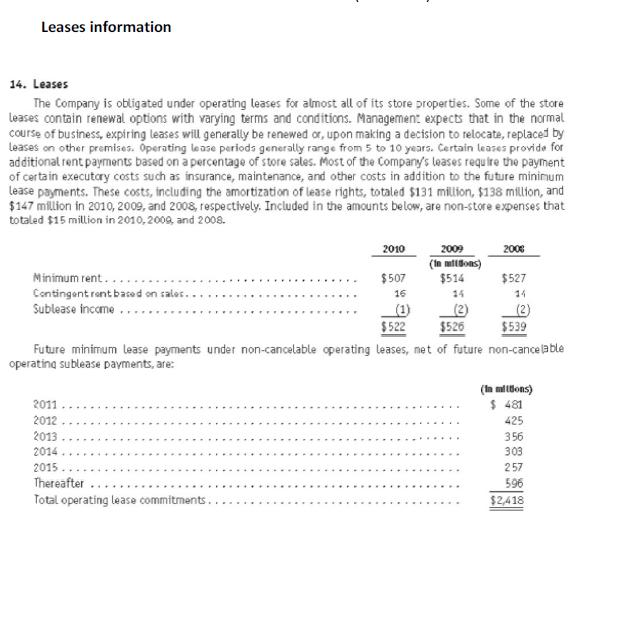

Calculate the return on equity (ROE) in 2010 and decompose it using Dupont decomposition. Use average equity in the calculation of ROE. [12 marks] (b) Calculate the following items for 2010 and discuss Footlocker's credit risk in 2010. You do not need to take into account the firm's operating leases in (b). i. Current ratio ii. EBITDA to interest iii. Total debt to EBITDA [12 marks] CONSOLIDATED STATEMENTS OF OPERATIONS Sales. Cost of sales Selling, general and administrative expenses. Depreciation and amortization Impairment and other charges Interest expense, net Other income.... ... Income (loss) from continuing operations before income taxes.. Income tax expense (benefit)..... Income (loss) from continuing operations. Basic earnings per share: Income (loss) from continuing operations.. Income from discontinued operations.. Net income (loss)... ... Income (loss) on disposal of discontinued operations, net of income tax expense (benefit) of $-, $(1), and $-, respectively. Net income (loss)... Diluted earnings per share: Income (loss) from continuing operations.. Income from discontinued operations... Net income (loss).. 2010 2009 2008 (in millions, except per share amounts) $4,854 $5,237 3,777 1,174 130 259 5 (8) $5,049 3,533 1,138 106 10 9 (4) 4,792 257 88 169 $ 169 $1.08 $ 1.08 $ 1.07 $ 1.07 3,522 1,099 112 41 10 ******* (3) 4,781 $ 0.30 $ 0.30 $ 0.30 $ 0.30 5,337 (100) (21) (79) (1) $ (80) $(0.52) $(0.52) $(0.52) $(0.52) CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) 2010 Net income (loss).. Other comprehensive income (loss), net of tax Foreign currency translation adjustment: Translation adjustment arising during the period, net of tax. Cash flow hedges: Change in fair value of derivatives, net of income tax Pension and postretirement adjustments: Net actuarial gain (loss) and prior service cost arising during the year, net of income tax benefit of $1, $4, and $62 million, respectively Amortization of net actuarial gain/loss and prior service cost included in net periodic benefit costs, net of income tax expense of $3, $2, and $- million, respectively.... Available for sale securities: Unrealized gain (loss).. Comprehensive income (loss). $169 11 1 7 $196 2009 (in millions) $48 65 (2) (12) 3 $106 2008 $ (80) (83) 1 (100) 1 (3) $(264) ASSETS Current assets Cash and cash equivalents Short-term investments Merchandise inventories.. Other current assets Property and equipment, net Deferred taxes. Goodwill Other intangible assets, net. Other assets.. CONSOLIDATED BALANCE SHEETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Accrued and other liabilities Long-term debt. Other liabilities Total liabilities. Shareholders' equity 2010 (in millions) $ 696 1,059 179 1,934 386 296 145 72 63 $2,896 $ 223 266 489 137 245 871 2009 2,025 $2,896 $ 582 7 1,037 146 1,772 387 362 145 99 51 $2,816 $ 215 218 433 138 297 868 1,948 $2,816 From Operating Activities Net income (loss) Adjustments to reconcile net income (loss) to net cash provided by operating activities of continuing operations: Discontinued operations, net of tax... Non-cash impairment and other charges. Depreciation and amortization... Share-based compensation expense.. Deferred tax provision (benefit). Qualified pension plan contributions.. Change in assets and liabilities: Merchandise inventories Accounts payable. Other accruals Income taxes.. CONSOLIDATED STATEMENTS OF CASH FLOWS Payment on the settlement of the net investment hedge Proceeds from the termination of interest rate swaps... Other, net...... Net cash provided by operating activities of continuing operations. From Investing Activities Business acquisition .... Gain from lease terminations. Gain from insurance recoveries Reclassification of cash equivalents to short-term investments Sales of short-term investments.... Capital expenditures.... Net cash used in investing activities of continuing operations. From Financing Activities Reduction in long-term debt.. Dividends paid on common stock Issuance of common stock Purchase of treasury shares.. Treasury stock reissued under employee stock plan Excess tax benefits on share-based compensation Net cash used in financing activities of continuing operations. Effect of Exchange Rate Fluctuations on Cash and Cash Equivalents Net Cash used by Discontinued Operations Net Change in Cash and Cash Equivalents Cash and Cash Equivalents at Beginning of Year Cash and Cash Equivalents at End of Year... Cash Paid During the Year: Interest.. Income taxes 2010 $ 169 EIROHNE BRURel (32) (19) (9) (24) (14) 1 1 | | (97) (87 (93) 10 (50) 3 3 (127) 2 114 582 $ 696 $ 12 $ 53 2009 (in millions) $ 48 (1) 36 112 12 2 (100) 111 23 (30) 9 19 105 346 1 16 (89) (72) (3) (94) 3 11 (94) 18. (1) 197 385 $ 582 $ 12 $ 19 2008 $ (80) 1 259 130 9 (44) (6) 128 (39) 36 383 (106) 3 (23) (146) (272) (94) (93) 2 11 (185) (29) (103) 