Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Calculate the unit contribution margin for each product type. b) Determine the weighted-average unit contribution margin. c) Compute the break-even point in units for

a) Calculate the unit contribution margin for each product type.

a) Calculate the unit contribution margin for each product type.

b) Determine the weighted-average unit contribution margin.

c) Compute the break-even point in units for the company as a whole.

d) Compute the break-even point in units for each product.

e) Determine the total number of units that must be sold to obtain a profit of $140,000 after tax for the company (The tax rate is 30%)

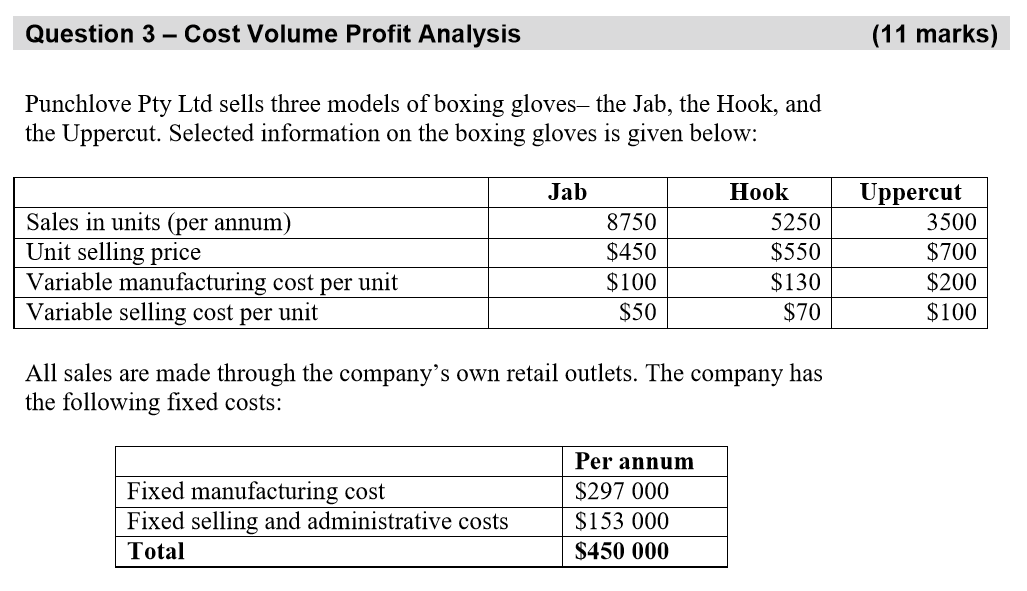

Question 3 Cost Volume Profit Analysis (11 marks) Punchlove Pty Ltd sells three models of boxing gloves, the Jab, the Hook, and the Uppercut. Selected information on the boxing gloves is given below: Jab Sales in units (per annum) Unit selling price Variable manufacturing cost per unit Variable selling cost per unit 8750 $450 $100 $50 Hook 5250 $550 $130 $70 Uppercut 3500 $700 $200 $100 All sales are made through the company's own retail outlets. The company has the following fixed costs: Fixed manufacturing cost Fixed selling and administrative costs Total Per annum $297 000 $153 000 $450 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started