488 $ 385 $ 11 $ 64 ADDITIONAL INFORMATION (from Footlocker's MD&A, notes to the financial statements and other sources) Income Statement information The "Other income" line includes non-operating items, such as gains from insurance recoveries, gains on the repurchase and retirement of bonds, royalty income, the changes in fair value, premiums paid and realized gains associated with foreign currency option contracts. The $10m impairment charge recorded in 2010 relates to certain intangible assets with indefinite useful lives. The even triggering the impairment is a decrease in projected revenue. "Interest Expense, net" is composed of: Interest expense Interest income Interest expense, net Federal statutory Income tax rate State and local income taxes, net of federal tax benefit. International income taxed at varying rates Foreign tax credits.... Increase (decrease) in valuation allowance. Domestic/foreign tax settlements. Federal tax credits.... Non-deductible impairment charges Canadian tax rate changes. Other, net. E-Tective income tax rate. 2010 35,05% 2.3 1.0 (2.0) (0.4) (2.3) (0.7) 2010 1.4 34.3% $9 17. Income Taxes A reconciliation of the significant differences between the federal statutory income tax rate and the effective income tax rate on pre-tax income (loss) from continuing operations is as follows: 2009 35,0% 0.2 1.3 (2.8) (2.0) - 2009 (in millions) $13 6.0 5.7 36.0% $10 2000 (35.0)% (6.6) (2.1) (5.3) 0.2 2008 (2.2) (1.2) 26.9 0.4 4.1 (20.8)% $16 (11) $5 ADDITIONAL INFORMATION (continued) Balance Sheet information 5. Merchandise Inventories LIFO inventories FIFO inventories Total merchandise inventories.. 6. Other Current Assets Income tax receivable... Net receivables... Prepaid expenses and other current assets.......... Prepaid rent... Prepaid income taxes. Deferred taxes and costs.. Fair value of derivative contracts 11. Accrued and Other Liabilities Incentive bonuses... Other payroll and payroll related costs, excluding taxes. Taxes other than income taxes. Customer deposits.. Current deferred tax liabilities The value of the Company's LIFO inventories, as calculated on a LIFO basis, approximates their value as calculated on a FIFO basis. The total merchandise inventories at the end of 2008 amounted to $1,120 million. Property and equipment... Income taxes payable... Pension and postretirement benefits. Sales return reserve.. Income taxes. Reserve for discontinued operations Other operating costs... ADAPAN .... .... .... 2010 ... (in millions) $ 694 365 $1,059 2010 $ 47 41 31 27 (in millions) 18 13 2 $179 2010 $ 48 43 37 995389 29 2009 20 19 $ 682 355 $1,037 (In millions) 8 1 1 52 $266 2009 $5 37 33 28 25 17 $146 2009 96795 $9 46 41 29 13 7 5 3 10 48 $218 (1) Customer deposits include unredeemed gift cards and certificates, merchandise credits, and deferred revenue related to undelivered merchandise, including layaway sales. The incentive bonuses are amounts payable to Footlocker's sales agents. Leases information 14. Leases The Company is obligated under operating leases for almost all of its store properties. Some of the store leases contain renewal options with varying terms and conditions. Management expects that in the normal course of business, expiring leases will generally be renewed or, upon making a decision to relocate, replaced by leases on other premises. Operating lease periods generally range from 5 to 10 years. Certain leases provide for additional rent payments based on a percentage of store sales. Most of the Company's leases require the payment of certain executory costs such as insurance, maintenance, and other costs in addition to the future minimum lease payments. These costs, including the amortization of lease rights, totaled $131 million, $138 million, and $147 million in 2010, 2009, and 2008, respectively. Included in the amounts below, are non-store expenses that totaled $15 million in 2010, 2009, and 2008. Minimum rent... Contingent rent based on sales. Sublease income 2011 2012 2013 2014 2015 2010 Thereafter Total operating lease commitments. $507 16 (1) $522 2009 (in milions) $514 14 (2) $526 200 Future minimum lease payments under non-cancelable operating leases, met of future non-cancelable operating sublease payments, are: $527 14 (2) $539 (In millions) $ 481 425 356 303 257 596 $2,418 I I I ADDITIONAL INFORMATION (Continued) All tax items on the balance sheet relate to the firm's financial activities. Derivatives contracts relate to hedging against financial risks. Discontinued operations relate to activities outside the firm's core operating cycle.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer these questions well need to use the financial statements provided to calculate the required financial metrics a Calculate the return on equity ROE in 2010 and decompose it using DuPont deco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started